![[Source: Isharya ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0a298bb8a4.png)

Charles R. Goulding and Preeti Sulibhavi of R&D Tax Savers discuss the use of 3D printing in the creation of traditional and modern Indian jewelry.

3D printing has revolutionized the ways in which complex design concepts are brought to life. Across many sectors, 3D printing has afforded designers virtually limitless design freedom.

The jewelry industry is no different. In fact, it was one of the first to realize the potential of 3D printing. With one of the largest markets in the world, Indians in the U.S. have sought to utilize 3D printing in creating complex jewelry in far less time.

Indian Americans comprised 1.3% of the U.S. population in 2017, but that does not limit their demand for Indian design jewelry in the U.S. market. 3D printing has provided a technological means for allowing supply to meet demand. Companies that are incorporating 3D printing strategies into their jewelry production processes may be eligible for R&D tax credits.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayers business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, pre-profitable and pre-revenue startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

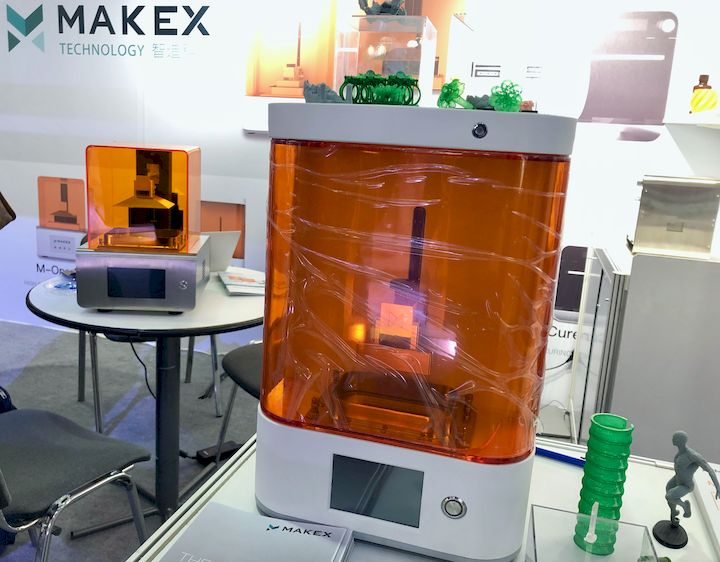

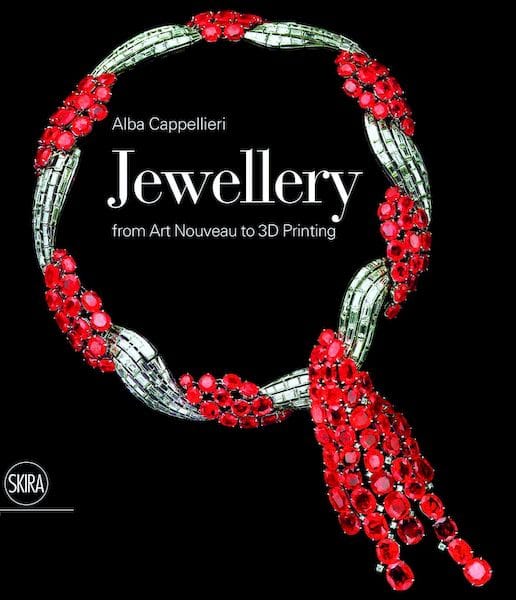

3D Printing Technology for Jewelry

Indian jewelry draws its inspiration from ancient designs that date back centuries. These designs are intricate, multi-layered, and often embedded with precious stones. 3D printing is a fast and easy way to create these designs without human error and toil.

With the help of Computer Aided Designing (CAD), manufacturers are able to 3D print moulds and master patterns for jewelry. These are then cast in precious metal to create intricate masterpieces of art. The result: dazzling jewelry exhibiting complex designs and abstract patterns. With the help of 3D printing, this has saved many jewelers time and improved efficiency – especially those merchants who are web-based.

Various Technologies Used in Jewelry Design & Manufacturing

-

Computer-Aided Design Software:

-

Rhinoceros Software & Models

-

CSS Matrix3d

-

3Design Jewelry Software

-

Monarch 3D Models and Flexible Filament

-

-

Computer-Aided Manufacturing Equipment:

-

Stereolithography (SLA or SL) 3D Printing

-

Laser Sintering (SLS) or Additive Manufacturing

-

Virtual Inventories in the Virtual Warehouse

-

3D Printing Jewelry in the Indian-American Community

Perhaps the most prominent example successfully utilizing 3D printing to meet the demand for Indian jewelry in the U.S. market is second-generation jeweler Eddie Bakhash, CEO of American Pearl & General Co. based in New York City. In recent years, Bakhash has aimed to shake up the $275 billion industry using proprietary CAD software and a Solidscape T-76 3D printer. Bakhash’s customers can completely customize their own design and have the finished product delivered in 3 or 4 days. There is no competing with inexpensive labor overseas, and no jeweler at the bench with a blowtorch. 3D printing has empowered consumers to make jewelry in real time at cost and labor savings.

American Pearl utilizes CAD/CAM software platforms to create a digital file to producing a perfectly proportional 3D printed model made of thermoplastic wax. The preferred metal is poured into this digitally-designed mould, and once hardened gemstones are added based on a customer’s online specifications. Below are some pieces that can be found on American Pearl’s website.

![[Source: American Pearl ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0a2993fcab.png)

Isharya Studios, a company based in India, also has a jewelry collection featuring 3D printed jewelry. Traditionally, Isharya’s pieces were handmade in India. But now, some of Isharya’s newest pieces were only possible with 3D printing. 3D printers offer Isharya’s pieces to have fine detail with the ability to print as quickly as desired. From brass casting their pieces, to plating them in gold, Isharya’s pieces benefit from the 3D printing process in their shapes and sizes, as well as intricate designs. Some popular traditional Indian designs are featured below:

![[Source: Isharya ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0a299966f3.png)

The attention to detail and reliability is exceptional with 3D printing. Their reliability and precision outweigh the costs for these Indian American jewelers.

Win, Win for Business and Community

The power of virtual inventory, according to Bakhash, is that supply meets demand, precisely and quickly. Low-cost labor overseas becomes less relevant in this market, as it once was, now that everything can be made domestically at competing costs and labor. Companies that are producing intricately designed traditional and contemporary Indian jewelry using 3D printing methods to improve their production process can benefit from taking the R&D Tax Credit.

1 comment

Comments are closed.