Charles R. Goulding and Alyssa Schneider take a look at the recently established US Digital Service Academy.

Eric Schmidt, the former CEO of Google, decided to partner with Robert Work, the former U.S. Deputy Secretary of Defense, to form the US Digital Service Academy. The US Digital Service Academy is offering classes in coding to help students become more advanced, offering higher-level course work and more potential degrees to obtain. The purpose of creating such an academy is to train students with the intentions of working for the government in applications related to cybersecurity and artificial intelligence. The idea reflects Eric Schmidt’s and Robert Work’s experiences with China, a furtive, government-controlled technology juggernaut. China has prospered in this field, which is sparking the drive for the United States to improve the knowledge and skill of government employees specifically.

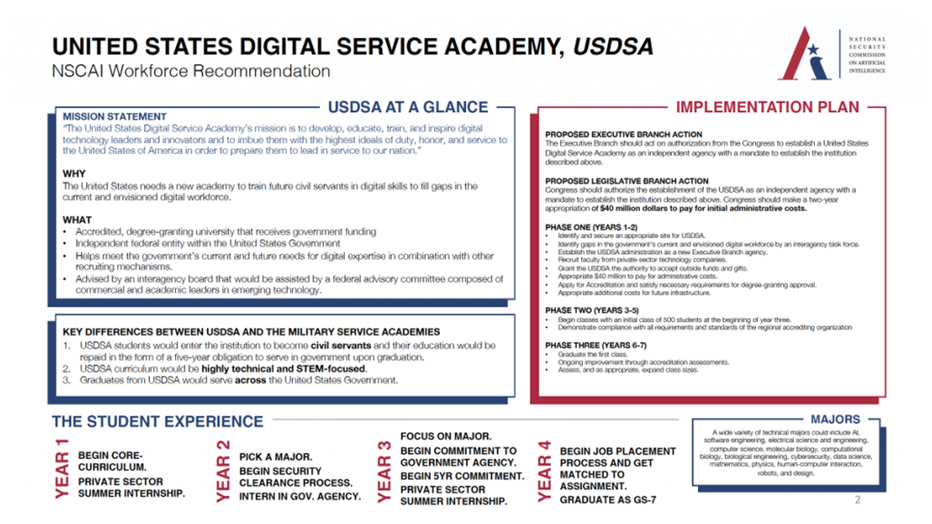

Below is a chart that summarizes the United States Digital Service Academy and how this military institution is different from others. This academy focuses on training their students to become civil servants. Following graduation, the students will partake in serving the government for five years to compensate their attendance to the university for free. The education will consist of STEM-based courses to help them persevere in this department. This is also beneficial to families who cannot afford to pay for their child’s education, providing similar academics to an ivy league university.

With a variety of technical majors to choose from, the students at the US Digital Service Academy have the opportunity to apply that skill and knowledge to 3D printing. Already, the military utilizes 3D printing technology to push the boundaries of science, perhaps most notably for embedded electronics.

In today’s increasingly digitalized world, it is critical that US employees strive to stay current with the latest digital technologies and applications, as well as the knowledge and skills required to understand and utilize them. This oftentimes requires specific training or further learning post-graduation. Recently, Microsoft has implemented a technical training program to improve digital skills worldwide.

With the current state and projections of foreign competition, 3D printing will play a prominent role in advancing our country forward, and it should be included in technical schooling programs.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Eric Schmidt’s movement towards developing this advanced and digitalized university should enhance the use and understanding of all digital technologies, including 3D printing, across the nation. The United States faces new challenges with the Chinese government-controlled economy often and the US Digital Service Academy can help in this crucial connection.