Charles R. Goulding and Arianna Coger examine ways that EnvisionTEC’s bioprinting technology may play into its new parent company’s operations.

Recently, more 3D companies are shifting their focus towards bioprinting technologies. Earlier this year, we discussed Desktop Metal’s acquisition of EnvisionTEC, a 3D printing company that specializes in photopolymer printing, and the research and development implications of this acquisition. One of EnvisionTEC’s notable products is their 3D-Bioplotter family of printers. EnvisionTEC’s Bioplotter technology is likely to influence Desktop Metal’s recent venture, Desktop Health, with the goal of providing additive manufacturing solutions for medical purposes.

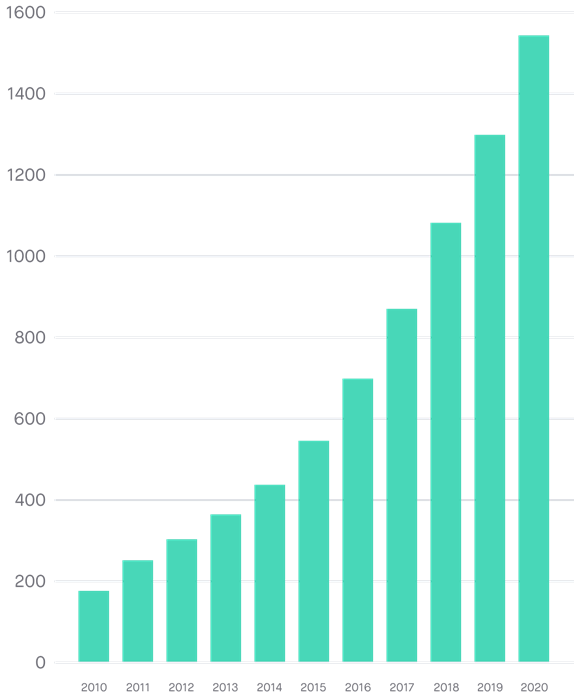

There are three versions of the Bioplotter – one for starters, one for manufacturing purposes, and one for development purposes. The Bioplotter printer is ideal for research and development due to its accuracy, reliability, sterility, and flexibility. Its modular components enable interchangeable printer heads as well as the usage of multiple materials in a singular print. Over the past decade, the number of times it has been referenced in publications has drastically increased due to its effectiveness and convenience.

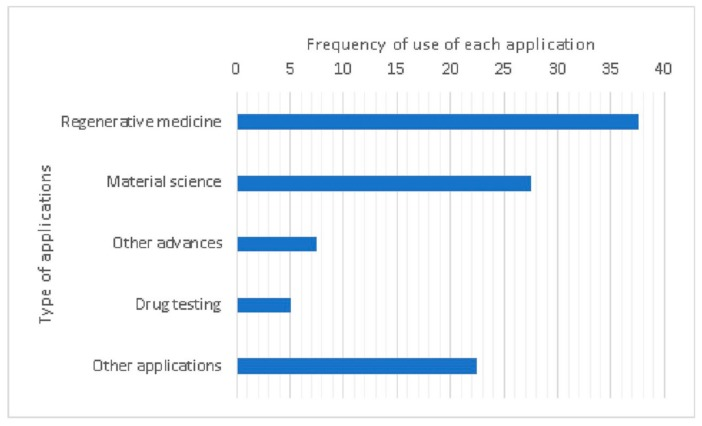

A large percentage of the research using the Bioplotter is related to regenerative medicine, followed by materials science. In the past year, the Bioplotter technology has been utilized to develop bone tissue, neural stem cells, and heart valves. Patient CT data and 3D CAD models can be used to design each 3D printed scaffold to fit patients’ specific needs. The ability to use a patient’s own cells to grow a new organ with 3D bioprinting can help reduce the number of deaths due to organ shortages and organ rejections after transplantation.

We recently discussed new research on tissue engineering with 3D bioprinting performed by the University at Buffalo and Washington State University. Refining the technology for widespread medical usage will require additional investments to improve cell and tissue viability.

Federal tax incentives, such as the Research and Development (R&D) Tax Credit, are available for companies that engage in 3D printing activities.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Interest in 3D bioprinting continues to grow as companies realize the immense potential within the field.