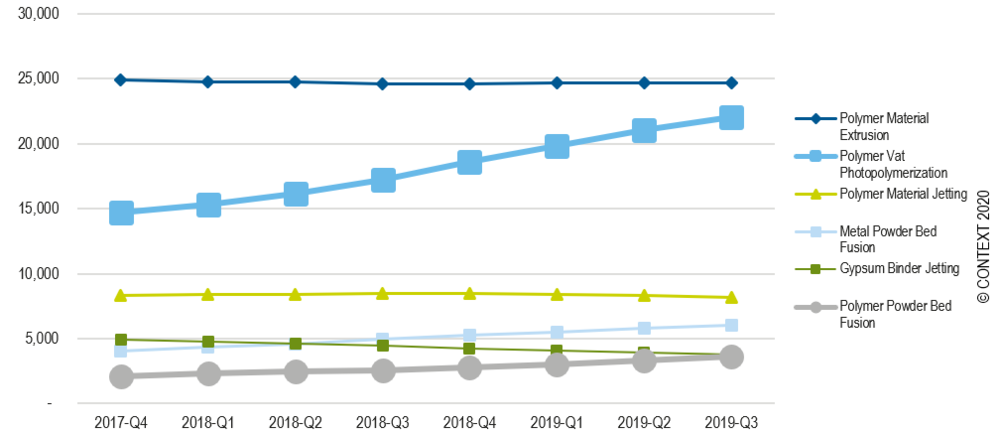

Global Industrial/Professional printers installed by primary material/process [Source: CONTEXT — from February 2020 update, Photopolymers and thermoplastics shine in 2019 as installed base of 3D printers grows]![Global Industrial/Professional printers installed by primary material/process [Source: CONTEXT — from February 2020 update, Photopolymers and thermoplastics shine in 2019 as installed base of 3D printers grows]](https://fabbaloo.com/wp-content/uploads/2020/05/context_img_5eb0653413086.png)

Times and markets are uncertain; how do we gauge 3D printer sales forecasting in 2020?

While the world is enduring the difficulties of pandemic conditions, economies all have a great big question mark over them. Unemployment, under-employment, and furloughs are becoming all the more common as decisions over which businesses are considered “essential” or “non-essential” dictate ongoing operations. Even for those businesses still up and running, it’s hardly “business as usual.” For those that aren’t up and running, the questions are many: how long will they be closed? When they reopen, will they be doing so with full staffs?

3D Printing vs COVID-19

It can be strange as well to see the other side of this crisis, as 3D printing has been opening up to significant opportunity. The speed of the technology in responding to need-it-now personal protective equipment (PPE) and other stop-gap supply chain solutions has been vital to many, in both healthcare and manufacturing.

Additive manufacturing is in mainstream headlines again, and while there’s some semblance of hype (“3D printing can solve the COVID-19 crisis!” — note: it cannot) it’s not generally at the same levels as the original hype of the desktop 3D printing heyday of nearly a decade ago. In all, this more mature industry is seeing more mature response now: desperately needed PPE as well as digital inventory solutions are coming into play with viable, quality solutions.

But the tagline of this entire crisis comes down often to one word: unprecedented.

In a global pandemic, impacting lives and businesses on every continent, how do you predict what will be needed? What about what things will look like “after”? Will the “new normal” look at all like the established norm?

Many conversations are focusing on the need for 3D printing — does that also mean sales of 3D printers will go up?

3D Printer Sales

The analysts at CONTEXT have been asking this very question as, indeed, it is actually their job to do so. The company tracks and forecasts data in the 3D printing industry (among others), and frankly right now I do not envy this work.

UK-based CONTEXT has today released a look at their current thinking, titled relatively calmly, “COVID-19 concerns make 2020 3D printer sales outlook challenging.”

Pointing out that many 3D printer manufacturers have shifted focus — “rightly” so, as they note (and we agree) — from making their systems to producing PPE and other pandemic response products and supplies, CONTEXT examines what this might mean for their focus: forecasting sales.

“By focusing efforts on producing much-needed medical supplies has meant a move away from the production and sale of printers towards service businesses and service-bureau infrastructure. Coming on the back of weak shipments in Q4 2019, this refocus – and the supply-and-demand constraints expected in the weeks to come – looks to make 2020 a difficult year for 3D printer shipments,” said Chris Connery, VP of Global Analysis at CONTEXT.

“While COVID-19 had not yet had an impact, global 3D printer shipments were already unseasonably weak in Q4 2019. For many manufacturers – particularly those focused on Industrial or Design price-class printers – this slowdown was associated with a weak automotive market, a generally weak manufacturing sector and sluggish Asian and European economies.”

For context, CONTEXT classes 3D printers by price point, namely as: Industrial (≥ $100K), Design ($20K–$100K), Professional ($2.5K–$20K), Personal ( ≤ $2.5K; excludes DIY kit printers).

As Connery touched on, shipments had already been less-than-stellar, with most of these categories seeing declines of 11%-23% in Q4 2019 compared to the previous year — aside from the Professional category, which in fact increased 26%. For the full year, Industrial shipments were up 1% and Professional increased by 16%; Design and Personal segments dropped (though many personal sales were impacted by a shift to kits, “sales of which are hard to quantify”).

That’s all from relatively standard business operations, though; what about sales in 2020, the whole of which has seen some impact from novel coronavirus on some level — and will see much more going into Q2? CONTEXT explains:

“Forecasts for 2020, based on information available as of 23 March, show printer manufacturers are now assessing, on a daily basis, the impacts of a disrupted supply chain and uneven human productivity on both their own ability to produce hardware and the end-markets to which they cater. In recent years, vendors have typically begun with a bullish outlook and slowly adjusted their shipment outlook over the year.

Currently, however, vendors are offering only informal/high-level forecasts: most are beginning 2020 with a negative outlook and anticipating they will recover as business begins again once the global pandemic subsides. While each printer class caters to different users, many of the key end-markets (such as the dental, aerospace, automotive, consumer product, orthopaedics and education markets) are negatively affected by global work closures and slow-downs. On the supply side, key components for printers, as for many other electronic goods, come from China, the region impacted first by the pandemic. As a result of the uncertainty, hardware vendors are now thinking in terms of weeks and quarters rather years…”

All estimates, basically, are subject to change — though some forecasts can be made anyway. That is, after all, the business of forecasting.

CONTEXT is currently projecting some declines in each segment for 2020. These are all relatively slight, especially compared to the weak shipments seen in 2019 for some of these areas. Immediate effects will likely see some drops before the trending upward again as region by region, markets begin to recover.

Looking ahead, though, there’s not just light at the end of the coronavirus tunnel for 3D printing, there’s rather a bright spot of opportunity. More and more, as the technology is put to use in addressing pandemic-related needs, it is also raising its profile. CONTEXT notes:

“As the pandemic comes under control and economies return to normal, there is great potential for the 3D printer market since the ability of the technology to assist with the immediate needs of the medical community have showcased its quick-turn capabilities worldwide. Responses to the pandemic are also demonstrating that leveraging 3D printing for local production, instead of relying on complex multinational supply chains, has the potential to help many companies mitigate future risk.”

So, how do we forecast 3D printer sales now? Thoughtfully, optimistically, and above all, understanding it’s all subject to change.

Via CONTEXT