Charles Goulding Jr. considers the place of 3D printing in the growing cannabis industry.

An Industry on the Rise

The marijuana landscape is changing rapidly. Cannabis is legal for medicinal purposes in 34 states, and in 15 more (plus D.C.) for all adults. One in three adults now live in states where the drug available to all adults.

With populous states like New York, Florida, and Ohio likely next in line, producers of cannabis and cannabis-related products may shortly form a market not dissimilar to any other national product or service.

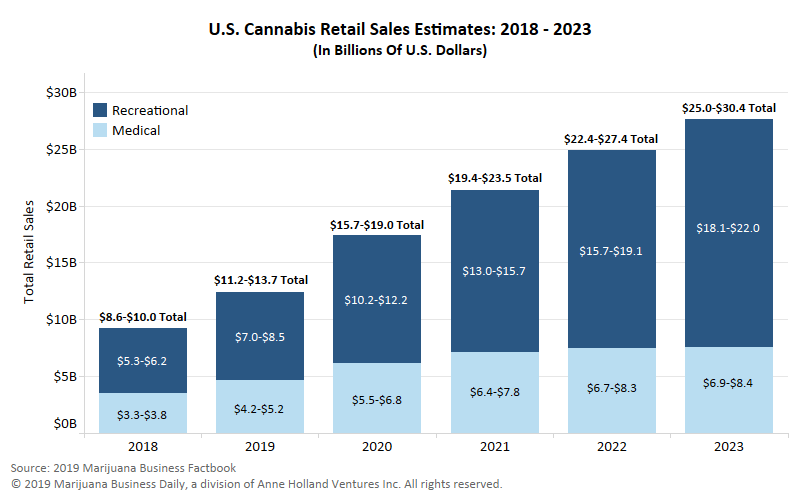

Numerous companies and aspiring entrepreneurs have already taken note of this, including multi-state operators like Curealeaf and Trulieve Cannabis which operate 93 and 60 dispensaries, respectively. Firms like these, as well as a host of smaller entities, will participate in an industry expected to grow quickly over the next few years:

An Expanding Landscape

Marijuana itself is not the end of the story. Accessories like pipes and bowls, for example, have also begun to proliferate. So too have newly innovated products like next-generation vaporizers. Such products, like the Davinci, isolate THC. This eliminates the smell of combusted marijuana (and allegedly makes inhalation safer for the same reason).

Other new products include phone apps that assist in dose measurement, waters, gels, and tablets that expand intake options, and vaporizer filters that eliminate second-hand smoke.

3D Printing Enters the Fray

Between customized dosing needs for medicinal marijuana to the creative world of paraphernalia, 3D printing has opportunities to participate in the growing cannabis industry. Indeed, a handful of interesting products are already under development.

In one high-profile example, Mike Tyson recently announced a major partnership with California-based startup Smart Cups, making cups containing extracts which, when mixed with water, form flavored drinks. Tyson’s company 3D prints cups composed of a marijuana extract which then creates a cannabis beverage once mixed. The purpose of the product is to ensure the proper dosage is being used for medical purposes.

Hydroponics (horticulture without soil) serves as another example. So-called grow boxes are a type of hydroponic, allowing weed plants to be grown domestically. Some states already allow home-grown cannabis, opening up the industry to innovation.

3D printed home grow boxes and gardens are already planned by some hydroponics companies specifically for marijuana. 3Dponics, for example, has made home systems for years for other types of gardens. They now intend to make a 3D printable garden for home cannabis growing.

Meanwhile, marijuana printing itself may be imminent. If that sounds far-fetched, one state government does not think so. Early this year, a Rhode Island senate committee voted on 3D printed marijuana regulations. With materials innovation a major 3D printing trend, the idea may be close to fruition.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum Tax for companies with revenue below $50MM and for the first time, pre-profitable and pre-revenue startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Any state without progressive marijuana legislation is already in the minority. Soon the entire United States may at least allow cannabis for medical purposes if not for recreational use.

Few industries figure to expand as quickly as marijuana and associated accessories. 3D printing has the ability to customize products that have traditionally been the subject of much creativity. It can also help foster a DIY sub-sector that could appeal immensely to consumers in states permitting that option. The R&D tax credit can help shoulder the load of innovation costs for this exciting field.