I noticed something very interesting in this month’s 3D Hubs Trends report, something that tells the story of the last few years of 3D printing.

3D Hubs produces a comprehensive statistical report each month based on the usage of their enormous network of 3D printer operations, each of which can accept local print jobs for a fee.

The report is largely the same from month to month, as people have consistent usage patterns. For example, the most popular print colors are always black and white. One section of the report that does change is the popularity of specific 3D printers, which always shifts as new models are introduced and discovered by the community.

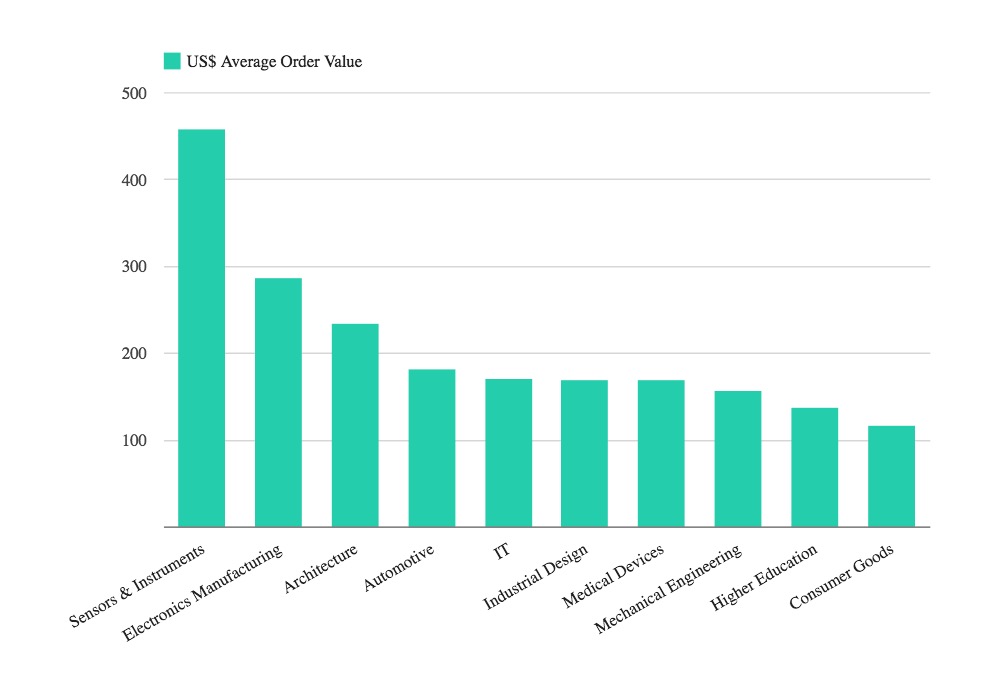

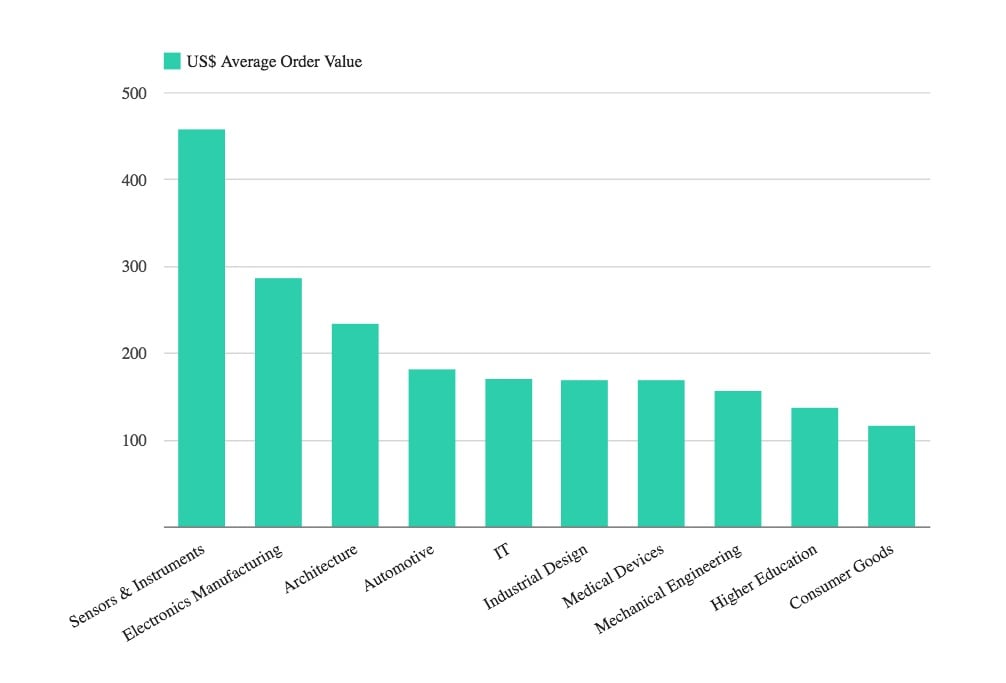

However, this month 3D Hubs included a chart of “Average Order Value by Industry”. In this report they’re categorizing the purpose of the print and checking the average value of the 3D print order to participating 3D print providers. The chart is shown at top.

Let’s look at the top value categories, in other words, the industries most willing to pay higher amounts for 3D print services:

- Sensors & Instruments

- Electronics and Manufacturing

- Architecture

- Automotive

- IT

- Industrial Design

- Medical Devices

- Mechanical Engineering

The very last two items, the lowest paying categories are:

- Higher Education

- Consumer Goods

And this tells the story of the last few years of 3D printing. You may recall that around 2009 the original patents for 3D printing expired and opened the door for several companies to produce inexpensive desktop 3D printers. These were touted as being suitable for use by consumers, and a “gold rush” took place where everyone charged at that market.

But it turned out not to be ready, as software, hardware and content challenges were significant barriers to the consumer market. As a result, the very numerous manufacturers of desktop equipment had to turn to different markets to make their money and survive. Some have been quite successful, others not so much.

Which markets did the desktop 3D printer vendors re-focus on? Mostly professionals, such as:

- Sensors & Instruments

- Electronics and Manufacturing

- Architecture

- Automotive

- IT

- Industrial Design

- Medical Devices

- Mechanical Engineering

- Higher Education

Looks familiar? I thought so too. The companies, as bank robber Willie Sutton famously said, “go where the money is”.

There’s one exception, though, which is somewhat concerning. A great many desktop 3D printer companies have re-focused on the education market, yet in 3D Hubs’ statistics, it’s the second-lowest paying category.

Perhaps they should have chosen a different, potentially more profitable market?

Maybe, or maybe not. There is certainly an education market and it is possible to make a go of it. It just may not be as profitable as some other segments.

This and many other interesting stats are available at 3D Hubs’ Trends report, which is published monthly.

Via 3D Hubs