Charles R. Goulding and Preeti Sulibhavi stitch up a look at 3D printing and embroidery.

Sewing, crocheting, and embroidering are often used synonymously. That is of course not correct since the three are very different forms of turning fabric into design. For instance, sewing is a term used to describe joining or attaching, repairing, or securing fabric/material with stitches. Crocheting is the process of creating textiles by using a specific crochet hook or tool to interlock loops of yarn, thread, or strands of other fabric/material. Embroidering refers to the craft of actually decorating fabric/material using a needle to apply thread or yarn. Pearls, beads, quills, sequins, are examples of items used to decorate fabric through embroidery.

Although it may not seem apparent, embroidery and 3D printing can create the perfect pattern. This is largely due to both the technology as well as the process of embroidering.

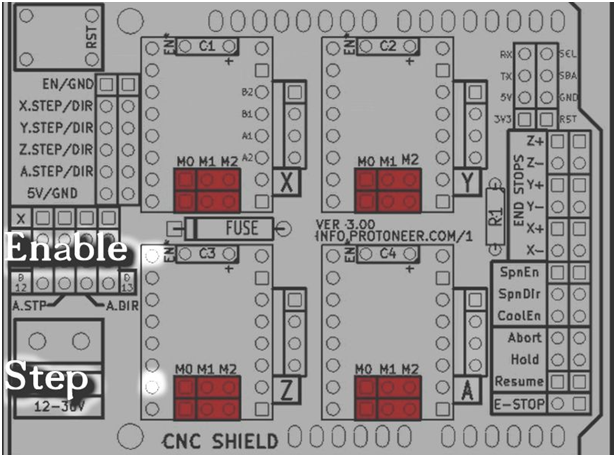

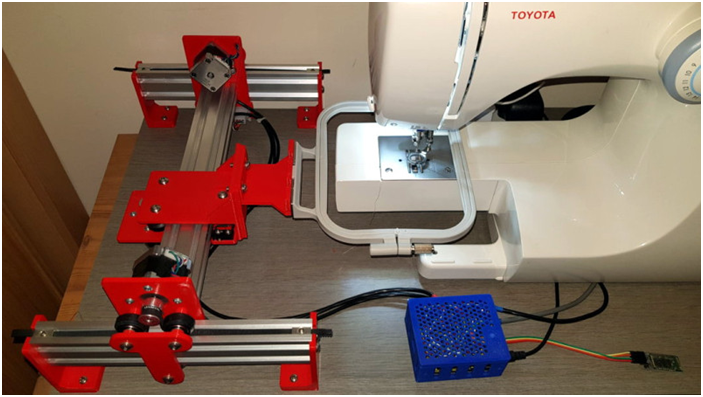

Embroidering generally requires the operator of the sewing machine to move the fabric around in various directions desired while the sewing machine stitched the decorative items onto the fabric/material. To aid as well as automate this movement of fabric/material, CNC has been used for motion control. Several embroidery machines integrate 3D printed parts and common components for an economical DIY solution. For instance, the DIY Embroidery Machine V2 is both functional and economical. The main control activity is provided by an Arduino Nano with a CNC shield and Bluetooth R2232 module. Never thought embroidery and CNC would be used in the same sentence, did you?

R&D tax credit incentives are available to new and improved embroidery products and processes, particularly those integrating 3D printers.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

And Sew it Begins…

3D printing can enhance the embroidery industry, especially now with the COVID-19 global pandemic turning people to taking up new hobbies (e.g., sewing masks, etc.). Those avid embroiderers are already aware of utilizing 3D printed parts for both new and old sewing machines to achieve incomparable results.

A Cricut is an embroidery die-cut machine that operates on digital design patterns to direct the movement of the machine. Those currently using their Cricut to create simple home goods, from personalized water bottles to personally branded t-shirts, have no complaints. In fact, much of the goods available on Etsy are likely made using the Cricut.

Conclusion

It’s time to stop thinking of embroidery as a delicate hobby. Embroidery is already utilizing advanced technology and 3D printing is soon to be next.