Charles R. Goulding and Peter Favata explore 3D printing implications from Brigs & Stratton’s use of the technology — and their recently-announced bankruptcy filing.

Over 100 Years of Business

Briggs & Stratton was established in 1908 in Milwaukee, Wisconsin and employed approximately 5,200 people as of 2019. The company was primarily known for designing and producing engines used for lawnmowers, pressure washers, and electrical generators. Sadly as of July 20, 2020, Briggs & Stratton has filed for Chapter 11 Bankruptcy.

The company has had a history of innovation starting in the 1950s with the development of the lightweight aluminum engine which was used on the recently invented rotary lawnmower, continuing into modern day where they had been experimenting and producing products using 3D printing.

Briggs & Stratton had been using 3D printing to create their prototypes since 2015 when they acquired a 3D Systems SLS Printer. This has resulted in higher accuracy, greater efficiency, and increased cost savings as it relates to product development.

Industrial 3D Printing

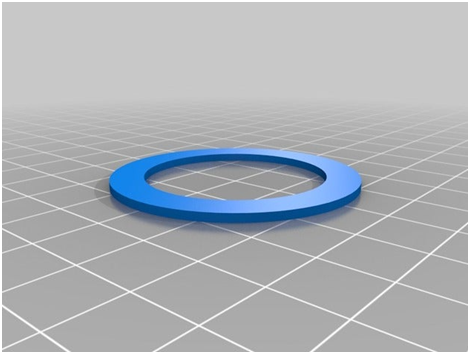

3D printing can be utilized during the design phase to create and test prototypes. It can also be used for final production. Components such as gaskets can be produced using 3D printers, which are crucial when producing any engine to prevent oil or coolant from leaking into the cylinders.

Generators can also benefit from 3D printing. Generators and the parts to repair them can be 3D printed to help manufactures reduce costs as well as maintain production.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Where to Go From Here

As stated above, Briggs & Stratton has filed for bankruptcy. It has been said that the novel coronavirus pandemic was the final reason for this. However, it seems as though the writing has been on the wall for a while.

Looking at their stock prices over the years, The Briggs & Stratton Corporation (BGG) once saw a high of over 40 dollars a share back in 2004. As of July 20th of this year, this price was down to just over 70 cents a share. They also have had short-term debt of $597.5 million and long-term debt of $7 million. It’s reported that Briggs & Stratton planned on selling off their commercial turf products business as well as its pressure washer and portable generator product lines. They would then focus on engines for residential outdoor power equipment, commercial engines, standby power generation, and commercial battery systems. This is according to a July 20th article from the Milwaukee Journal Sentinel.

Conclusion

Briggs & Stratton has been under some scrutiny in days since there bankruptcy filing. On Sunday, July 19th they announced they would be terminating health benefits for 450 former workers and ending life-insurance protection for 4,000 former workers. However, they have also announced the chapter 11 filing won’t stop the expansion of their new factory in upstate New York. Hopefully, they can combat these issues and reorganize to return to the company that once was while continuing to benefit from 3D printing.