![[Image: Pixabay]](https://fabbaloo.com/wp-content/uploads/2020/05/autos-technology-vw-multi-storey-car-park-632941_img_5eb08ee369b7a.jpg) [Image: Pixabay]

[Image: Pixabay]

Charles Goulding and Ryan Donley of R&D Tax Savers discuss the future of automotive 3D printing – in car dealerships.

Back in 2015 Ward’s Automotive, the leading auto publication, predicted that car dealers would be 3D printing 30 percent of replacement parts. In our limited survey of car dealers, we are not aware that this prediction has actualized. Analyzing dealer metrics, it is surprising that the business opportunities from dealer 3D printing are not being captured.

Dealer Profit Sectors:

Dealer profit centers include new and used car sales and financing and warranty sales profits. However, parts and services are the largest profit margin segments.

Dealer part sales revenue streams include:

-

Parts included in dealer repairs

-

Over-the-counter retail sales

-

Wholesale parts for repair shops

-

Warranty parts replacements

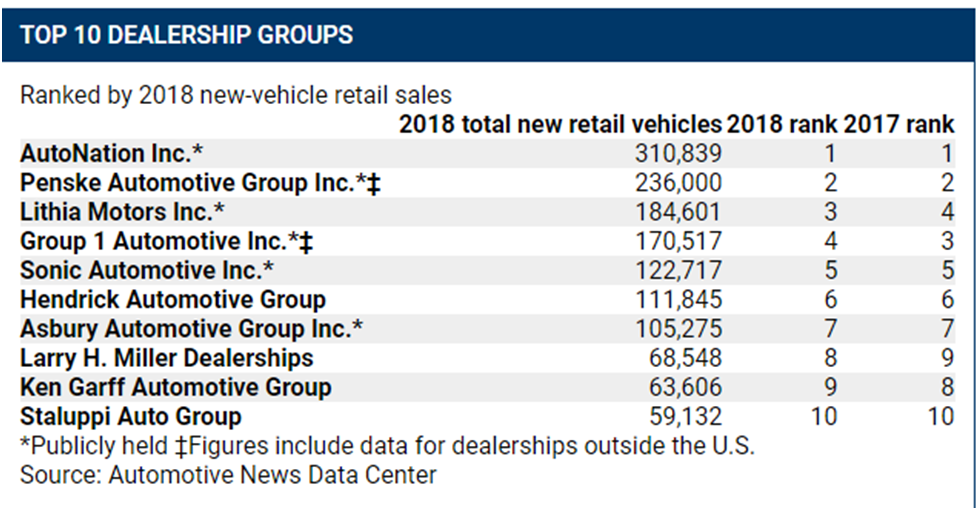

Since the subprime crisis, dealers have continued to consolidate with the top mega dealers selling large volumes of cars and parts as follows:

These mega dealers can leverage their parts’ high margin profits by investing in a variety of part selling processes including parts warehouse management software systems, parts counterpoint of sales systems, delivery route planning, and 3D printing.

Many of the mega dealers further concentrate on a few select car brands which provide additional opportunities from 3D printing even higher volumes of common fast wearing parts. The recent decrease in new car sales means that now may be the time for auto dealer parts business innovation. Dealers should be able to utilize R&D tax credits for a variety of parts business innovation including 3D printing.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

To date, the 3D printing industry may have overlooked this large new sales opportunity. Just like auto dealers demo cars for customers, 3D printer sellers may want to start demos of printers for the mega dealers.