Charles R. Goulding and Preeti Sulibhavi look at the possibilities for 3D printing in the healthcare sector.

After losing a Delaware Chancery Court legal battle, Hill-Rom Holdings, Inc. (Hillrom), the 10,000-employee medical products company, has just announced that it will now proceed with the acquisition of Seattle-based, Bardy Diagnostics (BardyDx).

Hillrom is one of the world’s largest manufacturers of medical equipment. This is an interesting corporate saga since Hillrom itself was subject to a potential acquisition by medical giant, Baxter International (Baxter). Soon after the Bardy acquisition was announced, Hillrom tried to back out since it learned that Bardy’s medical reimbursement rate for its Carnation Ambulatory Monitor (CAM) was facing a substantial decrease.

With the Federal Government invariably being the largest customer for medical devices and drugs, the reimbursement level is critical for medical product companies’ revenue streams. The Delaware Court found that the reimbursement rate change was not a Material Adverse Event (MAE) that justified terminating the transaction. Baxter has recently made a US$9.6B offer for Hillrom, which was rejected. Baxter has revenue approaching US$12B per year and has over 48,000 employees.

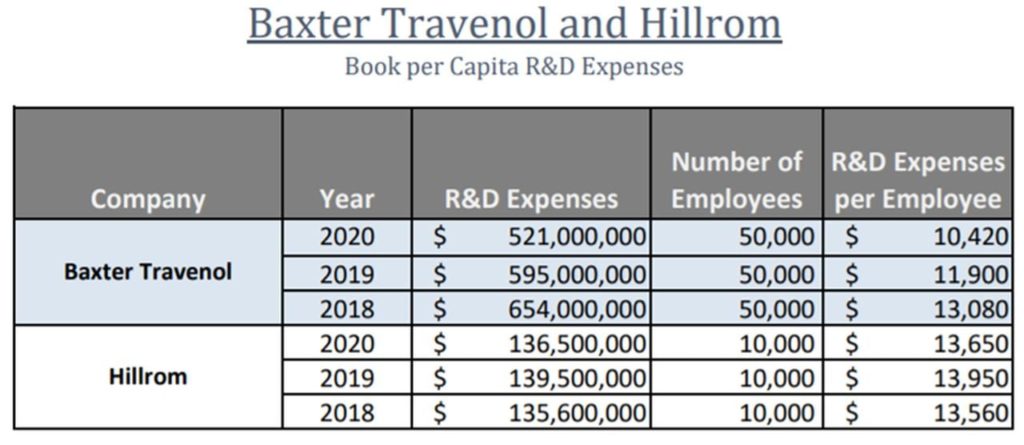

Below is the R&D per capita spend for Hillrom and Baxter (which made an offer to acquire Hillrom recently):

3D Printing Opportunities

There are several opportunities for 3D printing to advance itself in this industry, and Hillrom itself has been invested in advanced technologies. Much of its offerings had initially focused on bringing “home to the hospital.” That is mostly why you often see “homey”, wooden furniture in hospital rooms today. Later, the company developed the cardiac press, which was the beginning of Quinton Instruments, a pioneer in medical equipment, including treadmills and cardiac diagnostic equipment.

More recently, Hillrom acquired Trumpf Medical and developed the world’s first operating room light using LED technology to provide surgeons with consistent and optimal lighting. As we see doctors and nurses using electronic pads and filing systems instead of pen and paper, we can thank Hillrom for that. Voalte, a subsidiary, has been focusing on a mobile platform now used by more than 200 healthcare customers on more than 84,000 devices.

Trumpf Medical has been highly involved in 3D printing as has been reported on Fabbaloo previously. There are several product lines that Hillrom offers that can be 3D printed quite effectively. Surgical lighting fixtures, for example.

Whether it is spinal surgery or elective surgery, 3D printing has been playing a role in the med-tech and life science industry. Companies utilizing 3D printing may be eligible for the Research and Development Tax Credit.

The Research and Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies and startups developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Life science and med-tech are emerging as the premier sectors for the future of the U.S. manufacturing industry. We see strong growth and great opportunities for 3D printing to assist in and benefit from this trend.