A report from Pitchbook suggests investment patterns in 3D print companies is shifting upwards.

How times have changed over the years. Only a dozen years ago the landscape of 3D printing companies was utterly different. Then the only larger companies were a small handful organizations that were still benefiting from the original patents.

The startup companies, and there were plenty, were small operations. Countless folks were energized by the prospect of building their own 3D printer as a result of expiring patents, and their inventions soon turned into startup companies.

But they were small. So small that the investments made in those days were quite small. I recall it being big news that MakerBot, then a startup company, had received the unheard of amount of TEN MILLION DOLLARS as an investment from the Foundry Group. At the time it was by far the largest investment in 3D printing startups, and in hindsight, it paid off handsomely when MakerBot was acquired by Stratasys in 2013.

Most companies at the time had far smaller investments, with some using Kickstarter as a vehicle to generate funds. Bigger Kickstarter campaigns were only a million or two USD, and they were sufficient to get these companies going. Some of them, like Formlabs, eventually grew to the giants we see today.

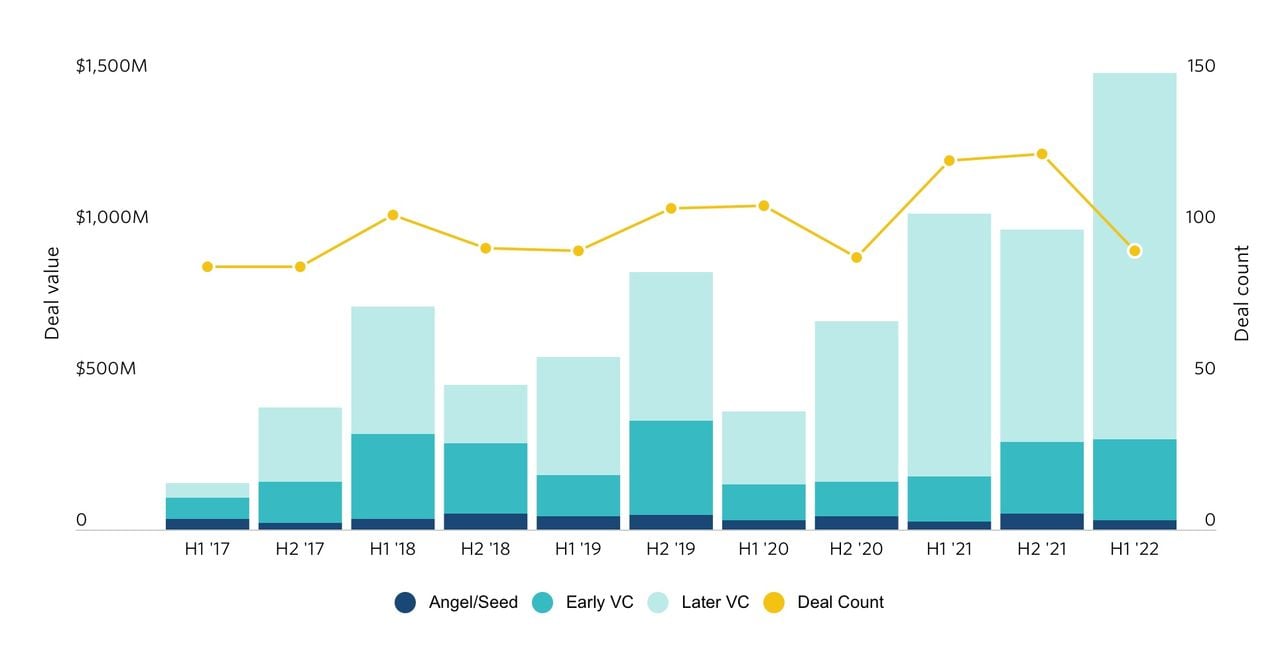

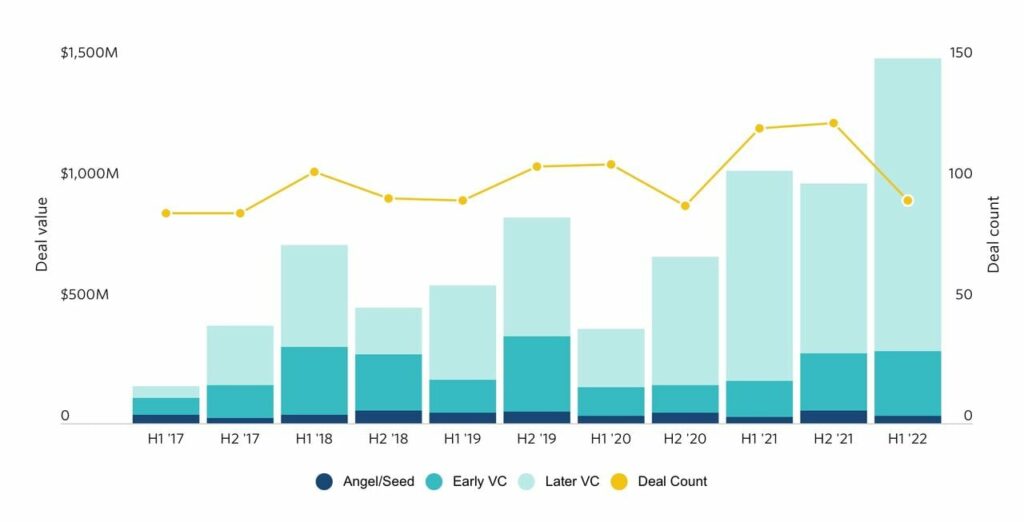

Pitchbook is a paid service that comprehensively tracks investment deals. If a deal has been made, it’s likely recorded in Pitchbook. Recently they analyzed investments in 3D printing companies and came up with some interesting results.

According to the Pitchbook report the number of deals per year is about the same as it always has been, but the magnitude of the deals has been significantly increasing.

They explain:

“The current market for 3D-printed products remains niche, but the number of those niche applications has grown. Several recent megadeals have underscored the diversity of companies innovating in a category once defined by hobbyists.”

(By “hobbyists”, they mean startups like MakerBot and Formlabs of the old days.)

The listed a series of massive deals in recent times, most of which we’ve reported on directly:

- ICON Technology, US$392M

- VulcanForms, US$250M

