Charles Goulding and Peter Favata examine the state of advanced footwear production using additive manufacturing.

A Legacy of Winners

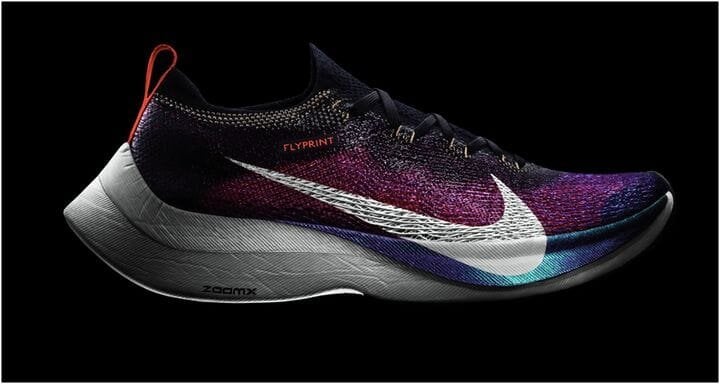

The recent success of the Nike Zoom Vaporfly demonstrates that 3D printing technology can catapult a company to the top of its category.

Nike has always been known as one of the top sportswear brands especially when it comes to sneakers. This company founded in 1964 by the University of Oregon’s track and field coach has become a multibillion-dollar giant in the shoe and sportswear industry. This brand has been known for representing some of the greatest athletes of all time including Michael Jordan, Tiger Woods, and more recently Eliud Kipchoge who became the first man to break the two-hour mark for a marathon coming in at one hour fifty-nine minutes.

The Shoe Behind The Run

The shoe that was worn during the record-breaking run was the Nike Zoom Vaporfly, a shoe loved by many runners both amateur and professional. The shoe’s upper unit is made of an extremely light and durable 3D printed fabric. This has made the Nike Zoom Vaporfly 3D the lightest running shoe on the market today.

Other 3D Printed Footwear

With the success of 3D printing in the sneaker industry, companies such as Adidas, Under Armour, and Reebok have also been experimenting with the concept. Adidas engineered 3D printed midsoles to put in the Futurecraft 4D project; these shoes were released as a limited edition for $300 and sold out quickly. Under Armour also developed a 3D printed midsole for one of their shoes, the UA Architech. Lastly, Reebok has developed a new material that they are using for 3D printing. It has both liquid elements and a flexible rubber material that they are putting on the top of the shoe to add support and act as the laces.

Companies that take part in 3D printing for footwear should be taking advantage of the Research & Development Tax Credit.

The Research & Development Tax Credit

R&D tax credits are available to support apparel companies that take advantage of additive manufacturing to create new and improved products and processes.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, pre-profitable and pre-revenue startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

Adidas Closing Factories

It was recently announced that Adidas is closing two of their facilities that utilize “Speedfactory” technology, one in Germany and another in the United States. Adidas has stated that the reasoning behind this was “less due to financial reasons and more for organizational reasons”, according to an article from CNN. Adidas has now chosen to deploy its Speedfactory technology at two Asian suppliers, one in Vietnam and one in China, and 3D printing operations apparently continue, according to sources at Carbon. Nike also announced that they will no longer be selling their products through Amazon.

Conclusion

Nike has never been afraid of experimenting with their shoes looking back at “The Glove” in 1998 up to now with 3D printing Nike has always been ahead of the pack with innovation and they seem to have a winner with 3D printing.

1 comment

Comments are closed.