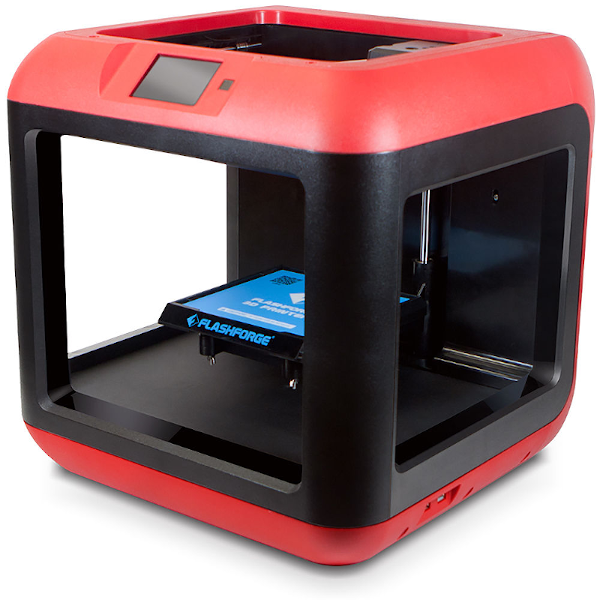

FlashForge Finder 3D Printer

FlashForge Finder 3D Printer

Charles R. Goulding and Preeti Sulibhavi of R&D Tax Savers discuss ensuring tax credits for companies working with three primary components of 3D printing: hardware, software, and materials.

In our specialty area of tax consulting, we essentially analyze 3D printing-related R&D tax credit projects within a rubric of three (3) components. Those three (3) components are:

-

3D Printers

-

3D Printer Materials

-

3D Printer Software

3D Printers

3D Printer: Prusa i3 MK3S

3D Printer: Prusa i3 MK3S

When a prototype 3D printer is being developed, the 3D printer manufacturers should use the 3D printer R&D tax planning criteria.

To document the 3D printer R&D tax credit claim, it is advisable to keep the prototype printer isolated from production, so the prototype preserves its tax favorable prototype status. Multiple 3D printer prototypes are permitted for tax purposes. The design records evidencing each 3D printer prototype iteration should be retained to substantiate the credit if need be. The complete bill of materials (BOM) should be retained and reflect both purchased and created sub-components.

Increasingly, 3D manufacturers are using production 3D printers and robots to build their own components. This enhances the 3D printer manufacturer’s prototype tax benefit calculation. It is particularly important to keep all testing records. We recommend creating and retaining each and every testing hypothesis and, of course, the results of those tests and experiments.

3D Printer Materials

The tax law specifically designates materials as tax credit eligible, in a tax category called”Supplies” for R&D tax credit purposes.

Many companies do not have accounting systems that accurately identify the amount of supplies or raw materials consumed in the R&D process. We recommend that 3D printing businesses have their operations and accounting professionals work together to create a methodology for documenting R&D raw materials consumed. One approach is to use the printers’ internal software to measure materials consumed just like a 2D printer can provide a hard copy page count. There is plethora of new and improved 3D printing materials available in the market and they all have different performance criteria that must be thoroughly analyzed and tested. Often outside materials laboratory testing is necessary, the cost of which is also tax credit eligible.

3D Printing Software

3D printing software qualifies for the more favorable external software R&D tax credit tax rules since it touches the customer via use of the product.

Today most software is developed using the “Agile Method” which has the advantage of self documenting all R&D testing iterations. Again for tax purposes it is important to retain the screen shots documenting all software iterations. The 3D printing industry has increasingly been using on-board smart sensors within printers to create the huge data sets needed for machine learning and artificial intelligence (AI). This is a very costly software development process that can materially impact the amount of the R&D tax credit.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates for up to five years.

Conclusion

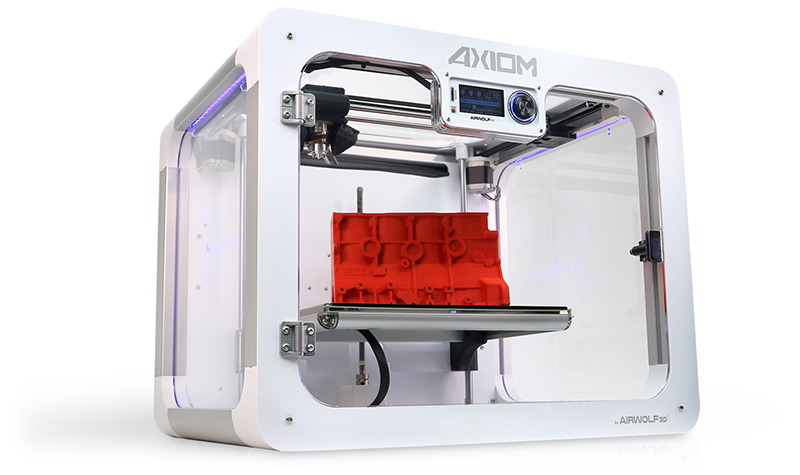

Airwolf AW3D AXIOM 3D Printer

Airwolf AW3D AXIOM 3D Printer

At the IRS appeals level, we recently had a machine building client sustain the majority of their R&D tax credit because all of the records described above were retained. For the taxpayer to establish the maximum R&D tax credit, copious documentation is critical.

Those 3D printing companies that understand the rules can create systems that use existing internal information and technology to more efficiently document their R&D tax claim and receive the credit they well deserve for utilizing technological innovation.