Charles R. Goulding considers the business side of Renishaw’s search for a buyer.

Since I like advanced engineering-based manufacturers, I have always liked Renishaw, the U.K.-based multinational. We have previously examined the announced partnership between Renishaw and BAE Systems to further additive manufacturing development in the aerospace sector. Despite my admiration, all good things must come to an end and Renishaw’s two majority owners are calling it quits.

Normally business sellers are opportunistic and sell at the peak of financial performance, but Renishaw is exiting after some down years. Various 3D printing blogs have speculated on who a strategic buyer might be. However, Renishaw has chosen to use an investment banker where frequently an auction takes place and a sale will be based on price rather than strategic fit.

Renishaw has publicly stated:

“We understand the importance of Renishaw’s culture, our place in the communities in which we operate, our commitment to research and development, and the loyalty of our staff, our suppliers, and the customers we serve; these together have been the foundation of our success for almost 50 years. With the Board, we are therefore focused on ensuring that we find the right new owner for our business – one who respects and will continue to nurture these important attributes,” said Sir David McMurty (Executive Chairman) and John Deer (Non-executive Chairman).

Moreover, Renishaw’s largest business sector is Coordinate Measuring Machines (CMMs) or what is called the metrology business. CMMs measure material surfaces and are critical for high-value material analysis including automotive, medical and the semiconductor business.

Competitors in this industry are leading precision technology companies like Hexagon AB, Faro Technologies, Nikon Corporation, Keyence Corporation, Carl Zeiss, Mitutoyo Corporation, GOM, Perceptron, Creaform Inc, International Metrology Systems, Metronor, Trimek, Applied Automation Tech, Wenzel, N.J. Metrology, Avon-Dynamic, Eley Metrology Limited, The Sempre Group, Apex Metrology, and Tokyo Seimitsu.

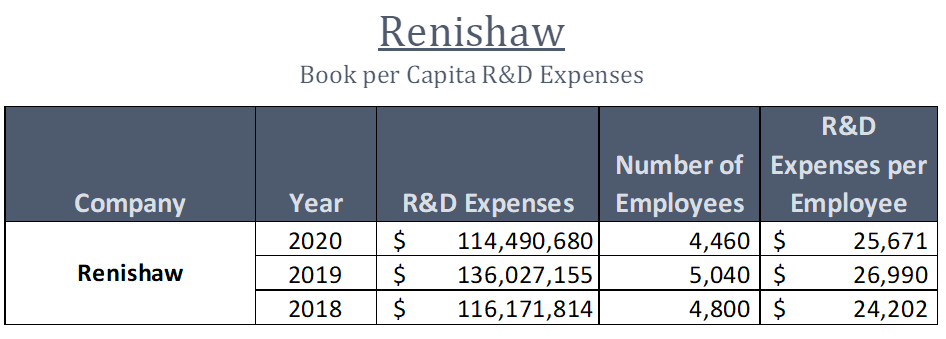

Renishaw’s R&D book per capita expenses are shown below:

Industry 4.0

There is certainly a 3D printing Industry 4.0 play in acquiring Renishaw because the companies that purchase CMMs and related equipment and software are typically leading manufactures and advanced machine shops, many of which are now embracing metal 3D printers. Renishaw presents a combination of CMM, 3D printing, engineering and software. Renishaw’s long-established customer databases and contacts should prove to be an extremely valuable sales franchise.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

It will be interesting to see who the eventual buyer of Renishaw is. Unlike some of the recent SPAC blank check companies in a variety of industries, Renishaw is a proven long-standing success story.