Charles R. Goulding and Preeti Sulibhavi examine the impact of 3D printing on businesses in Sweden.

A July 27th, 2020 Financial Times article described how large Swedish businesses are surprisingly outperforming expectations. The accompanying picture with the article included pictures of three leading Swedish companies: Ericsson, Volvo Trucks, and Electrolux, all of which have been subjects of our Fabbaloo articles. All three companies have U.S. operations, as do other major Swedish corporations like SKF. In the U.S., Ericsson has 7,200 employees including 1,100 field service people, 30 locations, and two R&D centers. SKF has multiple U.S plants and Volvo truck has a large 1,600,000-square-foot plant in Dublin, Virginia.

It is nice to see these companies doing well despite the global pandemic wreaking havoc on both the healthcare and the economic sectors. These companies being headquartered in Sweden is an observation worth noting because unlike the rest of Europe and North America, Sweden did not have a COVID-19-driven lockdown. In fact, it kept schools, shops and businesses open. While its death rate per capita is higher than neighboring countries (i.e., Norway and Denmark), its excess mortality levels have been lower than other European countries (e.g., Spain and France). This decision was controversial but the country’s officials believe that this approach to managing the coronavirus crisis has helped Swedish companies thrive.

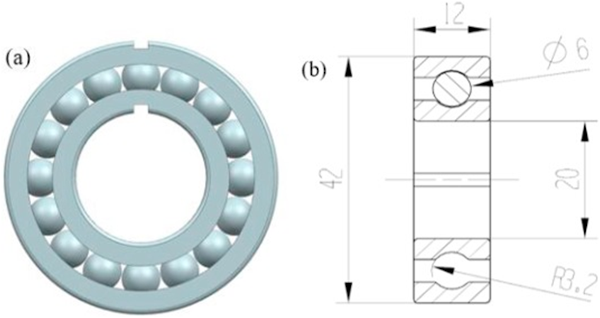

Ericsson is a reputable company and has recently been front-page news because of the controversy associated with Huawei, the Chinese telecom giant. SKF, the world’s largest manufacturer of bearings, has been an avid supporter of additive manufacturing technologies for parts and tools development. Electrolux, the Swedish appliance giant, has continued to demonstrate strong sales numbers, as more people migrate from major cities and set up new households in more remote work environments.

Sweden has always had a strong presence in the 3D printing industry.

Arcam AB, the Swedish 3D printing company, was acquired by GE in late 2017, in a $1.4 billion acquisition. This acquisition has helped to expand additive manufacturing projects within and outside of Sweden. With GE backing new ventures, projects can now be more complex and scalable.

Projects that involve additive manufacturing or 3D printing technologies are excellent indicators of research and development and can be rewarded with economic tax benefits.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Despite All Odds

They say the Swedish do live longer, fuller lives. This can be applied to their business sector as well. During this COVID-19 global pandemic, Sweden has shown its economy can thrive despite challenging conditions.