Charles Goulding and Ryan Donley examine a deal between GE and Wabtec and its potential implications on 3D printing in the rail industry.

Early talks of a large transaction between General Electric (GE Transportation) and Wabtec began in the middle of 2018. Since then, the deal has been restructured with added financial implications to shareholders and increased value to employees and customers. The restructured deal is expected to close by the end of February 2019 with both companies being optimistic about the deal, as Wabtec had announced, “Together, Wabtec and GE Transportation will create a stronger, more diversified transportation and logistics company.” This will end up being a major impact on the 3D printing sector for GE Transportation as this deal could be exactly what GE needs to accelerate their plans to apply additive manufacturing to components for their railroad technology.

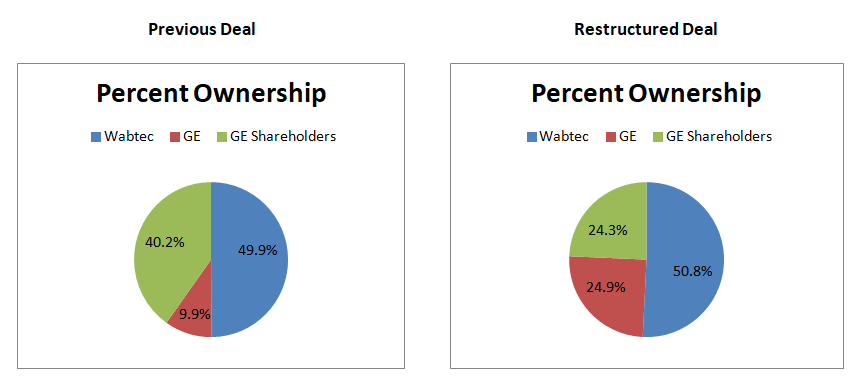

The restructured deal compared to the prior deal is represented below through the two charts in terms of total ownership.

*Aspects of 3D printing railroad technology may be eligible for the Research and Development Tax Credit, which is briefly described below.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Implications on 3D Printing Rail Technology

The transaction equates to a value of approximately $11.1 billion that, if successful, could herald in a new era of rail technology. The combination of the companies will bring a base of more than 23,000 locomotives globally along with combined technology and innovation that will enable the overall business to be a critical competitor on a global scale.

The technology and innovation includes the use of additive manufacturing for locomotive components. As mentioned earlier, GE has plans to implement additive manufacturing for railroad technology at the GE Brilliant Factory. The factory, which is in part based in the cloud, is a digital platform that collects big data from the production line and can identify important operation points to improve processes for effectiveness. The factory utilizes a practice of lean manufacturing that only uses the necessary amount of material to produce a part in addition to having capabilities to fix broken machine parts on-site. This will lead to overall less waste and more efficient production methods. The company plans to conduct a pilot run of additive manufacturing for locomotive components this year. If everything goes according to plan, GE transportation could potentially posses an inventory of up to 250 3D printed train components in the next 7 years.

Conclusion

The deal between GE Transportation and Wabtec will set the bar for 3D printing in the locomotive industry as both companies possesses strong manufacturing capabilities that will drive additive manufacturing within the rail sector.