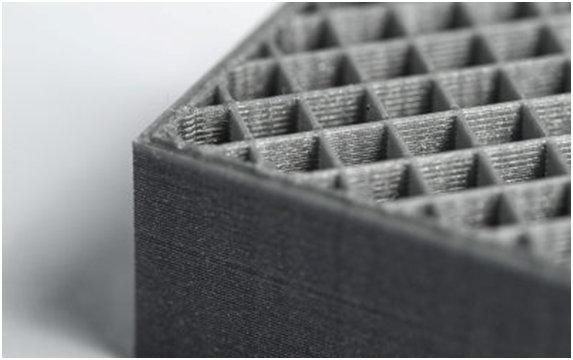

Shells and infill can be used to optimize a design [Source: 3D Hubs]

Charles R. Goulding reflects on a high-profile 3D printing shoutout.

Debbie Flood runs an architectural foundry business in Schonfeld, Wisconsin called Melron Corporation. She was one of the speakers at the 2020 Republican National Convention. After describing the negative impact of Chinese price competition she talked about the positive benefits of 3D printing equipment.

Politics aside, this was a great shoutout for the 3D printing industry during the 4th day of the convention, an event seen by 23.8 million viewers.

How Melron Uses 3D Printing

Melron makes sand castings for aluminum window hardware. In addition to 3D printing, their production equipment includes CNC machines and Bridgeport machine tools. There are multiple videos covering the company’s use of 3D printing. For instance, a customer requested a unique design and pattern for their window and the way that Melron could successfully achieve that product utilizing a sand casting technique was with a Stratasys 3D printer. In the video Dan Schaup, Melron’s Vice President, explains how 3D printing saves them $3,000 per pattern and two to three weeks of design time in tight deadline situations.

Research & Development tax credits are available for the eligible activities that Melron is involved in. Advancements that US companies make, like utilizing 3D printing, may help them obtain tax benefits like the R&D tax credit.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

It was very beneficial for the 3D printing industry to have this testimonial during a major television event. The multiple videos will enable those who follow-up on Melron to learn what the company has accomplished with 3D printing, including design cost and time savings.