Charles R. Goulding and Alyssa Schneider discuss the use of drones in warehouses, and where 3D printing fits into this high-flying physical inventory approach.

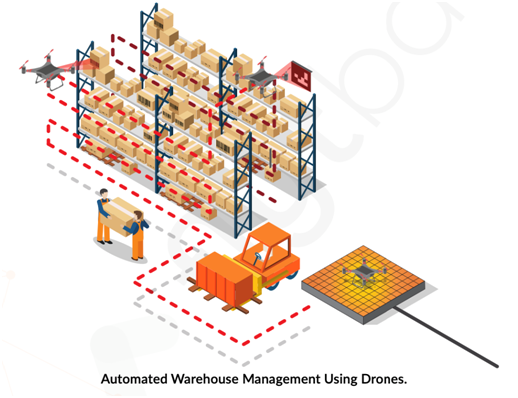

Drones are being deployed within distribution centers and for a myriad of applications. Drone technology implemented for indoor use at warehouses is free from the regulatory requirements that have constrained the projected growth of drones for many other applications. As ecommerce continues to gain popularity, cavernous warehouses with narrow aisles are jam-packed with inventory to maximize density.

One of our major logistics clients with numerous warehouses is one of the first companies to experiment with the FlytBase Warehouse Management drone system. This has given us a first look at the technology.

In a world filled with advanced technology, intelligent working drones are salvaging valuable human time while simultaneously increasing productivity in warehouses. Drones can navigate through today’s narrow aisles and assist with inventory work. This high-end technology has a multitude of abilities such as flying, avoiding collisions, scanning barcodes, keeping track of inventory, and much more. Drones are even able to select specific items that are unfit or damaged and store the records in the system. In addition, warehouse drones can also perform roof and lighting fixture inspections.

The process of counting inventory can be done quickly and accurately with the use of coordinated drone fleets. Having an army of drones doing separate tasks without colliding makes this process the most efficient. In addition, barcode detection drones can read and process different markers and can even locate the items. Drones also drastically help with inventory audits and cycle counting which eliminate the risk of human error and guarantee safety.

3D Printing for Drones

With the help of 3D printing, drones can be created substantially quicker, cheaper, and more efficiently. Drones have many complex parts which, when put all together, permit them to fly and complete tasks desired by the user. The creation process for drones involves all the parts being 3D printed or manufactured separately then assembled at the end.

This process is similar for drones that are intended for use in warehouses, however, the drone can be designed to better fit its specific task or application. The use of 3D printing can allow the user to test different materials and parts on the drone to see which combination makes the most effective and productive warehouse drone. For instance, specific propellers and motors can be created allowing for travel through narrow aisles with high speeds and no collisions. Morever, if a part becomes damaged or worn out, it can be replaced very quickly with excellent quality with a 3D printer. The use of 3D printing reduces manual labor, cost, and time while also creating the most efficient custom warehouse drone.

In a post-coronavirus environment, having fewer people performing administrative tasks and services in a warehouse is particularly beneficial. 3D printing is a low-cost and efficient tool for developing drones that can complete these functions. Companies who are now integrating automated warehouse drone solutions to improve operations while simultaneously lowering the number of personnel on the warehouse floor can take advantage of the R&D Tax Credit, which is described below.

[Source: sUAS News]

The Research and Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Implementing 3D printing enables the process of creating drones to be more proficient and simpler. 3D printing decreases the production time and cost of manufacturing drones enabling more businesses to make beneficial use of them. Drones are lightweight, fast, compact, and 3D printed technology makes them that way. Companies that are implementing drone fleets are drastically improving warehouse operations, which is an eligible activity that supports Federal and State R&D Tax Credits.