![[Source: The Mayo Clinic ]](https://fabbaloo.com/wp-content/uploads/2020/05/Mayo2_img_5eb095e015349.png)

Charles Goulding and Rafaella July of R&D Tax Savers discuss the Mayo Clinic’s use of 3D printing.

Ken Burns’ 2018 movie documentary, The Mayo Clinic: Faith – Hope – Science, details the journey of The Mayo Clinic, from the vision that started it all to all of its accomplishments to date. In the late 19th century, English immigrant physician William Worrall Mayo, his sons, and the nearby Sisters of Saint Francis built the Mayo Clinic flagship in Rochester, Minnesota. For nearly 150 years, the health system has been providing highly specialized medical care to those in need. The nonprofit academic medical center is based in Rochester but has additional facilities including major campuses in Arizona and Florida, as well as affiliated facilities throughout Minnesota, Wisconsin, and Iowa.

![[Source: Wikipedia ]](https://fabbaloo.com/wp-content/uploads/2020/05/Mayo1_img_5eb095e0c3290.png)

In addition to highly specialized medical care, the Mayo Clinic is a top research institution. Over its course, the institution has completed more than 12,000 active review board-approved studies, including more than 7,000 research and review articles in peer-reviewed journals. The Mayo Clinic is especially committed to advancing cancer research and care. It was designated a comprehensive cancer center by the National Cancer Institute for its many contributions to treatment including enhancing CAR-T cell therapy and proton beam therapy.

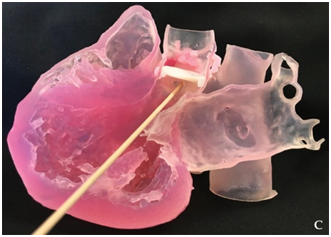

The Mayo Clinic has been on the forefront of incorporating 3D printing into medicine. Over ten years ago, the health system established the 3D Anatomic Modeling Lab where countless anatomical models have been printed for various reasons, but mostly to allow surgeons to thoroughly prepare before operations. As detailed in the documentary, the Mayo Clinic has had an unwavering commitment to innovation since it was founded by the Mayo family.

Materialise World Summit 2017

At the 2017 Materialise World Summit, Dr. Jonathan Morris, a neuroradiologist at the Mayo Clinic, gave a presentation that detailed incredible cases where 3D printing was used to provide the next level of excellent patient outcomes. In the presentation, Dr. Morris spoke about the very first case that led the institution to use 3D printing. The case involved a set of conjoined twins with very complex anatomies due to their fused organs. The surgeons on the case asked the radiology department if it was possible to make a 3D model of the twins’ conjoined organs. Once the models were created the surgeons were able to have a comprehensive discussion on how the operation would go, but instead of looking at a screen they were gathered in a circle holding the 3D models in their hands.

3D Anatomic Models Lab

![[Source: The Mayo Clinic via Materialise ]](https://fabbaloo.com/wp-content/uploads/2020/05/Mayo3_img_5eb095e127595.png)

As more and more surgeons became familiar with using 3D models, the Mayo Clinic had to establish a central location where all of the printing and processing could be done. For that reason, the 3D Anatomic Models Lab was established in 2008. The advantage to having an in-house 3D printing lab is that processing times are significantly reduced, therefore improving patient satisfaction. Instead of a patient going through many doctors in different locations over the course of two months, the Mayo Clinic’s patients can have all of their imaging, testing, and procedures done under one roof in the course of a week. The 3D Anatomic Models Lab also contributed to patient satisfaction by providing true informed consent to procedures since the 3D models were shown to patients to demonstrate exactly what would occur during their operation.

Renal Model Case

In one such case, a renal tumor had to be removed from a patient who only had one kidney. The surgeon determined that there was a very small chance the procedure could be done without damaging the remaining kidney, which would leave the patient relying on dialysis for the rest of his life. The surgeon requested a 3D model to plan for the procedure. The model was used during the procedure when the surgeon was unsure if one unseen blood vessel needed to be cut in order to remove the tumor. The 3D model showed that the blood vessel was not part of the tumor but of the kidney itself. Had the surgeon made the mistake of cutting the blood vessel, the patient would likely have lost his remaining kidney.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The Mayo Clinic has been one of the most innovative medical institutions in the world. Their 3D printing initiatives and creation of the 3D Anatomic Models Lab have contributed to many positive outcomes for countless patients and surgical teams.

FELIXprinters has released a new bioprinter, the FELIX BIOprinter, which is quite a change for the long-time 3D printer manufacturer.