![Analyzing 3D Systems’ financials over the years [Source: Seeking Alpha]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb09a9a432b2.jpg)

I’m reading a report on Seeking Alpha describing the stock price journey of 3D Systems, and have some things to add.

Seeking Alpha is a popular site for investors who look for stocks to buy and sell, with arguments happening to and fro on any number of options. In this case there is a very interesting report by Nik Schranz, who analyzed the stock price journey of 3D Systems over the past few years.

Schranz describes the journey as a “Failed Growth Story”, and we would not disagree.

Back in the 2010 era, 3D Systems’ stock price hovered around the US$10 level, but in the few years after that point it skyrocketed to an astonishing US$100, before plummeting downward, back to a level more or less close to what it started on before the price spike.

Schranz correctly points out that some investors were caught in this scenario, having bought the stock during its rise, but failed to dump it before the crash. These, he says, may still hold the stock in a long-term waiting game for the stock to eventually move upwards where they could recover their sometimes substantial investments.

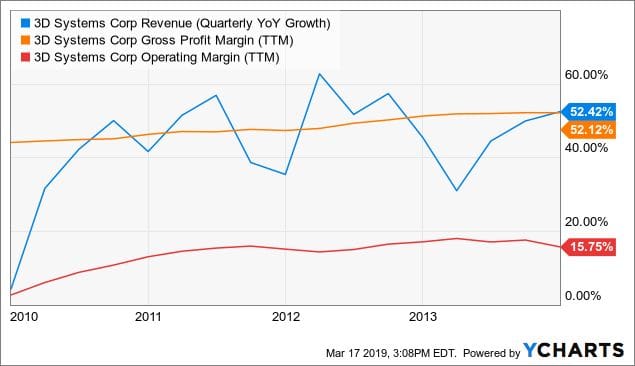

Schranz’s analysis is done from a technical point of view; that is to say he is examining the trends of the stock and some of the publicly released financials in an attempt to understand what’s going on and make informed decisions about buying or selling. This is a common technique used by some investors who are unable or uninterested in attempting to know more deeply what is really going down at a company.

Technical analysis often works well, but in this case we know a lot more about this scenario; we were there reporting on the events and speaking to some of the individuals involved.

To me there is only one explanation for the unnatural spike in 3D Systems’ stock price over the 2012-2015 period: hype. Allow me to explain.

When the original patents for basic 3D printing technologies expired around 2009, several companies sought to build inexpensive desktop versions they could sell at low prices to large audiences. Consumer machines, if you want me to be specific.

The consumer market was and is enormous, and any reasonably successful product could be massively profitable. Consider microwave ovens, mobile phones, smartwatches, or others. Could 3D printers be like them? That’s what some believed would be possible.

Certain companies (well, MakerBot) went to the wall to promote this concept in an attempt to build recognition and sales for their company. Soon we saw desktop 3D printer technology everywhere: on the news, in TED talks, being demonstrated at the library around the corner, and elsewhere. It was magic, or seemed to be.

Certain other companies (well, 3D Systems) saw the apparent success of the MakerBot promotion and jumped on the bandwagon, launching desktop 3D printing equipment and services. The idea was to put their company along the same trajectory as the buzz, or at least do so in the minds of investors.

With all the buzz, it was impossible for investors, both serious and casual, to not notice the apparent skyrocketing concept of 3D printing. In the rush to place their money somehow in the space, they found there were really only two publicly traded 3D printing companies one could invest in: Stratasys and 3D Systems.

Thus the stock prices of both of these companies drove to the sky, making many people very rich. People buying the stocks in many cases had no idea about the technology; only that it was “hot” and they had to “get in” before it was too late.

However, the reality was that the desktop 3D printing concept for actual consumers was incomplete. It was not clear what they would be 3D printing, nor where they would acquire the printable content. Soon the entire consumer notion collapsed and the stock prices simply went back to where they should have been all along.

And that’s where we are now, although 3D Systems has long dropped the consumer angle and has reverted to their original value propositions. More companies have entered the space offering greater value and technologies, although there are still very few publicly traded companies.

Sometimes there’s another level of investment analysis that must be done to truly understand what has taken place.

Via Seeking Alpha

A blog post reveals much of what happens behind the scenes at 3D print service Shapeways.