Fast Radius is the latest digital manufacturing company set to hit the public market.

Fast Radius

The Chicago-based company is becoming an ever-more-familiar name in conversations about next-generation manufacturing technologies. The cloud manufacturing and digital supply chain company was founded in 2017 and now has offices in Atlanta, Louisville, and Singapore, as well as microfactories in Chicago and Louisville.

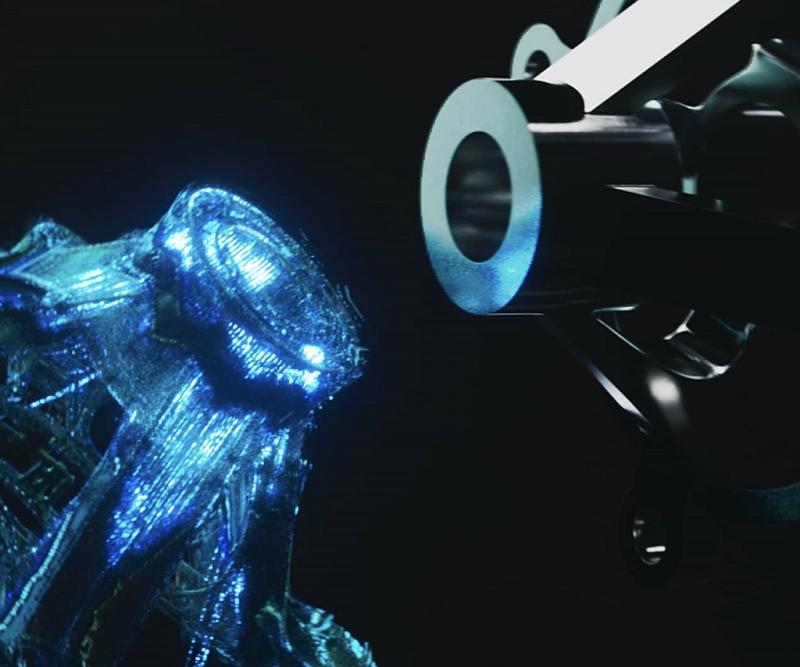

Fast Radius is perhaps best known for its Cloud Manufacturing Platform. The platform offers an integrated approach to software applications and manufacturing services, which Fast Radius describes as “a new infrastructure to design, make, and move physical products in the digital age, combining proprietary software with a distributed network of company-owned, world-recognized micro-factories and third-party suppliers.”

3D printing is, naturally, part of the Fast Radius suite of manufacturing technologies. The company offers access to industrial processes like those from HP and Carbon, partnering to launch major projects to the mass market. The company details in today’s announcement some of its production activity:

“The Fast Radius Cloud Manufacturing Platform has served over 2,000 customers, including Fortune 500 companies in the automotive, aerospace, medical, industrial, and consumer industries. The platform is purpose-built to provide industrial-certified parts at production volumes (e.g., thousands of units, not just prototypes) and has made over 11 million custom parts to-date.”

The Fast Radius solution has drawn plenty of attention, including from investors, over the years.

And now, Fast Radius is going public.

Fast Radius SPAC

Joining seeming legions of companies across the additive manufacturing world, including a widening set of competitors in the service sector, Fast Radius announced today that it will become a publicly listed company trading on Nasdaq.

Fast Radius is joining with special purpose acquisition company (SPAC) ECP Environmental Growth Opportunities Corp. (ENNV) to move onto the public market with a rather ambitious plan. They explain:

“Fast Radius plans to build the first $100+ billion cloud manufacturing and digital supply chain company, presenting a compelling investment opportunity in Industry 4.0 and next generation, sustainable infrastructure.”

Highlighting opportunities in the “more than $350 billion component manufacturing industry,” Fast Radius is set to ride on “massive tailwinds to replace rigid, outdated, and fragmented infrastructure.”

That is: advanced manufacturing capabilities, including digital warehousing and on-demand decentralized production, are the way of the future. The ever-nearer future, at that. With Industry 4.0 picking up real momentum especially on the heels of massive disruption to traditional supply chains over the last year and a half, it’s a good time for new solutions to catapult forward.

And that’s a bus Fast Radius doesn’t plan to miss.

“We are building a first-of-its-kind Cloud Manufacturing Platform that is providing a new infrastructure to design, make and move physical things in the digital age. As the Platform expands, we believe cloud manufacturing will have as great an impact on driving innovation in the physical world as cloud computing has had in the digital world. The benefits from the software and hardware powering cloud manufacturing are tangible and significant – the cloud brings improved speed, flexibility, cost, and accessibility to industry 4.0, all while providing a more sustainable model for global supply chains,” said Lou Rassey, Co-Founder and CEO of Fast Radius.

“We are excited to partner with ENNV, as their team’s long track record of success, history of being on the forefront of new sustainable infrastructure transitions, and their institutional reach will accelerate the next chapter of our growth. Our board and management team remain committed to executing on our proven business model and driving value for all stakeholders.”

Fast Radius Valuation

The financial situation is no small thing here, as Fast Radius is set to enter the public market at a hefty billion dollar valuation. The release explains of the details:

“The combined company will have an estimated post-transaction enterprise value of $995 million with an estimated equity value of $1.4 billion from the contribution of $445 million in gross cash proceeds from the transaction. Proceeds will consist of up to $345 million of cash held in ENNV’s trust account (assuming no redemptions) and an additional $100 million fully committed private investment (the ‘PIPE’), including a $25 million forward purchase commitment from Goldman Sachs Asset Management, L.P. Other investors in the PIPE include UPS, Palantir, ECP and other institutional investors.

The net proceeds raised from the transaction will be used to support Fast Radius’ continued growth across customer acquisition, software development, and micro-factory expansion. Fast Radius’ growth strategy is projected to generate revenue and EBITDA of $635 million and $135 million, respectively, in 2025.

Current Fast Radius management, employees and existing shareholders will roll 100% of their existing equity holdings into equity of the combined company.”

Both companies’ boards of directors have unanimously approved the move. Following closing conditions and regulatory approvals, we should expect to see Fast Radius trading on Nasdaq come Q4 2021.

As this is a SPAC situation, not an IPO, the trading company will actually be a renamed ENNV, which will remain listed on Nasdaq as “Fast Radius, Inc.”

We’re seeing plenty of big moves to the public market lately in advanced manufacturing. Fast Radius joins on a Monday a party most recently populated this past Friday by FATHOM’s SPAC announcement, as we see more transitions to publicly traded companies. The who’s who of major players in industrial 3D printing continues to reshape.

Via Fast Radius