Charles R. Goulding and Preeti Sulibhavi look at the increasing widespread use of 3D print technology.

In an article published in the Wall Street Journal on January 14th, 2023, a small town in Iceland was showcased because of its 10,000 square-foot building that houses a manufacturing facility that produces parts for fish-processing machines and that utilizes Desktop Metal 3D printers in doing so.

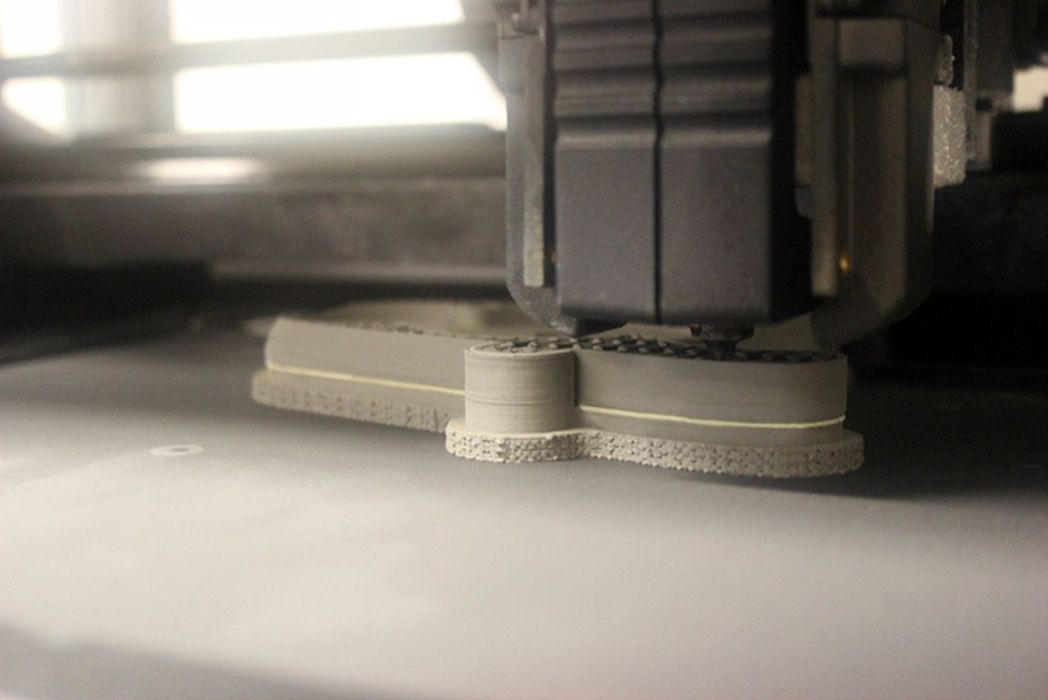

The company is called Curio and it is making history in the fish equipment industry by utilizing seven 3D printers, from Desktop Metal, to fabricate stainless steel parts for his fish-processing equipment, reducing production time and cost in the process.

We have previously written about 3D printing in the salmon industry as well as for sport fishing, but this is a bit different. We have even covered the traditional Japanese Sampuru culture.

The use of 3D printers for fish-processing machinery, especially in such a remote location, is remarkable. Before, Icelandic fish were sent to China to be processed by hand. Now, they can be processed close to where they are caught, using machines he manufactures from parts that were once made in Asia, if they could be made at all.

“What 3-D printing is doing now is revolutionary,” says Mr. Hreinsson, founder of Curio. “It’s not a dream anymore, it’s there, and it’s only going to grow.”

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Nothing “Fishy” About This…

It is clear that 3D printing can be of assistance in almost any industry, practically anywhere. The example of Curio utilizing 3D printers in an industry not generally perceived as high-tech should be a lesson to all sectors of the economy. 3D printing is catching on in many places.