Charles R. Goulding considers the rising importance of the semiconductor industry and its impacts on the 3D printing sector.

The global semiconductor industry is going through a major change period that will impact the 3D printing industry. The U.S. government, notably through the military sector, has invested substantial funds in 3D printed embedded electronics, which is a technology that holds great potential. Major developments that should be monitored are:

- Intel’s place in the market

- China’s come-from-behind strategy, and

- The Nividia effect

Intel

Intel has been the U.S. leading semiconductor company arguably from its inception. Currently, the company is under attack from an activist hedge fund investor called Third Point led by a well-known investor, Danial Loeb.

Loeb is calling for previous acquisition divestments and perhaps a separation of the design and manufacturing functions. Intel has recently been surpassed in market value by Nvidia, which has an Asian manufacturing outsourcing model. Intel has also lost market share to its long-standing rival, AMD. Unlike Intel, which manufactures in the U.S., AMD outsources its manufacturing to Asia. Those who know the semiconductor industry know that it is a cyclical business requiring huge capital investments at the height of a new cycle and becomes vulnerable to criticism at the bottom of a cycle. Intel is no stranger to overcoming adversity and at one time in its history almost cratered but for a life-saving investment by IBM.

*As this article was being written, Intel CEO Robert Holmes Swan resigned with Pat Gelsinger set to enter as new CEO.

China

China is not a major player in the semiconductor industry. Nearby Asian semiconductor powerhouses are South Korea with Samsung and Taiwan. China’s constant aggressive posture against Taiwan is and should be of grave concern to the United States. China’s goal is to become self-reliant on semiconductor supply and to produce 70 percent of its own manufacturing needs by 2025.

Nividia

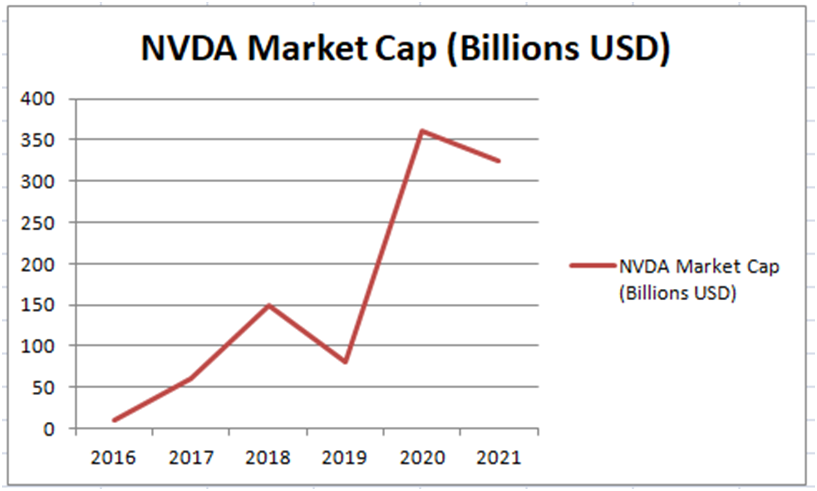

Nvidia has become the almost overnight powerhouse that the entire semiconductor industry is reacting to. At year-end, Graphcore, the U.K. maker of AI semiconductors, raised $222 million to prepare for tougher competition with Nvidia. Graphcore is a 4-year-old company currently valued at $2.5 billion. Nvidia is a behemoth with a market value that has grown exponentially after the $40 billion ARM acquisition and has exceeded $350 billion in value during 2020.

The chart above represents the market price per share of Nvidia stock. With 619MM shares outstanding, the company’s enterprise value is about $3.25 billion.

Companies engaged in 3D printing for the development of semiconductors and similar activities may be eligible for the Research and Development Tax Credit.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Although I am normally a free market advocate, there is too much at stake with this global industry that includes government-run economies in China and Korea. Our U.S. government is making tremendous investments in this industry with taxpayer funds. Embedded electronics is a critical industry for the 3D printing sector. Hopefully, Intel can withstand active investor pressure, and perhaps the U.S. government will make its overall strategic views more apparent and support Intel’s long-term strategy and independence. Intel is the only major U.S.-based manufacturer of semiconductors and investment bankers aren’t concerned about that.