Charles R. Goulding considers a recent move for electric vehicle production.

Distinctive electric car builder Fisker is a modern-day phoenix now that it lives again. In late February 2021, founder and CEO Henry Fisker announced that the company will be using global giant contract manufacturer Foxconn to assemble the new car. Wisconsin, the home of Foxconn’s highly publicized facility, may be the production site. Fisker has also announced that it is dropping its solid-state battery investment. Henry Fisker stated that after achieving 90 percent, they realized the last 10 percent would require more effort than the first 90 percent. Foxconn is a technology powerhouse famous for manufacturing Apple phones and has extensive 3D printing expertise. Foxconn also has auto experience as the company unveiled its first-ever electric vehicle (EV) chassis as well as a software platform to help EV automakers bring models to market.

In its previous life, Fisker used Magna, a Canada-based company, for assembly. Both Magna and Foxconn present disruptive challenges to the traditional fossil fuel car manufacturers. A Fisker-Foxconn EV partnership is also a viable competitor for Tesla.

Fisker Inc.

Fisker Automotive was initially founded in 2007 as a luxury all-electric vehicle company where the Fisker Karma was first produced. In 2016, the brand was relaunched as Fisker Inc. and became a New York Stock Exchange publicly traded company through a special purpose acquisition company (SPAC) merger public offering which raised US$1 billion in funding. The funding in Fisker Inc. will proceed the engineering towards an electric SUV called the Fisker Ocean. Fisker has ambitions of developing an affordable luxury EV with radical design and technology features and potentially rival Tesla.

Magna Steyr

Fisker contracted Magna Steyr to manufacture the Fisker Ocean with plans to utilize Magna’s EV platform. Magna is well known for their automobile manufacturing capabilities as from 1996 to 2006 they were the sole manufacturer of all Mercedes Benz E-Class models and continued with substantial development for vehicles such as the BMW X3, Aston Martin Rapide, and Audi TT. Magna Steyr also leverages an enormous vehicle assembly plant that is an early adopter of Industry 4.0 which includes big data and advanced analytics, 3D printing, digital modeling, robotics, and more.

Foxconn Technology Group

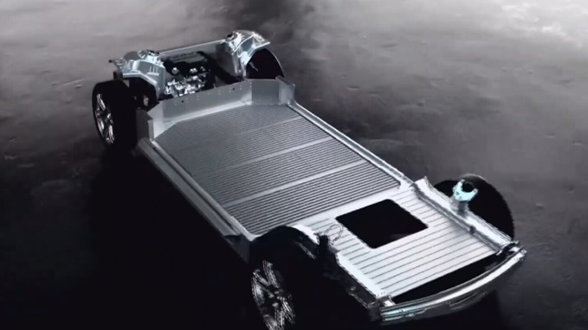

Foxconn Technology Group is a well-known Taiwanese multinational electronics contract manufacturer who notably has been responsible for assembling the Apple iPhone. The technology manufacturer has now expanded into the auto sector and positioned themselves to assemble cars for Fisker. Foxconn is determined to expand into the automotive market as they also unveiled their EV chassis and platform to mass-produce EVs. Foxconn also entered a manufacturing deal with a Chinese EV startup, Byron Ltd., and intends to begin mass production. Foxconn’s director of U.S. strategic initiatives also spoke on the development of the Wisconsin facility site and outlined the potential technology trends the facility would follow including 3D printing, artificial intelligence, internet of things, renewable energy, autonomous vehicles, and more.

3D printing and similar activities used for developing electric vehicles may be eligible for Research and Development (R&D) Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

It’s fun to see the Fisker return to the market. It’s also good news that a North American facility with a company that has 3D printing expertise is the probable manufacturer.