Charles R. Goulding considers ways in which 3D printing can help generators keep electricity online in difficult times.

Thinking of my son and his wife and baby in Dallas with no heat and power made me wish they had a generator in their recently purchased home. The number of deaths and the length of this Texas-wide power outage are going to result in substantial change. One result is that both during the event and for some time after, the sales of generators will soar, much like they did in the Northeast US after the events of hurricanes Irene and Sandy. During the Texas event, FEMA aid included sending generators. Our firm does a lot of tax projects for the generator industry and in 2020 we wrote two generator-related Fabbaloo articles; one on generators in general, and one on the bankruptcy filing of Briggs & Stratton. This article will cover 3D printing developments at four major generator manufacturers including Cummins, Generac, Kohler, and Briggs & Stratton.

Cummins

Founded in 1919 out of Columbus, Indiana, Cummins is a designer and manufacturer of engines, filtration, and power generation products. Cummins is a multinational business with $19.8 billion in sales in 2020. Cummins has been integrating 3D printing into its manufacturing process. One example of this is using 3D printing to repair cylinder heads. Cummins has also been utilizing 3D printing to make on-the-go repairs to engines. They have also produced 3D printed metal parts in the past.

Generac

Generac, founded in 1959 in Waukesha, Wisconsin, is an American manufacturer of backup generators. In a partnership with 3D Systems, they were able to produce replacement parts for their products on demand. They also have been able to use 3D printing for the design of prototypes. Using 3D Systems’ On Demand Manufacturing service, prototypes were brought to fruition much faster than traditional manufacturing would allow.

Kohler

Kohler Co., founded in 1873 out of Kohler, Wisconsin, is well known for its wide range of bathroom products including an expanding line of touchless products. Kohler is another user of 3D printing in the generator sector. Kohler uses Stratasys 3D printers to produce a variety of parts, from prototype parts for testing to production parts used in the final design. By doing so, their R&D test center has been able to reduce the prototyping process time as well as drive down costs.

Briggs & Stratton

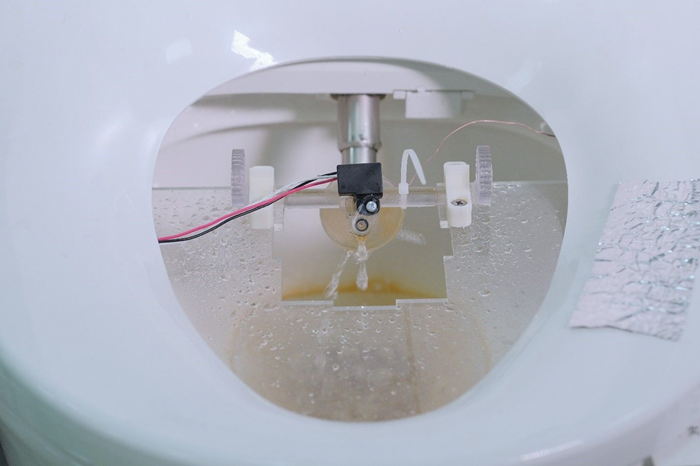

Briggs & Stratton, established in 1908 out of Milwaukee, Wisconsin, has recently been purchased out of bankruptcy and has a new CEO. The company is well known by customers for its large lawnmower business. Briggs & Stratton utilizes 3D printing techniques in producing their generators. The company primarily uses 3D printing to create prototypes for its systems. This is done mainly during the design phase in order to test and ensure their product is working properly. Briggs & Stratton also utilizes its 3D printers to make gaskets, a crucial component to engine building which prevents oil or coolant from leading into the cylinders of the generator. Additionally, 3D printing can be helpful in repairing broken or worn generator parts due to its low price point in production. In January of 2021 Briggs announced a $9.4 million expansion of their Auburn, Alabama plant.

Manufacturers and technical designers utilizing additive manufacturing may be eligible for Research and Development (R&D) Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

At a time where more people in Texas are in need of a generator than ever, some people are getting creative with the ways to power their house. One man in Texas decided to use his new Ford F150 to power some of his appliances around his house including his heat, refrigerator, and toaster oven. Ford has also offered to lend out F150s with generators to people in need throughout Texas. With the demand for generators on the rise, manufactures are going to need to lower the production time when manufacturing them. 3D printing can assist in this effort.