Charles R. Goulding examines a major investment into Japanese companies and the impact it may have on their 3D printing activities.

Warren Buffett surprised the investment community on his 90th birthday with a $6 billion investment (pdf) into five of Japan’s century-old trading companies. These five massive companies with global tentacles are Mitsui & Co. Ltd, Marubeni Corp., Mitsubishi Corp., Itochu Corp., and Sumitomo Corp.

Berkshire Hathaway, Inc. has acquired slightly more than 5% of the shares in these established Japanese investment firms, via its National Indemnity Company subsidiary, and is willing to boost the stakes to 9.9%. These investments are intended to be held long-term as Buffett is keen on balancing Berkshire Hathaway’s portfolio (currently heavily skewed to Apple, Inc.) to something “completely different” in order to offset the deep U.S. losses due to the recent and still ongoing COVID-19 pandemic. Buffett was likely attracted to these Japanese investments because they are deeply rooted in “real economies” (i.e., steel, shipping, and other commodities).

Those who haven’t followed the evolution of these giants may mistakenly think they remain low-margin commodity trading companies. However, they have evolved into strategic equity investors including investments in 3D printing. We describe below some of the many additive manufacturing (AM) investments made by each company:

Mitsui

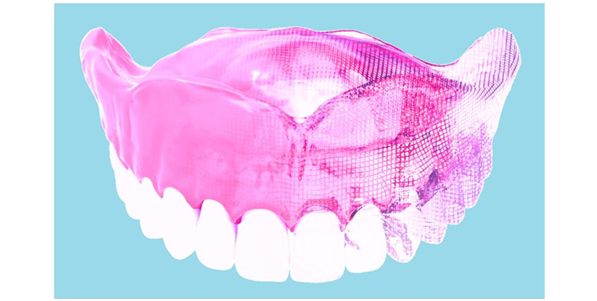

- The company runs studies and defines clear implementation guidelines for AM projects. Also involved in a global dental material 3D printing project.

- Involved with redesigning components to be manufactured with AM technologies.

Sumimoto

- Large investment in Sintavia, a Florida-based AM company serving the US aerospace industry.

- With its recent investment in Elementum 3D, Inc., there is a deep reach into AM and the creation of advanced metals, composites and ceramics. The metal powder, combined with ceramics, enables faster 3D printing speeds and stronger mechanical properties. Large focus on reducing waste in the AM production process and creating lighter end-stage products as well.

Marubeni

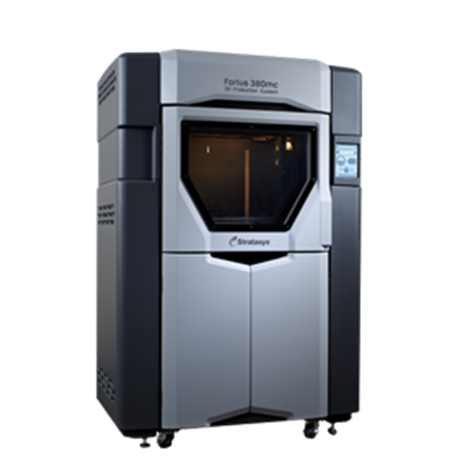

- Marubeni Information Systems is the Japanese distributor of Stratasys 3D printer FDM and Polyjet products, which are AM technologies that can build parts layer-by-layer or by jetting liquid photopolymer materials on surfaces.

- Recent collaboration with Osaka Titanium Technologies Co. Ltd. To distribute Titomic Kinetic Fusion (TKF) systems and supply aerospace-grade gas-atomized titanium metal powders globally. When combined with automated AM systems, it drives new opportunities for high-volume production of titanium parts.

Mitsubishi

- Has developed a hybrid AM machine that combines metal sintering and milling. This new technology is called “Dot Forming,” and is inspired by the technology of metal deposition under concentrated energy (DED).

- Mitsubishi Chemicals is delving into developing a wide variety of materials focused on deposition modeling (FDM), water-soluble materials, sustainable materials, etc. for its 3D printers (such as the Colossus).

Itochu

- Combining the use of the Internet with its own proprietary algorithms, Itochu’s Plethora technology can provide a contracted production service with very short turnaround times. This is achieved by CAD modeling and immediate feasibility estimates. The AM machines are completely run through digitization.

Federal Research and Development tax credits are available for the eligible U.S.-based 3D printing activities that these Japanese giants are investing in.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Buffett’s investment will shine some light on the modern-day structure of these business giants and enlighten the business community. Part of this new understanding will include seeing who the real investors are behind niche 3D technology. It will also become apparent that this is actually a global investment rather than a concentrated in-country Japanese investment due to their global reach.