Charles R. Goulding and Preeti Sulibhavi look at how buildings could be 3D printed on another planet.

Scientists and architects have been speculating about life on Mars for decades. It has been pondered by scientists, depicted on television (“My Favorite Martian”) and in cartoons (“Marvin the Martian”). Life on Mars is not a novel concept but whether life existed, or extraterrestrials currently exist on Mars is still to be confirmed. However, scientists are now revealing how they have been exploring options for humans to inhabit Mars.

In a November 15, 2021, issue of Bloomberg Businessweek magazine, a piece was included that questioned the proposition of urban life on Mars. Exactly how would a red planet colony, inhabited by humans, work? The other option that has been considered is the moon, but some scientists believe Mars is the more viable option. This is largely due to ore deposits containing iron, aluminum and other minerals as well as a low gravitational pull leading to a more feasible construction and development environment in space.

There are Hollywood depictions of humans endeavoring to Mars. “The Martian,” is one blockbuster film that carefully depicted one man’s journey to Mars.

3D printing is no stranger to space either. We have previously written about The Race to Space as well as SpaceX’s rocket contracts. We covered how 3D printing has and can play pivotal roles in space exploration. This includes potential human inhabitation of Mars.

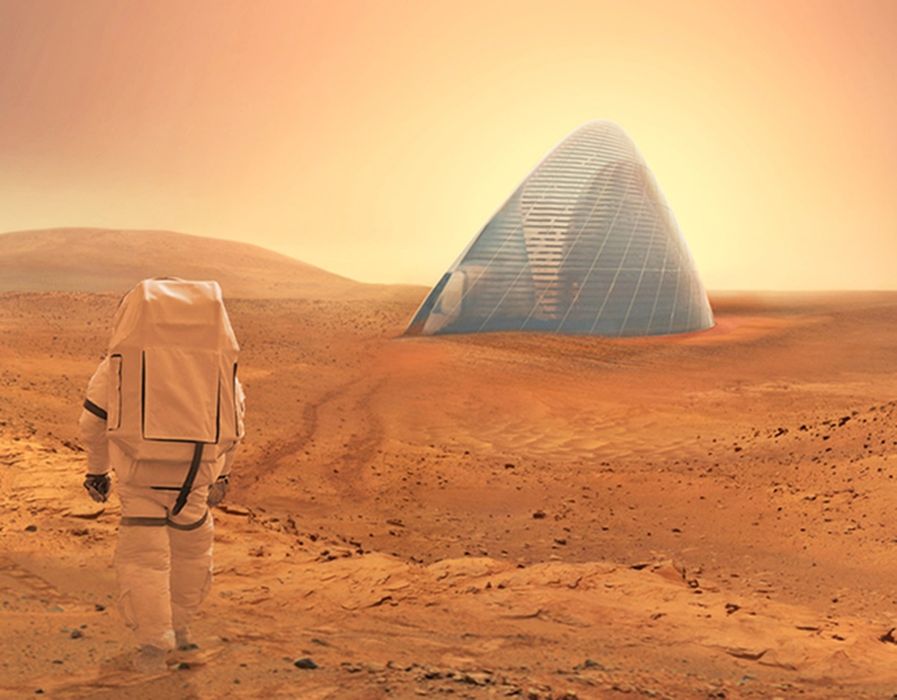

It is not easy to build an urban center on Earth, let alone on Mars. The atmosphere on Mars is 95% carbon dioxide and extremely thin, and exposure to solar radiation more intense. Any remnant water sources are frozen in underground lakes making it even more challenging to sustain life. This is where technology and 3D printing can help create prototype habitats as well as building large habitats out of Mars’ regolith environment

In fact, NASA is determining how humans would survive on Mars, given the surrounding environment. Instead of testing this in outer space, NASA intends on having four volunteers live on Mars Dune Alpha, a 3D-printed, 1,700-square-foot module inside the Johnson Space Center in Houston, TX. Three experiments have been planned: the first in the Fall of 2022, then in 2024, and last in 2025. The paid volunteers will be given tasks such as simulating spacewalks, using virtual reality and conducting scientific research.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Space exploration and inhabitation is a relatively new venture for humans. 3D printing has a place in this new neighborhood, it’s just a matter of time as to how it will make its home on Mars.