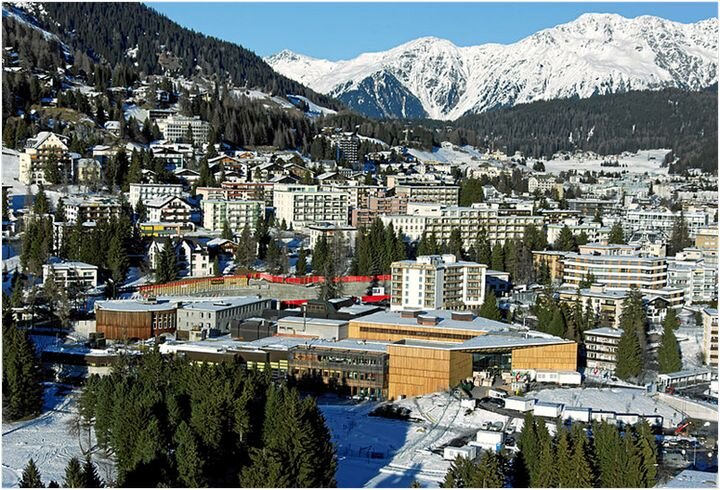

![Could Carbon IPO? [Source: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb095ff56e6f.jpg)

A report suggests Carbon may issue an IPO. What could this mean?

An IPO, or “Initial Public Offering”, is a stage in the investment lifecycle of a company where the stocks of the company become publicly traded on a market, such as the NYSE or NASDAQ. This is the end-state of investment, as previous investments are privately executed by individuals or investing companies directly with the company.

I’m reading a report on The Motley Fool that predicts Carbon will become a publicly traded stock company in the near future. They base their prediction on a few key signals:

-

Carbon has recently added IPO-level expertise to their board

-

Prices of 3D print stocks and the stock market itself are stabilized and thus ready for investment

Further, it’s said that during Carbon’s most recent investment round the company was valued at approximately US$1.7B (yes, “B”). However, other sources predict if traded publicly, Carbon could be valued as high as US$2.5B.

That is a staggeringly high number. To put it in perspective, as of this writing, the two largest publicly traded 3D print companies, 3D Systems and Stratasys, are valued at US$1B and US$1.24B, respectively. Thus Carbon would be literally worth more than 3D Systems and Stratasys combined!

There would be multiple effects as a result of the maneuver.

Carbon IPO Challenges

For Carbon: The immediate effect would be an enormous boost to Carbon’s bank account, due to the shares they sell on the exchange. The amount would likely be in the hundreds of millions of US$, and, like Carbon’s previous investment rounds, would be used to further develop and market the technology worldwide to industry. This would give Carbon a significant advantage over cther companies: for example, Carbon would be able to deploy an enormous and well-funded sales force to attract industries not currently engaged.

While that’s certainly a positive effect, there are some challenges for Carbon as well. An IPO transitions a company to the public eye. Carbon would forever be required to issue formal statements to the public regarding their finances and operations, as other public companies do. Do not underestimate the amount of effort required to handle this transition and ongoing reporting. However, with Carbon’s stash of cash that should not be an issue.

One issue could be publicity. Consider, for example, the travails of Tesla, who, while putting out an excellent product, find market short sellers fostering negative news. Carbon could potentially be faced with similar adversaries.

A more interesting challenge is that of innovation, as public companies have a more trying time innovating due to the public nature of their operations. The public responsibility to shareholders can be problematic, and the degree of effect depends on the amount of shares sold to the public during the IPO. If a sufficient number of shares are sold to relegate current management to a minority position, they no longer will be able to control key company decisions, which would be handled by a board elected by the shareholders.

This can be so challenging that I am aware of major corporations who have temporarily bought all the shares to make the company private again just so they could undertake difficult technical transitions, only to re-IPO after the transition.

Stratasys and 3D Systems Stock

For Other Publicly Traded 3D Print Companies: 3D Systems and Stratasys could feel the effects of a Carbon IPO as there would then be an alternative investment option for traders. In other words, the finite amount of investment cash targeting 3D printing could have some flow diverted to Carbon, lowering demand — and stock prices — for existing players. That’s not good for their investors.

Another effect would be an ongoing comparison between Carbon and existing players. Since all are then issuing identically formatted financials, investors can easily compare them — and make trading decisions. In other words, this will make all parties pay far more attention to their financials. Perhaps this could lead to some good strategies to keep up, but it could also lead to drastic scenarios.

3D Print Competition

For Other Non-Publicly Traded 3D Print Companies: If Carbon succeeds in their IPO (meaning the value of their company exceeds estimates when trading begins), it could attract other players in the 3D print industry to consider IPOs. However, few are in a good position to do so, aside from obvious players like Desktop Metal.

It’s possible some companies poorly positioned may unwisely attempt an IPO, only to find their company valuation decimated and then burdened with public reporting afterwards. Failures of that type would reflect on all publicly traded 3D print companies, unfortunately.

But all this is entirely speculation, and everything depends on what is really going on in the Carbon boardroom.

Via Fool.com

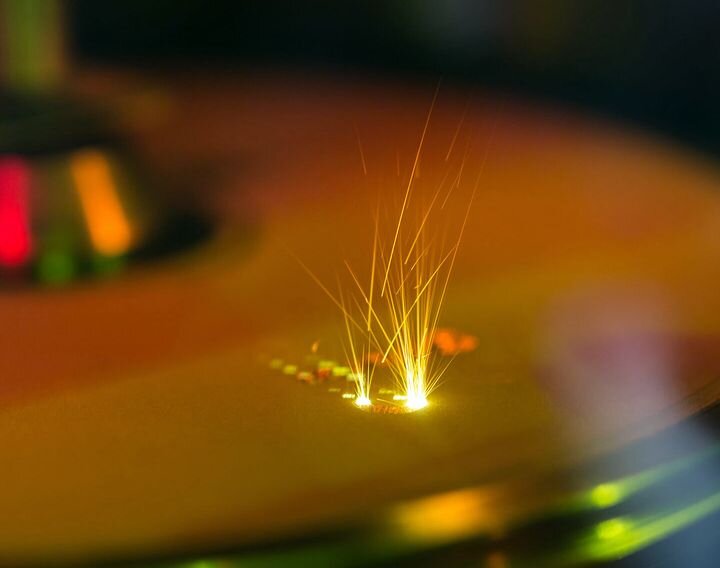

A blog post reveals much of what happens behind the scenes at 3D print service Shapeways.