Charles R. Goulding and Preeti Sulibhavi look at the implications of Adobe’s bid to acquire Figma.

Adobe announced on September 15th, 2022, that it has proposed to acquire Figma, the leading web-first collaborative design platform, for approximately US$20B in cash and stock.

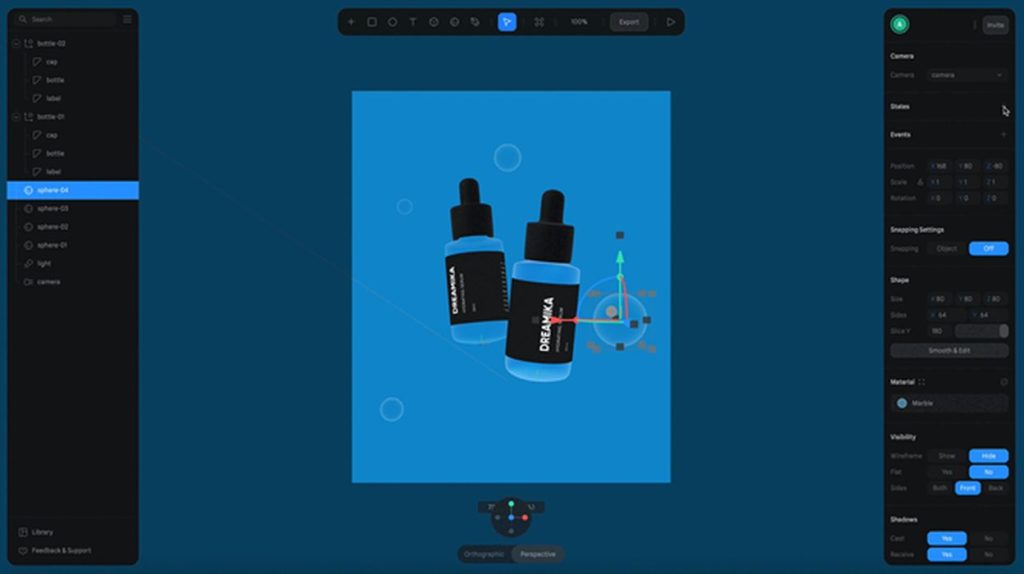

The aim is to bring a new era of collaborative creativity. Figma has web-based, multi-player capabilities that will accelerate the delivery of Adobe’s Creative Cloud technologies on the web.

Figma and 3D Printing

Adobe’s contributions to the 3D printing industry are not new. We have covered Adobe, Stratasys, and 3D Printing in June and Adobe Solutions in August. But bringing in Figma can improve the mix.

Figma, founded by Brown University Alumnae, is a relatively little-known, but fast-growing cloud-based design platform (akin to Canva). Dylan Field, one of the co-founders who dropped out of college to pursue a fellowship that offered $100,000 no strings attached, will now be a billionaire. The market is looking very cautiously and carefully at this transaction, but those in the design industry are excited.

Figma can introduce some new layers to Adobe’s already creative design portfolio. This can help improve the prototyping of a variety of products. Whether 3D printing objects, such as those found in IKEA or labels and packaging for household items, Figma can enhance those designs immensely all while creating the best possible user experience.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

There is more than the software aspect of Adobe’s merger with Figma. This impacts a whole host of industries including 3D printing.