Charles R. Goulding and Preeti Sulibhavi believe lawn mower manufacturers should use more 3D print technology.

Lawn maintenance and lawn care is a major U.S. industry. The industry is estimated to be worth about US$25B and it is still expanding. To achieve lawn care and maintenance there is a myriad of lawn equipment to choose from. Most, however, have traditionally been gas-powered, which poses health, environmental and noise concerns.

With this comes a fast-growing new product category, battery-powered and/or electric lawnmowers, leaf blowers and chain saws. In a recent Wall Street Journal article from April 26, 2022, California was highlighted in terms of its new state and municipal laws that are driving the shift from gas-powered lawn equipment to battery-powered alternatives.

California, our most populous state, is set to ban the sale of the most gas-powered lawn tools, starting with 2024 models. Other states and cities are considering doing the same. Some have already banned the use of gas-powered yard machinery (both commercial and residential) for four months out of the year (May 20th through September 20th ), like East Hampton, Long Island, New York. The step California has taken makes the change more permanent, though.

In addition to health and environmental benefits, battery-powered equipment operates more quietly and generally does not require a cord. The cost, however, can be prohibitive. Electric-powered equipment sold to professional landscapers amounts to a fraction of the entire market segment (estimated at 6%), the bulk of which lies in residential homeowners.

Battery-powered yard equipment is more expensive to buy, but maintenance costs may be less as consumers will not have to repeatedly purchase gasoline or replace engine filters and spark plugs. In fact, it is estimated that consumers can break even on the price differential after approximately two and a half years through minimal maintenance costs.

Manufacturers such as Toro Co, Briggs & Stratton LLC, Stihl Inc, and now Stanley Black and Decker (which just acquired two lawn care equipment manufacturers) are just some of the names addressing the new market demand for electric equipment and batteries.

Briggs & Stratton has extensive experience with 3D printing equipment components, which it can use for electric lawn equipment. The acquisition price for Stanley Black & Decker’s remaining 80% ownership of MTD Holdings Inc, a lawncare equipment company, was $1.6 billion. The acquisition price for Excel Industries, the second lawncare equipment business, was $300 million, inclusive of standard purchase price adjustments.

Stanley will be able to leverage its deep experience in both 3D printing for components and fasteners with its large new lawn segment. Moreover, Stanley will outline a treasure trove of lawn care data for its tool business.

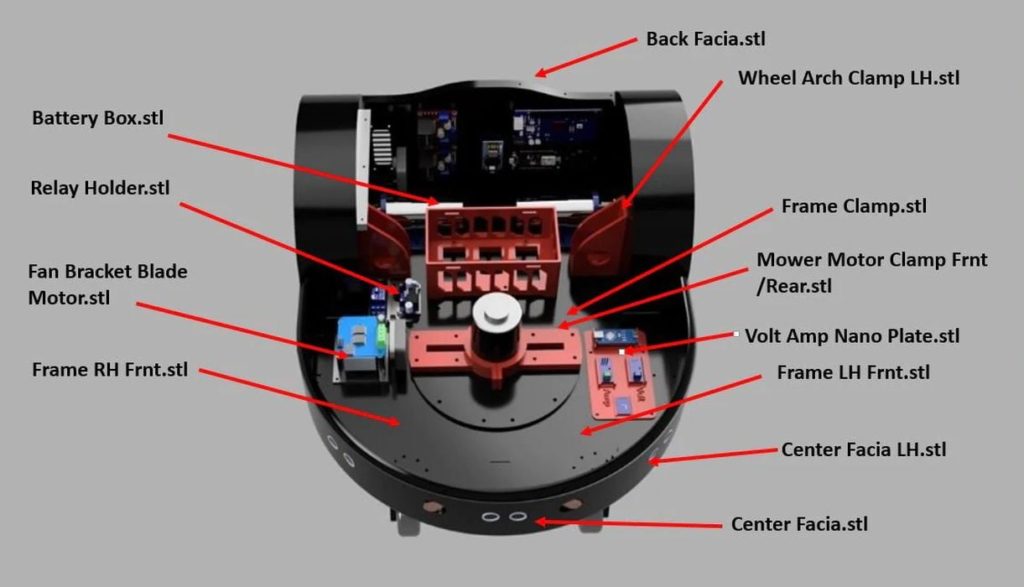

3D Printing can become involved in this evolving trend while it is still in its nascent stages. Battery-powered lawn mowers, leaf blowers, chainsaws, etc., require components and parts that need to be durable yet of a precise shape and fitting. 3D printing can help achieve these results in a cost-effective and time-efficient way.

Historically, a large portion of lawncare equipment was made in China and reshoring to the US is a positive development.

There are sites that offer construction instructions for DIY 3D printed lawn mower parts as well.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

It is not often that 3D printing can play a pivotal role in an emerging, fast-growing industry right at the onset. The push to go electric for lawn gear should make the 3D printing think of moving to greener pastures.