Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s first take a look at the major 3D printing companies on this week’s list. I consider these companies “major” because their market valuations are significantly larger than others in the space.

Major Players

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 4914 | +1189 |

| 2 | Desktop Metal | 3328 | +38 |

| 3 | Protolabs | 2682 | +267 |

| 4 | Nano Dimension | 2182 | +251 |

| 5 | Stratasys | 1682 | +234 |

| 6 | Materialise | 1376 | +131 |

| 7 | ExOne | 511 | +36 |

| TOTAL | 16676 | +2142 |

This week saw massive gains led by industry leader 3D Systems.

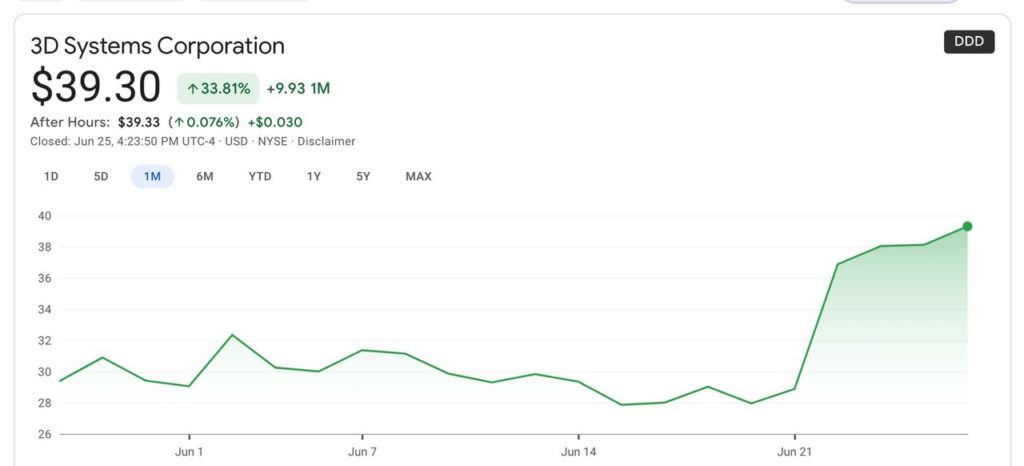

I don’t think I’ve ever seen this occur in the history of 3D print stock trading: a single company gained over US$1B in a single week of trading. 3D Systems gained US$1,189M, pushing their lead as measured by market cap. As of this writing the company is just under the US$5B valuation mark.

It wasn’t that long ago that the leading company in the space was valued in entirety at US$1B, and here we have a gain of that amount in a single week!

3D Systems is now comfortably in the top position with a lead of almost US$1.6B over second-place Desktop Metal thanks to this week’s massive 32% gain.

Why the huge charge by 3D Systems? It wasn’t the overall market effect, which gained only a few percentage points. No, instead the trigger seems to be the company’s announcement on June 22 of a deal with Collplant. The arrangement has the two companies co-developing a 3D bioprinted regenerative soft tissue solution for breast reconstruction. This could indeed become a large business for the two companies.

The rest of the pack also gained, but not as much as 3D Systems, with gains in the stock 7-16% range. I suspect these gains were largely caused by the huge investor attention on 3D Systems, which sprinkled some gold on the other players.

One notable exception was Desktop Metal, which gained only a single percent in value. As explained in recent weeks, this is likely due to previous overvaluation from their market entry. The stock price could continue acting against the flow of others until the stock price finds a stable level.

Other Players

| RANK | COMPANY | CAP | CHG |

| 8 | voxeljet | 86 | +1 |

| 9 | ARC Group WW | 35 | -2 |

| 10 | AML3D | 17 | -4 |

| 11 | Aurora Labs | 8 | 0 |

| 12 | Tinkerine | 3 | 0 |

| TBD | Massivit | TBD | TBD |

| TOTAL | 149 | -5 |

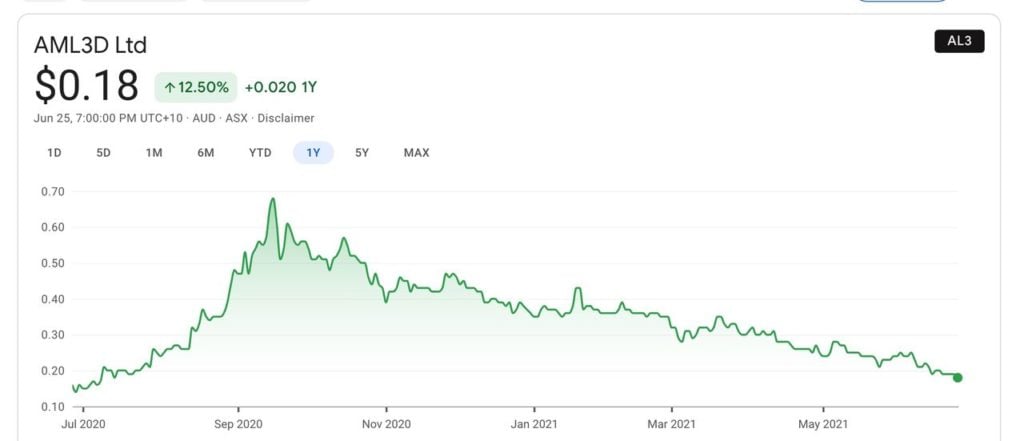

This week for the other players in the industry saw very little change, unlike the larger players that saw huge gains. In fact, this category dropped in total value from US$154M last week to US$140M this week, with the drop being led by Australian AML3D, which saw a dip of over 18% in value.

This stock has been slowly dropping in value since its all-time high last September, when it was in the high $0.60s range. Today it’s valued at only $0.18.

The lesser valued companies tend to have much smaller shifts in their market capitalization because there is far less trading occurring on their stocks. The big money tends to hover around the larger players.

Note that we are unable to obtain Massivit’s market cap value, as it does not seem to be published, even though they are a publicly traded company on the Tel Aviv Stock Exchange.

Upcoming Changes

We still await the introduction of four newcomers to public trading: Markforged, VELO3D, Shapeways and Xometry. These companies have all declared their intention to “go public”, and have even lined up the exchanges and ticker symbols they’ll be using.

None have yet appeared, but there are rumors that Xometry may be getting close to their launch.

I’m very curious to see where each of these companies lands once public investors have a chance to gauge their stock value.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t now exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.