![[Source: Dell’Oro Group ]](https://fabbaloo.com/wp-content/uploads/2020/05/Huawei_img_5eb095bb19a4c.png)

Cameron Torti and Charles Goulding of R&D Tax Savers examine 3D printing opportunities in 5G telecommunications.

Market Conditions

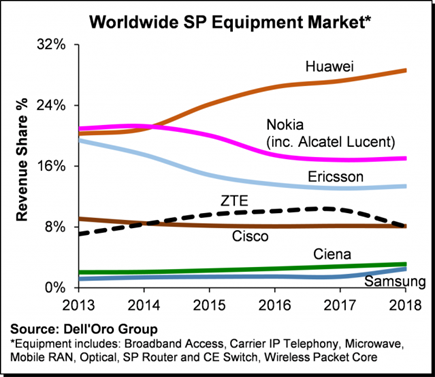

Fifth-generation (5G) wireless networks are expected to become a reality on a global scale in the near future. Deloitte predicts that 25 operators will launch 5G service in 2019 and another 50 in 2020. Consequently, the largest telecom-equipment makers are in an all-out sprint to provide the infrastructure in as many places as possible before their competitors do. Among these, Huawei, Ericsson, and Nokia lead the race, accounting for approximately 60% of the market share for service providers, with Huawei leading the pack. However, Huawei has notoriously been scrutinized by the U.S. government, which claims they are a national security risk, allowing the Chinese government a backdoor to spy. The U.S. has also recommended that allies follow suit, despite Huawei’s best attempts to reassure the world that it operates independently from their government. Nonetheless, the precedent set by the U.S. has definitely had its impact.

As many companies in countries around the world have heeded the warnings, Nokia and Ericsson have been snatching up deals left and right. Companies are eager to pick up any business lost by the Chinese behemoth. A spokesman for Huawei has stated that they “have seen no significant impact on our 5G sales,” but the company needs to remain vigilant. In April 2019, the company said it signed 40 5G deals globally but Nokia and Ericsson have continued to replace Huawei as the supplier of 5G gear for multiple companies. One TDC A/S, a Danish carrier, had been supplied for 12 years by Huawei before switching to another supplier. Due to the infrequency of such large infrastructure rollouts, early establishment is crucial and any negative press such as security concerns could be drastically detrimental for years to come.

Implementation and Obstacles

Regardless of who comes out on top, manufacturing the infrastructure presents many logistical issues that every player will need to tackle. One such issue is that although boasting speeds 10-20 times faster than 4G and 3G, 5G services have reduced ranges and weaker signals. This can only be solved by installing more 5G nodes to expand range and signal boosters to strengthen 5G signals. Signals are weakened by barriers such as hills, walls and even vegetation. 5G is also more profoundly affected by these barriers than previous generations meaning that the new network requires a large increase in the number of antennas to make the new network viable, a costly endeavor.

3D Printing’s Role in Telecom

A team of researchers lead by Mark Mirotznik at the University of Delaware has developed specialized software and algorithms to design small lightweight and cost-effective 5G antennas that can be 3D printed. Beyond antennas, 3D printing presents an avenue for manufacturing all kinds of electrical equipment.

![University of Delaware’s Passive Beam Steering solution, a 5G antenna using a 3D printed graded dielectric beam forming lens. [Source: XJet ]](https://fabbaloo.com/wp-content/uploads/2020/05/Huawei2_img_5eb095bb83aa7.png)

“Telecommunication components are expensive to prototype, fabricate and install due to these parts being geometrically intricate and complex,” and 3D printing can mitigate these difficulties, cutting down on costs associated with research and development as well as a production. The main advantage is prototyping since 3D printing faces challenges in scalability. Even so, being able to develop 5G equipment faster and with more precision will be a major cost saver. U.S. companies engaging in R&D related to 3D printing and improving production processes are eligible for the Research & Development Tax Credit.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent. On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, pre-profitable and pre-revenue startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

Conclusion

With the 5G boom well under way, telecom companies will strive to find every advantage they can to enable their expansion and stay ahead of their competitors. One such advantage may be investing into 3D printing technologies as they appear to be very promising for the industry. If Huawei is to remain an option for those investing in 5G technology, it must look into sources of competitive advantage like additive manufacturing.

The use of “3D Printing” is beginning to fade, at least with respect to application-focused 3D print services. As for the rest, we’ll find out what happens.