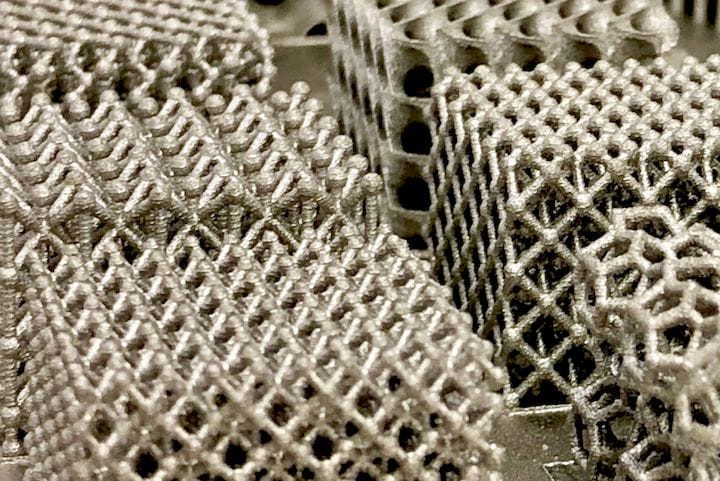

Charles R. Goulding examines metal 3D printing applications outside of automotive and aerospace.

After years of development, metal 3D printing industry providers are beginning to hit their stride. With the auto and airplane industries at record low production levels, the 3D printing providers need to diversify their customer base.

I spent 26 years at a $7 billion sales multi-industry metal fabricator and we avoided the auto and airplane industries because of their relentless cost-cutting demands.

Alternative large metal product users include:

- Farm Equipment

- Railroads

- Kitchen Appliances

- Washers and Dryers

- Infrastructure (including bridges)

- Telecom Equipment

- Trucks

- Tools

- Packaging Equipment

- Robots.

- Elevators

- HVAC

It is generally a business strength to have a diversified customer base and not be overly dependent on one industry. Additionally many other industries have a greater appreciation of supplier added value than the auto and aircraft industries do.

R&D tax credits are available to support new customer product development.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The metal 3D printing industry started with the auto and airplane industries. Now it needs to use that experience to diversify and find new growth opportunities.