![[Source: trekearth.com ]](https://fabbaloo.com/wp-content/uploads/2020/05/Bombardier1_img_5eb065c8bebd2.png)

[Source: trekearth.com]

Charles Goulding and Peter Favata of R&D Tax Savers examine Bombardier’s history and future — and use of 3D printing.

A History in Transportation

Bombardier was founded in July of 1937 by Joseph-Armand Bombardier in Quebec, Canada. The company got its start by designing and manufacturing snowmobiles which would later become known as Ski-Doo. These would be the backbone of the business until the mid-1960s when Bombardier began an acquisition spree, going after different train businesses, and later expanding into aviation in the 1980s. Snowmobiles would still be part of the business until Ski-Doo was spun off and sold to investors in 2003. Above is a photo of the first Bombardier snowmobiles.

Ambitions Too High

Recently Bombardier had attempted to break into the commercial aerospace industry, an effort which ended very quickly and poorly for the company. When competing with industry giants such as Boeing and Airbus, a company needs substantial resources and sadly Bombardier was not able to succeed in this industry. The result was serious financial troubles, including $9.3 billion in long-term debt in addition to projected layoffs of up to 70% of their employees.

Moving Forward

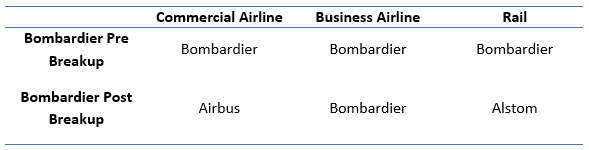

In response to these financial troubles, Bombardier has had to sell off its stake in the commercial plane market to Airbus, as well as its large rail sector to the French rail manufacturer Alstom, a company that had a proposed merger with Siemens railway product businesses in 2018. Bombardier’s sale of its train division is projected to reduce its profits by up to 50%. Below is a chart displaying Bombardier pre and post sell-off.

The company is now left with a much smaller business operating within the jet industry. In the business jet trade, Bombardier competes at the top of the industry along with General Dynamics and Gulfstream to name a couple.

3D Printing

Bombardier is no stranger to 3D printing. In May of 2019, they adopted the Stratasys F900 3D printer to be used for 3D printing end-use rail parts. They have also stated in the past they would like to install a 3D printer in every engineering department for prototyping parts.

![[Source: blog.stratasys.com ]](https://fabbaloo.com/wp-content/uploads/2020/05/Bombardier2_img_5eb065c9bcd66.png)

[Source: blog.stratasys.com]

Airbus’ mainstream commercial jet segment already engages in the extensive use of 3D printing. Airbus is a large proponent of 3D printing mainly because it is proving itself as a highly efficient way for weight reduction. 3D printed parts can weigh up to 55% less than traditional manufacturing methods. Weight reduction is very important for the aerospace industry since it results in substantial fuel cost reduction. The rail industry is a large user of 3D printing and Alstom should be able to combine Bombardier 3D printing experience with its own.

Companies that engage in 3D printing aerospace parts may be eligible for the R&D tax credit.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

The potential for Bombardier’s now singular focus on its jets segment to thrive is a real possibility. Already being a respected leader in the field and with private jet chartering, becoming more popular than ever with platforms such as BLADE the private jet booking app, Bombardier could see some growth in this industry.