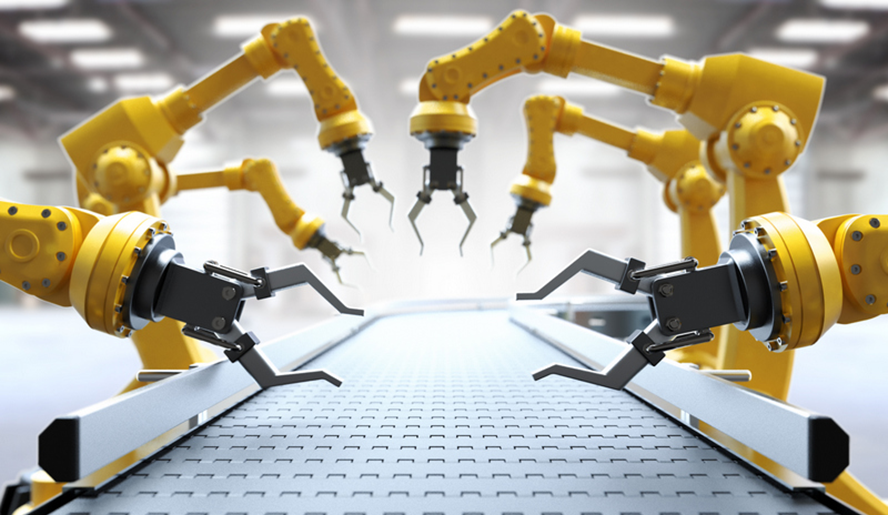

Charles R. Goulding considers advances in automation and where 3D printing fits into this new workflow.

Headquartered in Indiana, Bastian Solutions is a large provider of automation solutions including robots, collaborative robots, conveyors, palletizers, case packing and related equipment. HP Inc. has an impressive marketing video that shows how Bastian has made extensive use of 3D printing in the manufacturing of its product offerings:

This is a synergistic partnering since the automation market is currently experiencing rapid growth and Bastian can use HP 3D printing for its products and customer solutions. We recently published an article on how Emerson Electric is automating its worldwide plants while providing automation solutions for customers. Bastian is a member of the Purdue University Indiana MEP.

Back on November 12, 2014, I had the privilege of being the keynote joint panel presenter at a NIST/Oregon MEP-sponsored Innovation Showcase event with Ken Tinnell l, Bastian’s general manager. This event attracted participants from 23 states and 9 countries. Sponsors included Rethink Robots, Universal Robots, and Seegrid, the provider of automated guided vehicles (AGVs) for material handling.

Rethink Robots products include the Sawyer BLACK edition. Rethink is now part of the German HAHN Group a 1,600-employee multinational industrial automation company that also engineers AGVs. One year after the takeover of the assets by the HAHN Group, Rethink Robotics presents the Sawyer BLACK Edition. The improved hardware is based on the combination of German engineering competence and many years of application experience. Cobot Sawyer is now quieter and more durable with higher product quality.

The use of the Sawyer BLACK Edition contributes to a quieter work environment and makes the Cobot with the friendly face even more popular among employees. Thanks to its robot arm with 7 degrees of freedom and a range of 1,260 mm, Sawyer can also be used where there is no space for human employees. Possible areas of application include tasks that are dangerous or monotonous for humans, such as CNC machine assembly, circuit board assembly, metal processing, injection molding, packaging, loading and unloading, as well as tests and inspections. The Cobot solution is ready for use immediately after delivery and equipped with powerful Intera software and two camera systems.

HAHN’s Werke unit has used 3D printing to create Porsche lighting products and a sewerage/water treatment plant 3D models. Seven years later, all the companies at the 2014 conference remain at the forefront of ongoing automation activities that are increasingly utilizing and integrating 3D printing.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

As presented above, 3D printing is increasingly part of industrial automation solutions. Industrial automation is experiencing a fast growth phase and 3D printing can both improve the underlying products while also being incorporated into the customer solution.