Charles R. Goulding and Preeti Sulibhavi examine the intricate landscape of defense contracts amidst economic risks and legal complexities.

In a world marked by global conflicts and military tensions, with the U.S. supporting two current wars and concerns about global conflicts including China and Iran, it would seem that now is a great time to embrace government defense contracts where it would be a boon for businesses, particularly in the cutting-edge field of 3D printing.

However, as recent events demonstrate, the landscape is fraught with economic risks, and the nascent 3D printing industry must tread carefully.

Risks & Lessons from Established Players

Northrop Grumman’s Setback with the B-21 Raider:

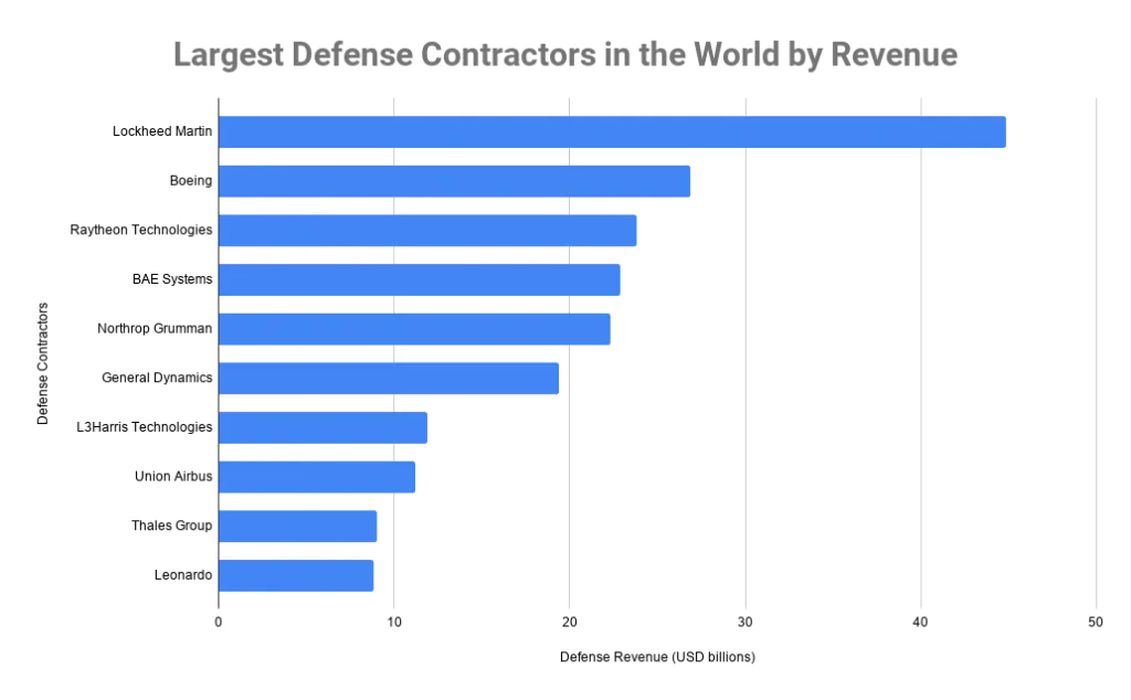

Northrop Grumman, a seasoned defense contractor with nearly a century of experience, recently faced a substantial setback with the B-21 Raider aircraft project.

The company took a US$1.2 billion charge on the project, highlighting the potential economic risks associated with government defense contracts.

Boeing’s Struggles and Historical Perspective:

Boeing, a giant in the aerospace industry with roots dating back to 1916, has incurred significant losses related to government contracts.

While the company has been in the news for its commercial projects, it has also incurred billions in losses related to government contracts.

The Impact on Smaller Contractors:

If established companies like Northrop Grumman and Boeing, with their deep industry knowledge, can incur substantial losses, on defense and government contracts, smaller companies should approach government contracts with caution.

The historical context of large companies facing such challenges emphasizes the need for careful consideration.

The Changing Dynamics of Defense Contracts: Saying No to Traditional Approaches

Defense contractors, in general, have been increasingly interested in additive manufacturing for producing components with enhanced performance and cost-effectiveness.

CEOs Prioritizing Cash Over Revenue

L3Harris Technologies CEO Chris Kubasik’s statement, “I will sacrifice revenue for cash any day of the week,” reflects a shifting sentiment among defense contractors. The recent losses and economic risks associated with some defense contracts have led CEOs to prioritize financial stability over immediate revenue gains.

Government’s Response: Flexible Contracts and Inflation Adjustments

In response to industry concerns, the government has signaled a willingness to provide more flexible contracts. Authorization for inflation adjustments demonstrates a recognition of the challenges faced by defense contractors, particularly in periods of supply chain disruptions and inflation.

Risks Specific to 3D Printing in Defense Contracts

- Intellectual Property Concerns – 3D printing applications often involve the use of intellectual property, including design and material data. Protection of these rights becomes crucial as the Department of Defense (DOD) and military increasingly leverage 3D printing for product replacement and repairs.

- Export Control Requirements – Providing 3D printed products to the government, especially for defense and space applications, introduces export control requirements. Companies must navigate these regulations, as similar products might be prohibited from sale to specific countries, adding complexity to their operations.

- Legal Consequences: 3D Systems’ Fines for Violations – Drawing from recent examples, 3D Systems faced legal consequences and was obligated to pay millions in fines for violations related to military and defense contracts. These fines follow allegations that, between 2012 and 2019, 3D Systems had violated U.S. Export Control Laws by unlawfully exporting unlicensed material overseas. The Department of State has declared that, due to 3D Systems’ ongoing cooperation in taking corrective actions, the company is not a threat of being administratively debarred.

This underscores the importance of compliance for 3D printing companies operating in this space.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

In navigating the evolving landscape of defense contracts and 3D printing, companies must approach opportunities with caution. The risks associated with traditional defense contracts, as highlighted by the setbacks of industry giants like Northrop Grumman and Boeing, emphasize the need for a strategic and informed decision-making process.

Moreover, 3D printing companies must recognize the unique challenges and legal complexities that come with supplying products for defense applications. While saying no might be a difficult decision, it can often be the smart one, ensuring the long-term sustainability and success of businesses in this dynamic and demanding sector.