3D print analyst firm CONTEXT released a report on the current industry state, and it reveals some interesting trends.

CONTEXT, an IT market research firm, has recently provided an overview of the market’s performance in the last quarter of 2022, revealing some interesting insights.

Although 3D printer shipments remained flat or fell, industrial unit shipments dipped, and system revenues increased due to inflationary price hikes and a shift towards more efficient industrial metal machines.

Personal and Kit & Hobby 3D Printers

Personal 3D printer shipments dropped by 2% year-over-year in Q4 2022, while revenues increased by 16%. Kit & Hobby shipments were up by 15%, with Creality dominating the market. Consumer spending in the US, the largest end-market for these categories, remained weak in Q4, but shipment rates held up better than expected. However, some higher-profile companies began exiting this market segment, such as XYZprinting, Sindoh, and Dremel. Their absence could boost prospects for other companies providing this type of 3D printing equipment.

Professional 3D Printers

In Q4 2022, professional 3D printer shipments (costing US$2,500–US$20,000) declined for the third consecutive quarter, down by 12% year-over-year. Revenues remained mostly flat due to inflation. Market share leader UltiMaker saw a 26% year-over-year decline in aggregate shipments, but enjoyed success with new products in other price classes. Raise3D performed best among the top 5 vendors, shipping 32% more printers year-over-year.

These declines are quite interesting, because for many years the professional market was the refuge for desktop producers that faced increasing competition from Asia. If the professional market is now longer safe, we could see several notable companies fall in coming years.

Midrange 3D Printers

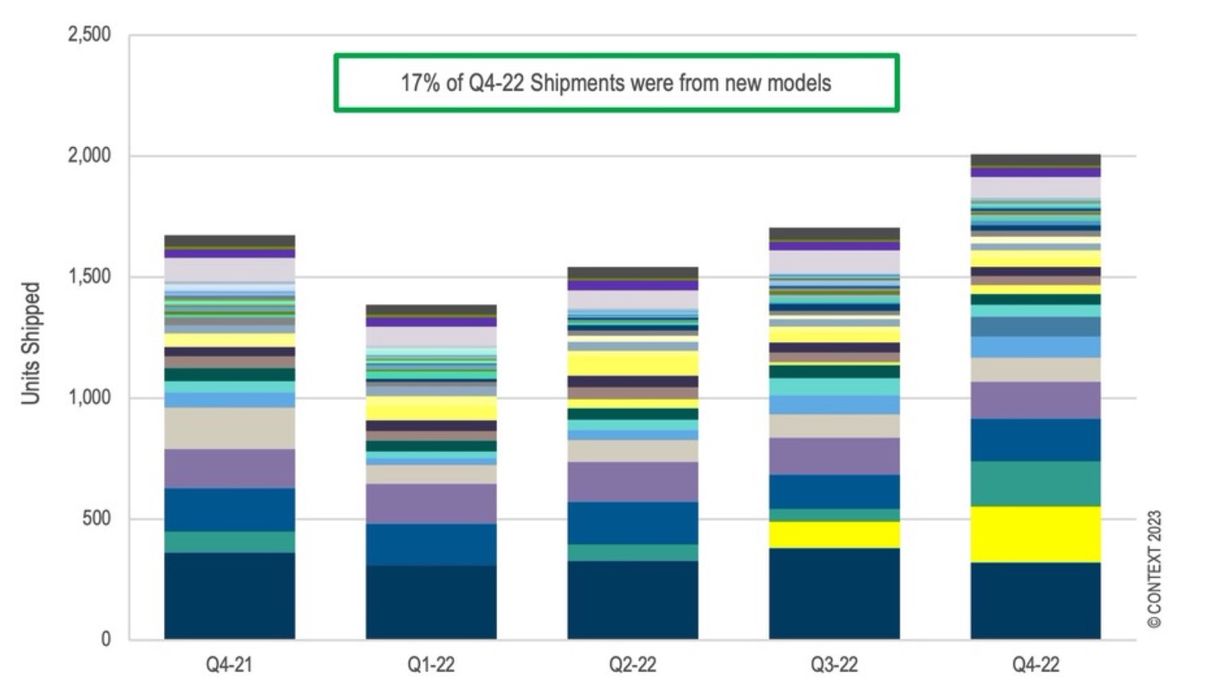

Midrange 3D printers, costing $20,000–$100,000, provided a bright spot in the Q4 2022 market, with a 20% increase in shipments compared to Q4 2021. Stratasys remained the leader in this price class, followed by Formlabs and its enhanced Fuse SLS polymer powder bed fusion line. The introduction of new products from other vendors, such as Sinterit, Roboze, Xact Metal, and Desktop Metal’s Desktop Health line, also contributed to the growth of this category.

The implication here is that there are plenty of companies now beginning to use this equipment for manufacturing purposes. With prototyping, one or two machines are purchased, but with manufacturing many are purchased. That could be why this segment is growing so strongly.

Industrial 3D Printers

In Q4 2022, the industrial price class, which accounted for 57% of global system revenues, saw a 13% year-over-year decrease in shipments. However, revenues rose by 7%, thanks to a 23% increase in average prices. Industrial polymer shipments dropped by 19% year-over-year, and metal shipments fell by 11%. Despite this decline, new multi-laser, large build-volume systems from vendors such as Velo3D and SLM Solutions continued to grow, leading to an overall revenue increase of 26% for metal powder bed fusion printers.

Industrial 3D printing has always been quite expensive, and now it seems it’s even more expensive. Nevertheless, it appears the companies manufacturing these systems are generally in good shape.

Forecast for 2023

Chris Connery of CONTEXT forecasts low- to mid-single-digit unit shipment growth across all major price classes in 2023, with industrial printers expected to perform best. Shipments are forecast to increase by 7%, and revenues by 19%. Despite the challenges of 2023, there is still longer-term momentum, with a predicted +28% CAGR in system revenues for the key industrial printer market over the next five years.

The global 3D printer market has experienced some setbacks, but it continues to evolve, offering potential opportunities for growth. While the short-term outlook remains uncertain, the market’s long-term prospects are more promising. As industries continue to explore 3D printing as a means of localizing production and mitigating supply-chain issues, we can expect to see further developments and advancements in this space.

Via CONTEXT