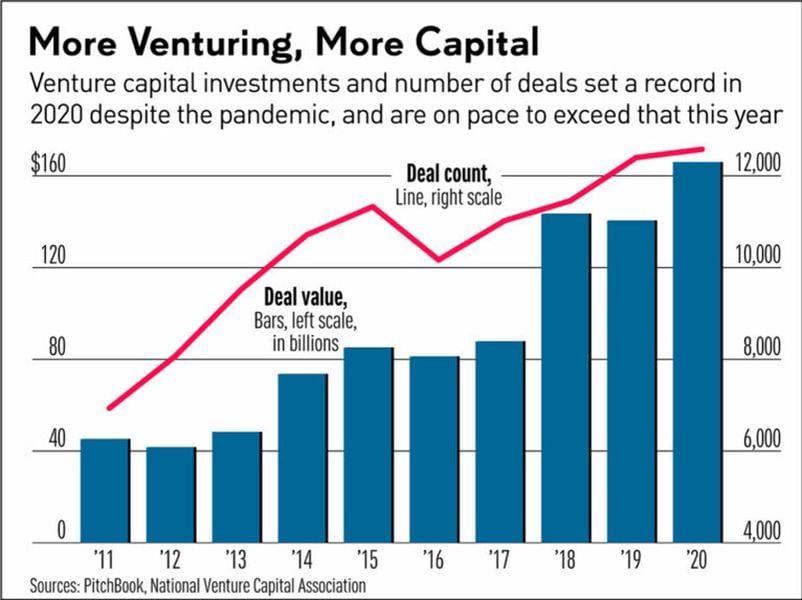

Venture funds and other cash-laden investors are on track to make a record US$100B in startup investments.

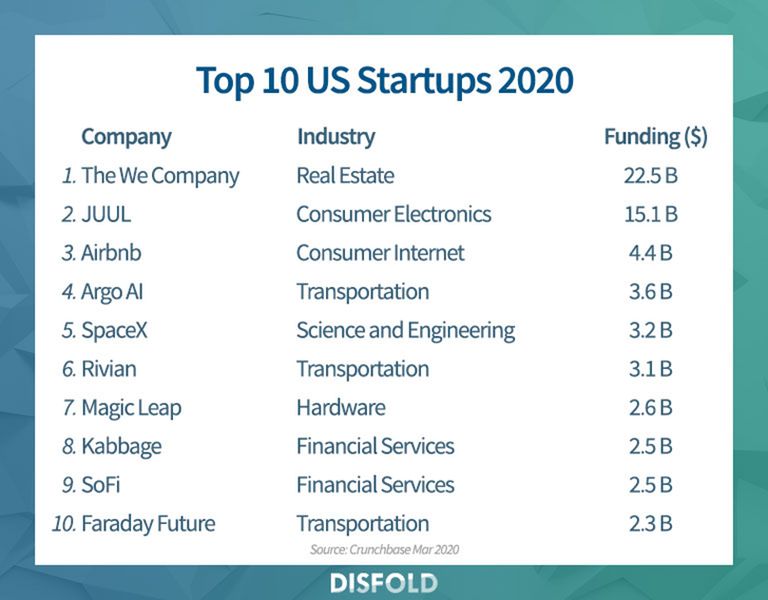

This is good news for 3D printing-based startups and other tech investments that utilize 3D printing including unmanned vehicles, robots, and medtech. One example of such a fund is Tiger Global, which is in the process of raising a $10 billion tech fund. So far in 2022, Tiger has participated in over 100 tech investment rounds in 120 days that raised $22 billion.

It’s not surprising that many industries have been enabled by improved access to 3D printing technologies, particularly over the past few years. Pricing for the technology and materials have become much more accessible, leading to heavier use by startups, and consequently more investment.

These funding rounds are typically used for R&D, technical employee hiring, software, and a variety of technologies eligible for R&D tax credits. Many VC, PE and other fund investors do not realize that since January 1, 2016, startups are eligible for up to $1,250,000 in R&D tax credit startup cash rebates in the form of payroll tax rebates.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

These are the good ‘ole days for startups. The recent number of 3D printing companies going public via SPACs has made it clear to the investment community that 3D printing is a technology category worth looking at. The smart money will access this unprecedented level of funding and capture the tax cash rebates.