I’m skimming through a very long securities submission by 3D Systems that details, among other things, their executive compensation levels.

Public companies are required to post quite a few types of reports publicly in the USA to maintain transparency to their stockholders, who otherwise would have little idea of what’s going on with their investment.

The new posting, found on the US SEC site EDGAR, is a “SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934”. It announces the annual shareholders’ meeting and lists the agenda of items requiring votes and approvals.

Such items include things like appointing an auditor for the corporation and adding new board members to fill in gaps, and those are routine matters. But the Schedule 14 also tells us of the complex compensation programs for the company’s executives.

The board of directors and executives of 3D Systems are rewarded handsomely, but as you might suspect the highest compensation is reserved for their CEO, Vyomesh Joshi, who joined the company about a year ago.

Mr. Joshi’s annual salary is USD$925K, a high but not unreasonable salary for someone running a billion dollar company. But what’s more interesting is the other compensations awarded to Mr. Joshi.

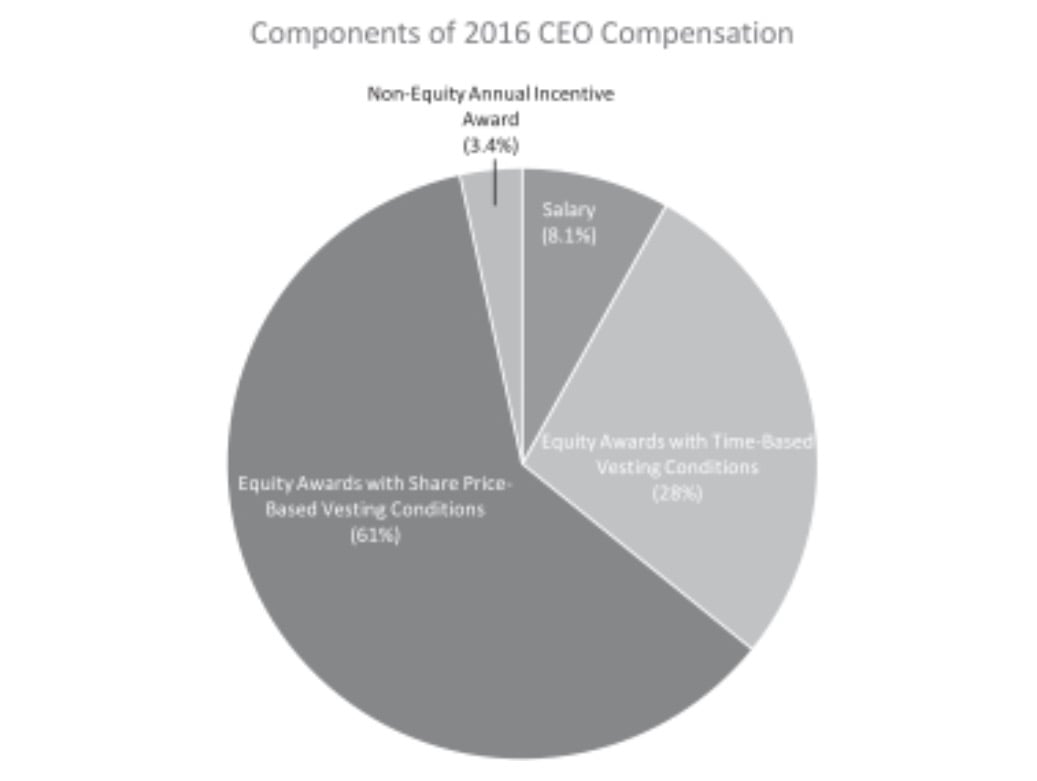

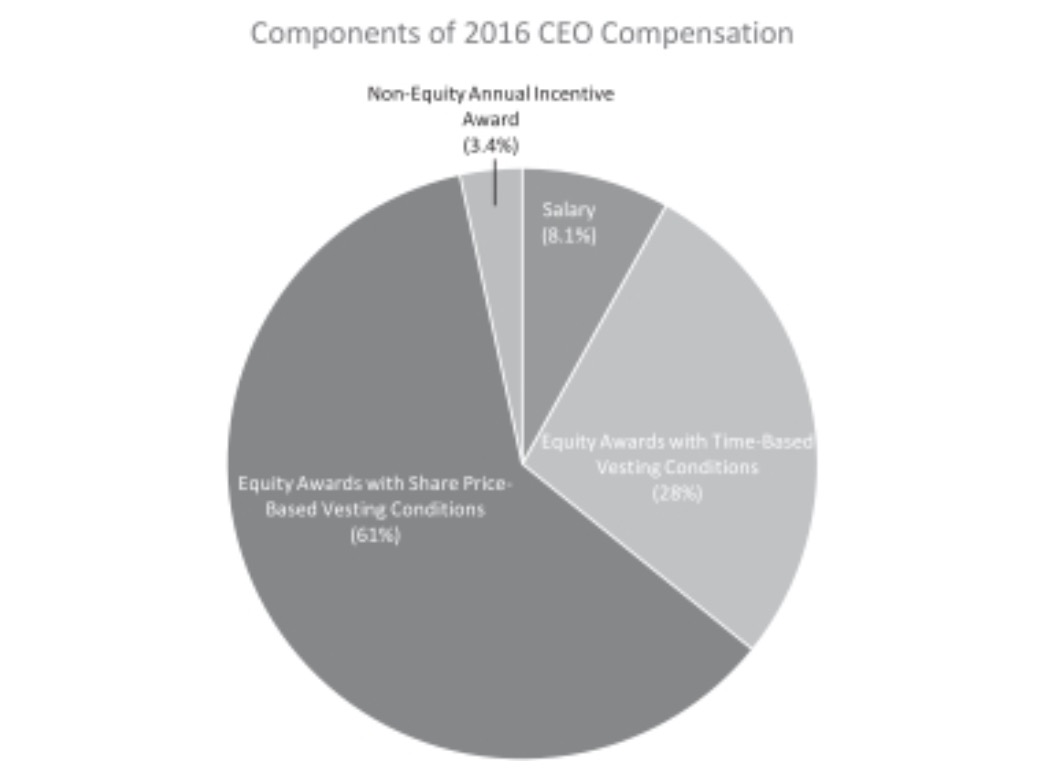

As is customary the CEO is awarded a number of stocks and options. In this case, Joshi is awarded USD$7,244,500 in such stocks, for a total of almost USD$8.2M in total annual compensation.

That sounds like a lot, but it isn’t necessarily so. The stocks are awarded in five different categories:

- Time-Based Restricted Shares

- Performance-Based Restricted Shares ($30 vesting condition)

- Performance-Based Restricted Shares ($40 vesting condition)

- Performance-Based Stock Options ($30 vesting condition)

- Performance-Based Stock Options ($40 vesting condition)

Here’s how it works: if the 3D Systems stock price hits something over USD$30, then Joshi is awarded 50,000 shares and the option to purchase 250,000 more at a set price. If the stock hits USD$40, then other shares and options become active.

So you can see, it’s a highly performance-oriented system that is designed to strongly encourage the executive to achieve a higher stock price. This is why executives are focused primarily on the stock price and not as much on other aspects of the business.

So if you hear that the CEO is “making USD$8M” and wonder why they’d pay someone so much, there’s a reason. You can’t just say that the USD$8M is worth 100 printer sales so he’d better get selling, for example. The CEO produces value by organizing the company so that it will truly be worth, say, USD$30 per share.

The CEO gets rewarded for what is accomplished.

Via EDGAR