Charles R. Goulding and Peter Favata explore the role of 3D printing in the manufacture of hip replacements.

In the United States, more than 450,000 hip replacements are performed each year. To add to that, total hip replacement is one of the three most common joint replacement surgeries done per year. The growing prevalence of hip replacements has made a profound impact on many Americans by allowing patients the opportunity to regain the mobility and freedom they once had.

There are three major types of hip replacement surgeries, namely total hip replacement, partial hip replacement and hip resurfacing.

During a total hip replacement, worn-out or damaged sections of the hip are replaced with artificial implants. The socket is replaced with a durable plastic cup that sometimes has a titanium metal shell and the femoral head is replaced with a ball made from ceramic or metal alloy. The new ball is attached to a metal stem that is inserted into the top of the femur. Partial hip replacements involve only replacing one side of the hip joint (the femoral head) instead of both sides. Lastly, hip resurfacing is mostly performed on younger, active patients and consists of shaving and capping a small portion of the hip to smooth out the bone.

Orthopedists have been utilizing 3D printing for hip replacements for nearly a decade now with much success. Specifically, 3D printing is used as a blueprint model for producing a traditional hip replacement or, in some cases, a 3D printed replacement is made.

Hospital for Special Surgery has been utilizing 3D printing in collaboration with LimaCorporate since 2016. The two organizations have announced that they are founding the first design and additive manufacturing 3D printing facility for custom complex implants on a hospital campus, which will positively impact the accessibility and speed of personalized orthopedic care for those who need it.

Stryker, a global leader in medical technology, is another example of a large company leveraging additive manufacturing for titanium implants and other products in its medical portfolio.

With the advancements made in 3D printing technologies in recent years, there have been over 100,000 3D printed joints as of 2018.

The Impact of 3D Printing

As mentioned, 3D printing applications are being used to create new hip replacements for patients with very positive results.

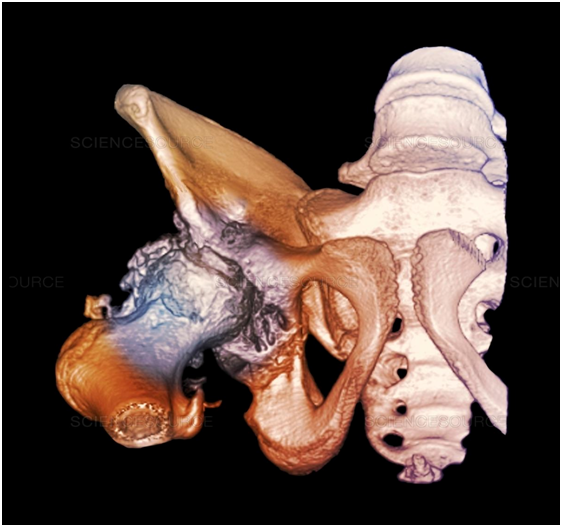

This process begins by taking a CT scan of the patient’s hip that needs replacing. Once the CT scan is received, clinical engineers can identify the bone defect and thickness after which they will run a bone loss analysis and compare those results with the patient’s healthy bone.

Once they have this information to act as a reference point, the design of the implant can begin using CAD, where factors such as the ideal center of rotation and bone preservation are taken into account for the new joint. The existing bone density as well as screw placement also must be incorporated. This only takes about one week to complete. After the design for the replacement joint is finalized, the implant is 3D printed out of metal, the most popular being highly porous titanium.

This 3D printing technique is not limited to hip replacement surgery. We have recently published articles covering 3D printing for shoulder and ankle surgeries.

Manufacturers and technical designers utilizing additive manufacturing for implants and similar medical devices may be eligible for R&D Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

Hip replacements are one of the most common joint replacement surgeries performed today and millions of Americans are living easier because of it. With well over a decade of research to back the application, the power of additive manufacturing has made great strides in the medical device sector in recent years. 3D printing and similar activities related to the development of medical device technology such as implants may be eligible for R&D tax credits.