- Redefine Meat, US$135M

- Formlabs, US$150M

That list of four deals totals almost US$1B alone.

My thinking here is that the reason for the increase in deal value is because the industry is maturing. Equipment is being purchased by a much wider audience at higher unit prices, and in particular by business rather than consumers.

The “hobbyist” level of the market is now mostly dominated by low-cost Asian manufacturers in a “race to the bottom”. This means that any new entrant had better offer some very powerful and unique features or cost advantages, otherwise they will not be able to compete.

The result is that entering the market today with new technology is fantastically more expensive than it was in the past, hence new investment. It is no longer possible to quickly throw together a machine in a garage and start a major 3D print company. If one were to do that, they’d compete against inexpensive and now pretty capable desktop devices.

The only way into the market at this stage is the invention of something completely new, and that typically requires considerable research and development. That costs a lot of money, but with the expanded market, also offers more potential for growth.

Thus, it’s not surprising we see the average deal value rising significantly.

Pitchbook also noted something else quite interesting. They said:

“Despite winning VC deals, 3D printing companies that went public during the SPAC craze of recent years have faced a chilly reception.

Desktop Metal was valued at $2.8 billion post-money in its SPAC deal and now trades at a market capitalization around $711 million. Such high-profile stumbles—others include Markforged and Velo3D—may weigh on the future valuations of late-stage companies in the space.”

I’ve noticed this effect as well in our weekly tracker. SPAC companies are those that “merge” with a placeholder company that’s already on a stock market to sidestep the usual lengthy process of doing an initial public offering. It would appear that this approach has not been particularly effective, at least for the initial investors.

On the other hand, stock prices are universally down anyway due to external factors, and so the recent trend to use of the SPAC method may simply be due to timing.

Via Pitchbook