![[Image: Wohlers Associates]](https://fabbaloo.com/wp-content/uploads/2020/05/wohlers2019_img_5eb098a887938.jpg)

The 24th annual Wohlers Report is available now; Terry Wohlers shares a look at the findings.

Each year, the Wohlers Report shares an in-depth examination on the state of the 3D printing industry. It’s been called many things, but most commonly the “bible of 3D printing” or, a bit less hyperbolically, simply a well-regarded, trusted resource.

The annual updates build upon past years’ findings, diving into more detail and tracing trends worldwide in 3D printing hardware, materials, and services. Contributors from around the world ensure global perspective; for the 2019 edition, 80 individuals and organizations from 32 countries contributed and served as information sources. In addition to Terry Wohlers, principal authors Ian Campbell, Olaf Diegl, Ray Huff, and Joseph Kowen, as well as associate authors David Bourell, Ismail Fidan, and Peter Sander led the way in gathering and presenting the tremendous amount of detail.

Wohlers Report 2019 was released in late March, clocking in at 369 pages.

I’ve greatly appreciated the opportunities to both read the report and catch up with Terry Wohlers on his and the team’s impressions for this latest edition.

“This year, Wohlers Associates gathered more input from users of AM technology,” Wohlers told me. “We collected detailed information from the likes of Airbus, BMW, Deutsche Bahn, Jabil, and many others to identify and exemplify recent trends in the industry.”

This is in response to my query about an evolution in this year’s approach to the report. Just as the industry itself, the report matures each year, able to draw from more resources and more accumulated data from more sources.

Per the report’s announcement, new and expanded features of Wohlers Report 2019 include:

-

Benefits and challenges of designing for AM

-

Listing of 107 early-stage investments valued at nearly $1.3 billion

-

Production, pricing, and use of metal powders

-

Expert reports from 32 countries

-

Tables of systems, third-party materials, software tools, and emerging developments

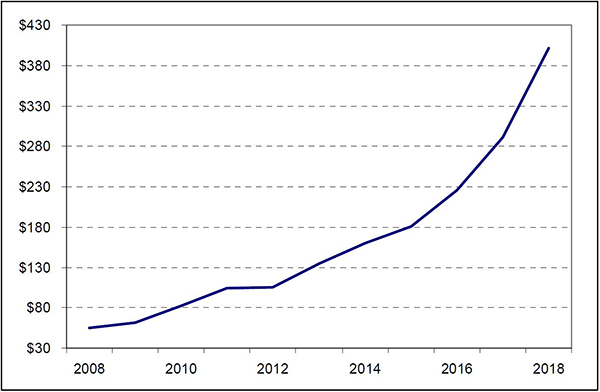

Information shared from the report indicates that 2018 was a record year of growth for additive manufacturing materials, in terms of both development and consumption. Metals revenue continued a half-decade-long streak of 40%+ growth, rising 41.9%. Polymer powder bed fusion materials also reached an all-time high, with growth illustrated:

When looking into 3D printers themselves, Wohlers Associates continues to segment 3D printers into sub-$5,000 desktop systems and $5,000+ industrial systems. With the ongoing growth of high-temperature and other more advanced desktop machines, I asked Wohlers about the potential establishment of a mid-range/prosumer category to create a third category.

“Currently, the price of a machine does not directly relate to the usefulness of the parts it produces. In recent years, we have seen a blurring between desktop printers and some industrial machines. Many of the long-running desktop-only producers, such as MakerBot and Ultimaker, are now also producing machines above the $5,000 price point. At this time, we do not plan to create a third price category of AM machines, although we discuss and debate the idea every year,” Wohlers told me.

In their $5,000-plus industrial category, the team examined growth and sales for 177 producers — a notable rise from 135 producers the prior year. The report indicates that “while industrial system manufacturers grew notably, desktop 3D printing systems (those that sell for under $5,000) saw significant decline in annual growth.”

On top of the expertise gleaned from authors and contributors, Wohlers Associates additionally gained input from:

-

127 service providers

-

71 manufacturers of industrial systems

-

30 producers of desktop 3D printers and third-party materials

I wanted to know more about what they heard from service providers, and inquired about trends observed there.

“Half of the service providers (SPs) that we research offer metal services, which was certainly not the case just two years ago. In fact, it was not that many years ago when only a small handful had a metal AM system. This is one of the most interesting trends. Another is the strong interest in machines from EOS and HP among the 127 SPs that provided detailed information to us,” Wohlers explained.

These findings correlate well with another conclusion: not only is end-use production a big focus, it has actually become the top use case for additive manufacturing. Wohlers elaborates:

“The use of AM for end-use production is now the number one application of the technology, followed closely by functional prototypes. Together, they represent 56.3% of the total. In recent years, the industry has transitioned in a direction that many had hoped.”

Of course, Wohlers noted as well, DfAM (design for additive manufacturing) remains “among the biggest challenges and opportunities we see,” as the skill set remains both desirable and “hard to come by.” 3D printing requires new ways of thinking, and there is great demand for those trained in thinking — and designing — additively.

Wohlers Report 2019 of course dives deeply into these areas and many more. This is a valuable resource for any bookshelf in 3D printing. It’s available now, priced at $495 for an electronic copy and $595 for a printed version.

MiniFactory’s new software produces a very useful report for each 3D print that may be important for clients. We had a close look at one.