3D Systems abruptly sliced off some of its parts this week, selling Cimatron and GibbsCAM.

The buyer of these two companies is Battery Ventures, a Boston-based investment firm. Battery Ventures is also a major investor in SigmaTEK Systems, a CAD/CAM company, and the new acquisitions are expected to join SigmaTEK Systems in a newly named holding company called “CAMBRIO”.

While this may seem to be a straightforward divestiture, there is a lot more at play here.

First, some history. 3D Systems began decades ago as an SLA company — in fact, they invented the SLA 3D printing process. Since then they have added several additional 3D printing processes to their portfolio, growing a very large business.

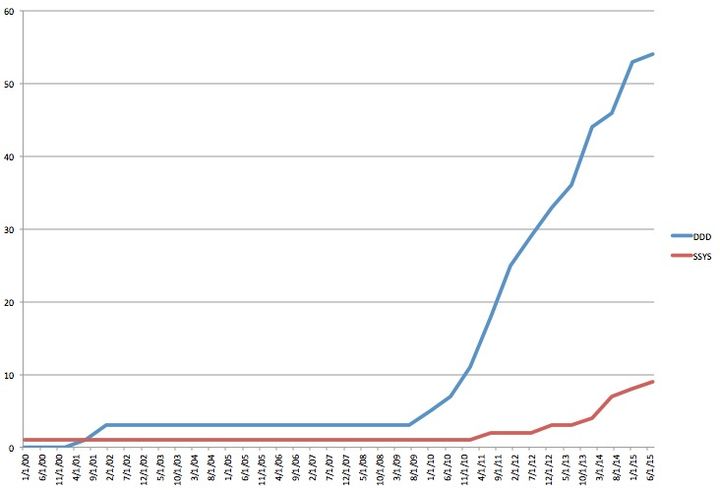

In the 2010-2015 period, however, they had a strategy to grow by acquisition. During this period they were scooping up 3D-related companies almost every week, it seemed. The torrent of acquisitions was so strong I even decided to analyze 3D Systems’ acquisitions, and found they had acquired 54 companies during the analysis period.

In 2015 3D Systems acquired Cimatron Group for US$97M, a company that produced CimatronE and GibbsCAM, tools for the machining industry. At the time I thought this was quite strange, as normally a 3D printing company would have no technical interest in traditional CAM software.

After the strategy shift away from acquisitions, 3D Systems found itself awash in dozens of smaller companies, many of which overlapped in functionality and products. To solve the complexity 3D Systems shut down many of them, blended their tech into other products or in some cases simply abandoned them. The result was a lot fewer businesses to manage.

However, one of the survivors was GibbsCAM and the Cimatron team. When many others were being shut down, I wondered why GibbsCAM was allowed to survive, and speculated that it might be because that particular business was profitable. It should have been, having spent US$97M to buy it in 2015.

Now we see that 3D Systems has sold off this part of their business after five years of ownership. This was done under the new CEO, Jeffrey Graves, who was brought into 3D Systems this past May.

Graves faced notable financial challenges upon taking over 3D Systems, of which I’ve written many times. The issue is that they have been consistently been unprofitable for some years, and have been slowly burning off their cash reserves. That’s not a long-term strategy for success, and the previous 3D Systems CEO was unable to resolve the situation.

I felt the company had to take some dramatic steps to alter their trajectory, even making some aggressive suggestions in a post earlier this year.

It now seems that style of action is now underway with this divestiture. Cimatron should never have been a key part of 3D Systems’ strategy, and so the sale makes a great deal of sense from a strategic point of view.

However, 3D Systems did keep it in-house for five years, presumably because it was profitable. But in these difficult financial times for 3D Systems, why sell a profitable unit? Perhaps there are more strategic reasons? Could it be that 3D Systems is seeking a cash infusion and this sale is one way to get some cash quickly?

The terms of the sale were not specifically announced, but if 3D Systems paid US$97M in 2015, it’s possible they now will receive something close to that in return for this sale. If that’s the case, then 3D Systems has perhaps US$100M available to extend the time they have to optimize the rest of their operations.

I’m very interested to see their next steps.

Via BusinessWire