Charles R. Goulding considers R&D studies that should be undertaken in 3D printing M&A transactions.

The 3D printing industry is a very fragmented industry that is arguably ripe for consolidation. Recently we have seen some important acquisitions including Desktop Metal’s purchase of EnvisionTEC for $300 million, Protolabs’ acquisition of 3D Hubs for $280 million (additional contingent $50 million) and Covestro’s purchase of Royal DSM’s large 3D printing materials business segment for $1.8 billion.

Reviewing the R&D Tax Credit Study

During the acquisition process, the prospective acquirer should review the prospective acquiree’s recent R&D activities. Our firm produces an annual analysis of the per capita R&D expenditure of the largest 3D printing companies. The majority of U.S. 3D printing companies take an R&D tax credit and the tax law requires that companies taking an R&D tax credit have contemporaneous documentation, in other words, a written study. The purchaser’s due diligence team should obtain this study or review it in the acquisition data room.

The R&D tax credit study should explain and highlight what the largest R&D projects were for the year, the titles of employees that worked on them, and what percentage of each employee’s total annual work time was spent on them. The study should also show the cost of raw materials spent on new products including prototype expense. Additionally, it should include the dollar amounts paid out to third-party consultants including but not limited to laboratory testing, outside engineering and software integration. Lastly, the study should show the number of cloud charges allocated to R&D. If a target is not taking an R&D tax credit there may be a meaningful opportunity for the new purchaser to file a retroactive tax refund claim. Furthermore, if the acquiree is taking an R&D credit but not preparing the required study, there is both tax and penalty liability exposure that needs to be reserved.

Post-Purchase Business Integration

In today’s acquisition environment purchasers act quickly to integrate a new business. For example, concurrently with the DSM acquisition, Covestro stated that to help pay for the acquisition they were going to wring $140 million in annual cost savings.

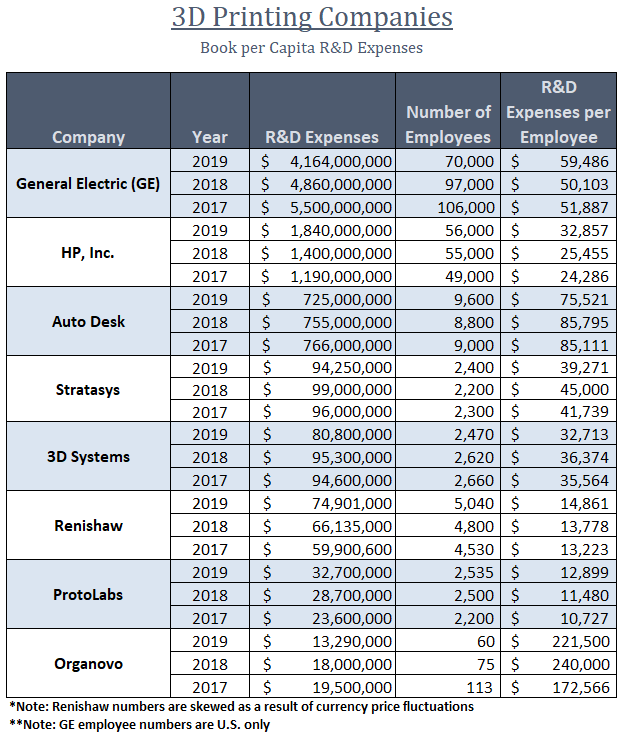

The 3D printing industry is one of the leading industries in R&D spending commitment, a summary of which can be found in the table below:

3D printing presents a unique opportunity for companies to take advantage of the Research & Development (R&D) Tax Credit, which is described below.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The 3D printing industry is an R&D-intensive business sector and may be poised for a wave of acquisitions. Reviewing the prospective acquiree’s R&D tax credit study should be an important part of purchaser due diligence. Additionally, knowing who the key R&D technical staff are and what projects they work on should be crucial to the post-merger integration process.