Andressa Bonafe and Preeti Sulibhavi examine the interplay between demographic makeup and 3D printing activity.

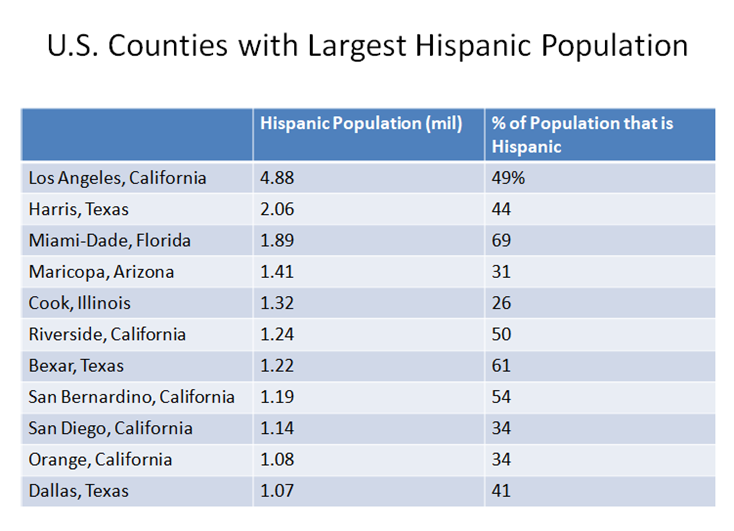

Well-run national and international businesses carefully monitor demographic trends to identify both market and employee talent opportunities. The September 21, 2020 issue of Barron’s focused on U.S. counties with a Latino Population of 1,000,000 or more. The results are presented above. It is important to realize when reviewing this table that Harris County, Texas is really Houston and Bexar County, Texas is really San Antonio. Focusing only on county data creates some distortions since the top three counties encompassing Los Angeles, Houston, and Miami Dade counties cover very large geographic areas, much larger than the average American county covers. For example, geographic areas included in the New York City/Newark metropolitan region contains over 5,000,000 Latinos.

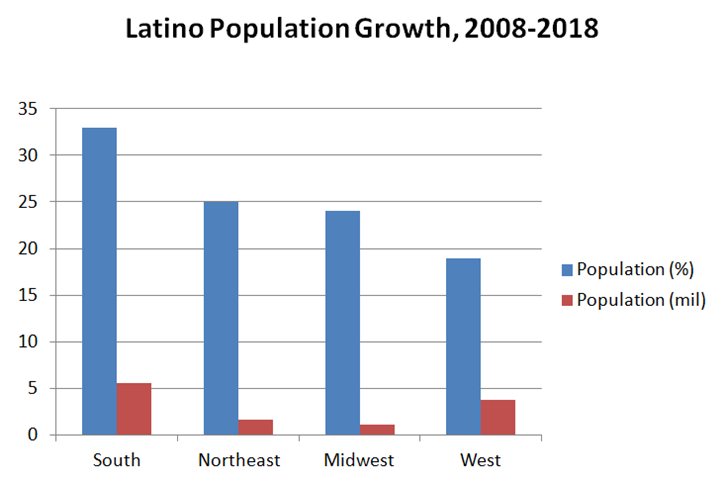

Each of these areas contains important sectors where 3D printing is very relevant. Los Angeles has a large aerospace and machine shop industry. Houston has a major medical complex where Latinos from Central America and South America travel for medical care. Miami is also a major gateway to Central and South America. In addition to understanding the high growth rate of the overall Latino population, it is important to understand the particularly high growth rate of the Latino population in the South

3D Printing Industry Strategy

The 3D printing industry looking to participate in this growth should be seeking more sales among the Latino demographic as well as design and technical worker recruitment, including software developers. Marketing communications including sales collateral, social media and websites should include Spanish versions. Following this recommendation, this article will be published in both English and Spanish languages.

Research and Development Tax Credits are available for the eligible US-based, 3D printing activities that companies engage in.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives.

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The Latino market presents a great business opportunity. The demographic data speaks for itself and that language is bilingual.