Charles R. Goulding and Arianna Coger look at how 3D technology usage could increase at J&J.

On November 12, 2021, healthcare giant Johnson & Johnson (J&J) announced its plans to split into two separate publicly traded companies; one will be focused on consumer products while the other will be focused on pharmaceuticals and medical devices.

The pharmaceutical and medical devices division will continue to keep the J&J name, while the consumer products division will be renamed.

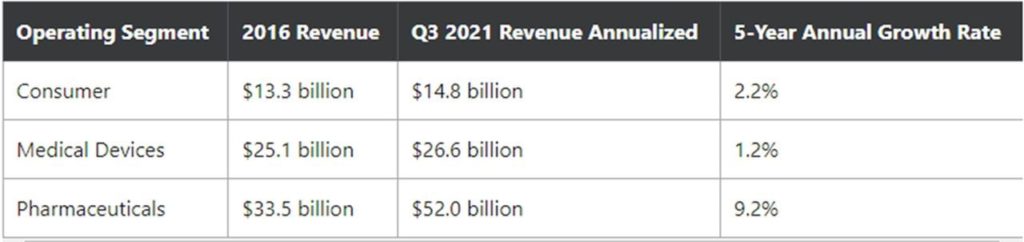

This decision was partially driven by the volatile nature of pharmaceutical and medical device businesses, where the higher risk can yield greater rewards compared to consumer products. The pharmaceutical segment of J&J specifically has experienced significant growth in the past year compared to other segments.

Following the separation, J&J plans to funnel more resources towards research and development efforts to quickly innovate and grow the company’s pharmaceutical and medical device lines.

3D Printing Opportunities

Johnson & Johnson’s new focus on innovation may lead to greater usage of 3D printing to develop and manufacture products. 3D printing can be used in both the pharmaceutical and medical device industries, whether it be for printing pills or for prototyping tools.

We’ve previously discussed Johnson & Johnson’s wide range of 3D printing initiatives, which includes funding internal departments dedicated towards 3D printing development as well as partnerships with companies such as Carbon. The Head and Senior Fellow of the Johnson & Johnson 3D Printing Center of Excellence, Sam Onukuri, views 3D printing as a strategic technology, similar to artificial intelligence. He has previously stated:

“If I look at what J&J has invested over the past four or five years, it is clear that we believe [3D printing] is an important enabler of value to customers and patients. This is true not just for medical devices—there are a lot of models for that—but also for personalized medicine, pharmaceuticals, and consumer products. We see a big value on a global scale across all those businesses.”

Sam Onukuri and his team primarily work on integrating 3D printing technology across the J&J enterprise by exploring the usage of new 3D printing materials, processes, and software. Another Research Fellow at the Johnson & Johnson 3D Printing Center of Excellence, Orchid Garcia, helps lead the development of 3D bioprinting and related tissue regeneration technology to build a new class of next-generation healthcare solutions. 3D bioprinting research is currently being performed to develop techniques for growing tissues and organs for patients in need. With more time, researchers may finally achieve clinical success with the technology.

One of Johnson & Johnson’s Innovation divisions, JLABS, often works with 3D printing to develop new medical products. JLABS facilities are scattered throughout the world and provide resources to innovators working on advancing their ideas.

Many JLABS facilities include 3D printers, electrical tooling, and other equipment for prototyping medical devices and products. With the separation of J&J into two separate companies, more resources can be directed towards these facilities and their 3D printing capabilities.

J&J also has several subsidiaries implementing 3D printing to manufacture healthcare products. Last year, DePuy Synthes, a Johnson & Johnson Medical Device Company, was able to develop a resorbable 3D printed implant called the TRUMATCH Graft Cage – Long Bone. The team was able to create a highly customizable implant that can be printed within 10 days to fit a patient’s unique anatomy and effectively strengthen the bones of individuals struggling with critical-sized segmental defects. The implant is designed to retain morselized bone graft or bone graft substitutes in the desired location during healing and allow nutrient access and bone restoration while ensuring compatibility with common rigid fixation devices.

J&J and its medical device subsidiaries have plans to continue pursuing new applications of 3D printing, particularly for orthopedic treatments. Companies taking on similar endeavors may be eligible for Research and Development Tax Credits.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing, and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

J&J is in a great position to accept larger risk while developing new pharmaceuticals and medical devices. 3D printing and bioprinting are on the rise within the biomedical field due to its flexibility and speed. The separation of the J&J business will likely lead to greater usage of 3D printing technologies while pursuing new developments.