The latest 3D printing IPO sees Massivit 3D Printing Technologies go public.

This week, the Tel Aviv Stock Exchange (TASE) added the ticker “MSVT” as Massivit 3D completed its initial public offering. The announcement explains:

“The company has raised NIS 169 Million with a pre-money valuation of circa NIS 490 Million and a post-money valuation of circa NIS 660 Million. As part of the offer to institutional investors, the company received a demand of circa NIS 249 Million. Leading institutional entities in the Israeli market have invested in the current IPO.”

In USD, that’s about $51 million raised, with a pre-money valuation of about $148 million and post-money valuation of about $200 million. (Checked using Google’s conversion at today’s exchange rate of “1 Israeli New Shekel equals 0.30 United States Dollar” as of March 11, 2021.)

Massivit 3D Technology

Massivit 3D is well-named; the company produces massive 3D printing technology.

Their large-format 3D printers are designed to address “three fundamental market barriers that have – until now – prevented the manufacturing arena from evolving.” The company defines those barriers as production speed, production size, and versatile industrial materials.

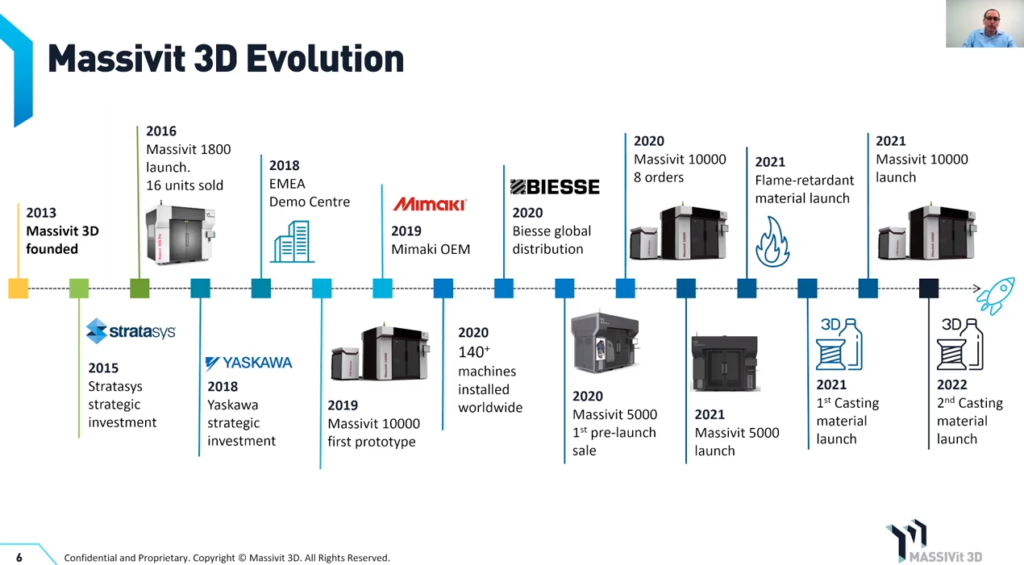

A quick look at Massivit 3D’s journey to date details their growth in addressing and overcoming those hurdles:

With “50 patent assets” backing their efforts, Massivit 3D definitely has something going for it. Large-volume 3D printers, an expanding portfolio of materials, and “integrated software based on sophisticated algorithms” enable some big usage. The company notes that its tech has found a foothold in several key verticals:

- Automotive

- Marine

- Rail

- Aerospace

- Architecture

- Energy

- Sign & Display

These big systems have also drawn big attention. A few years back, Stratasys invested in Massivit 3D. Last year, Mimaki introduced its large-scale 3DGD-1800 that is their branded version of the Massivit 1800.

Both companies were named as of strategic importance to Massivit 3D’s growth:

Massivit 3D IPO

Of the IPO, Massivit 3D CEO Erez Zimerman said:

“We are thrilled to join the TASE and are delighted with the significant trust we have gained from the capital market, that has led to the company’s successful IPO. The demand we have witnessed as well as the investments by institutional entities testify to the market’s substantial evaluation for the solution that Massivit 3D provides and the technological value that we bring to the market.”

Co-Founder and Chief Innovation Officer Gershon Miller additionally noted that:

“As part of the company’s plan for growth, the funds raised will be leveraged to continue innovating vital and disruptive technology that address pertinent market gaps.”

The IPO is well-timed as the 3D printing industry continues to mature. Among other recent companies in the industry to go public are Desktop Metal and Markforged, both of which worked via special purpose acquisition company (SPAC) moves, rather than traditional IPOs, to hit the New York Stock Exchange.

Massivit 3D shared more details about its motivations and strategies in a webinar at the end of February following the TASE IPO; while the session is presented in Hebrew, many of the slides (like those included in this article) are in English, for a good overview:

Via Massivit 3D