Charles Goulding and Valentina Alzate consider the use of 3D printing in the planning and design iteration process for big projects.

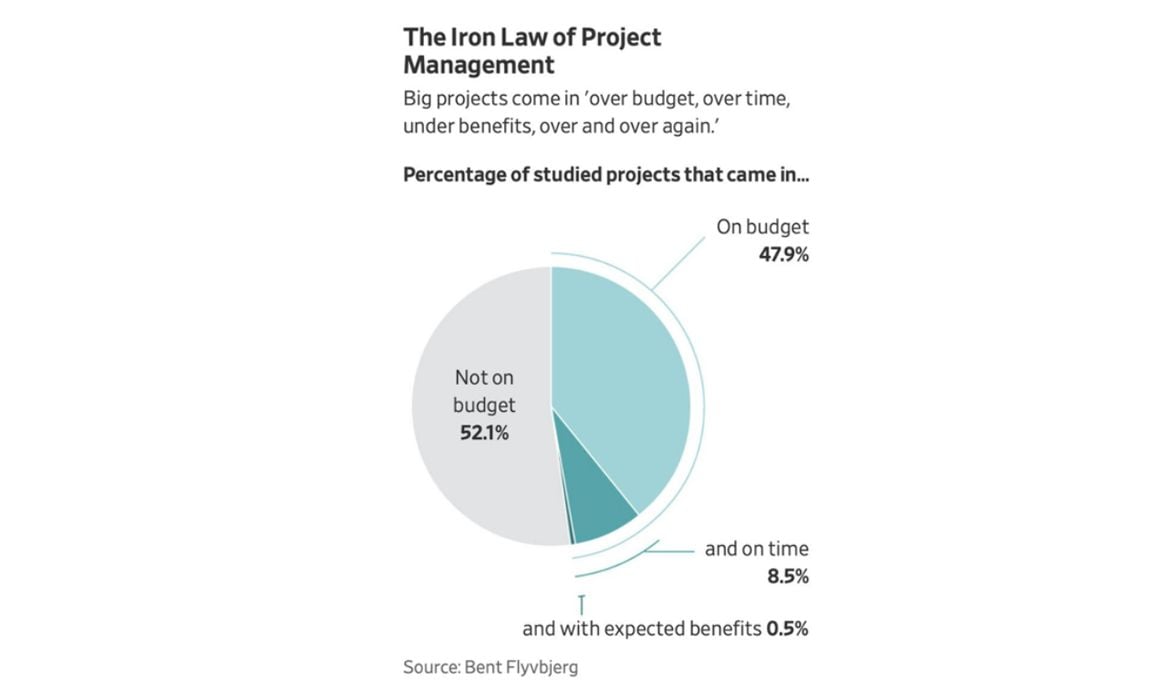

Bent Flyvbjerg and Dan Gardner have written a highly informative book titled “How Big Things Get Done,” which sheds light on the reasons behind the astonishing failure rate of 99.5% for major projects.

The book’s message is especially relevant in today’s climate, as the United States embarks on numerous large-scale infrastructure projects with the Chips Act, as well as clean energy projects with the Inflation Reduction Act (IRA). Flyvbjerg is a Danish Professor, speaker, advisor, and author who has consulted on projects worth over one hundred billion dollars. Gardner is a NY Times best-selling author.

The sheer number of large projects that have failed is astounding. These projects include Boston’s Big Dig, California’s fast rail system, as well as numerous Olympic venues. To avoid failure, Flyvbjerg and Gardner recommend careful planning and modular construction based on concepts learned from LEGO building blocks. The LEGO modular brick design originated in Flyvbjerg’s Danish homeland.

The authors also recommend leveraging proven technologies and experienced project leaders. The authors support their analysis with data from the few big projects that have not failed, including the design and construction of the Apple Headquarters and the Empire State Building, as well as Pixar Movie productions, and the projects undertaken by Frank Gehry, a renowned Canadian-American architect.

The Empire State Building’s unique modular design involved its’ construction as 102 separate floors. Similarly, Pixar and Gerhy went to incredible lengths to meticulously model their designs. Despite vastly different project goals, Pixar Studios and Frank Gerhy’s projects are similar in that they require a significant amount of time within the pre-project modeling and design phases.

These design phases are so in-depth that the actual execution of the project is almost anti-climactic. In fact, Gerhy’s design focus is so intense and meticulous that it is likened to the creation of a digital twin (see our article on digital twin design for helicopters). A digital twin is a digital model of a design that is almost indistinguishable from its’ real world, physical counterpart.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

With the unprecedented level of major projects commencing in the United States, Flyvbjerg and Gardner’s book has become increasingly relevant. The need for greater levels of pre-project design is a perfect opportunity for 3D printing.

Specifically, 3D printing can allow designers to effectively model their designs and reduce errors through rapid prototyping and design validation.