Charles R. Goulding and Preeti Sulibhavi look at 3D printed lighting initiatives.

Let there be light! With that, today, light is its own language that connects us and conveys meaning, illuminating the paths our lives take. 3D printing has been a part of this journey as it has helped in improvements to existing and new designs in the lighting industry, particularly in Europe and India.

3D Printed Luminaires in India

Signify is the relatively new name for Philips Lighting (announced in 2018). The 125 year-old business is at the forefront of the lighting industry’s major advancements. Today, Philips Lighting has the largest connected lights network around the globe.

Custom-tailored design, personalization and home delivery leave customers highly satisfied with Signify’s new project now available across most European countries and in India.

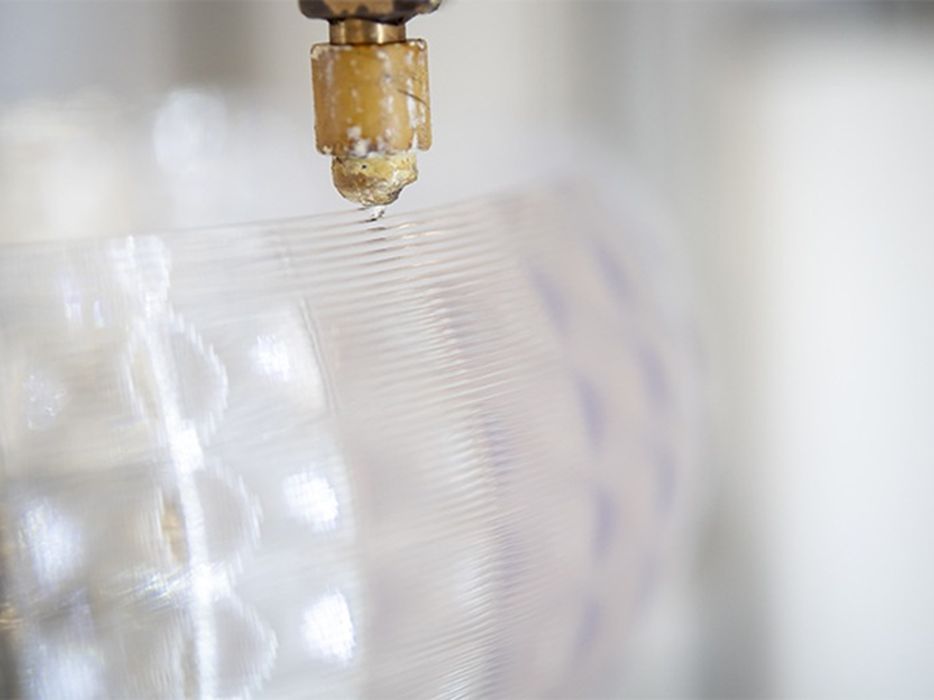

Signify has launched the 3D printed luminaires project in India to help the country achieve a circular economy. Signify is the only lighting manufacturer, producing 3D-printed lighting products on an industrial and commercial scale in India at this time.

In alliance with the Indian government’s agenda of ‘Make in India’ and ‘Atmanirbhar Bharat,’ Signify has set up a 3D printing manufacturing facility at its existing lighting production factory in Vadodara. Signify also has a design lab at its R&D center in Noida where interior designers, architects and lighting designers can experience the technology first-hand and see their luminaires 3D printed.

3D printing is a key element of Signify’s commitment to doubling its circular revenues to 32% in 2025, as part of the Brighter Lives, Better World 2025 program launched in September 2020. 3D printing is a triple bottom line technology that has proven beneficial to the climate, consumers, and companies.

Lighting & 3D Printing

Reducing our carbon footprint is important. 3D printing is helping achieve sustainability goals as well. In the Netherlands, Signify, the global giant in lighting, is providing the world’s first online, custom-tailored, 3D printed from recyclable materials luminaires. Signify is using recycled materials, beginning with used CDs, to create these 3D printed lighting fixtures and lampshades. Better customer service, while reducing Signify’s carbon footprint.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Light ‘em Up!

With light comes progress. There is no limit to how endless the design and development progress can be when 3D printing is introduced into the fabrication of luminaires. It is also a great accomplishment to reduce the corporate carbon footprint.