Charles Goulding, Jr. considers how dual trends position equipment makers like John Deere and Caterpillar for upcoming success.

Both Caterpillar and John Deere have large business segments including construction equipment and farming.

Infrastructure

The first of those trends is infrastructure spending. On Wednesday, President Biden released more details of his infrastructure plan, originally titled Build Back Better and now dubbed the American Rescue Plan.

Regarding construction, Biden intends to build or renovate two million affordable homes and commercial buildings over the next decade. Federal funding for the homes will come through block grants awarded to state and local governments.

If indeed the retrofit and new construction markets grow as planned, equipment makers will stand to benefit.

Record Growing Season

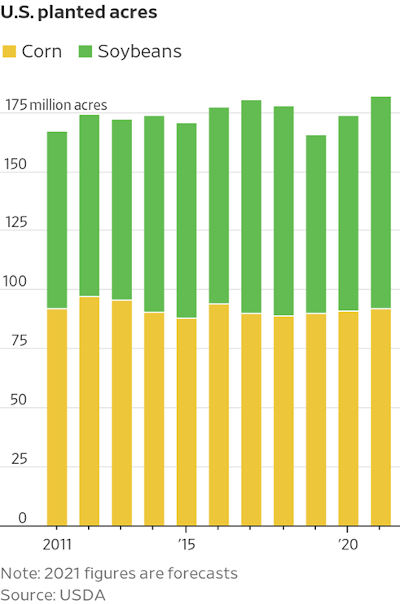

A second trend on course to positively impact equipment makers is a record growing season. Propelled by rising crop prices, American farmers are presently on schedule to plant record acres of crops.

“If realized, this would approach the highest planted soybean area figure on record,” said Mac Marshall, vice president of market intelligence for the United Soybean Board, about the U.S. Department of Agriculture’s prediction of 182 million acres of soybean and corn crops in 2021.

Caterpillar

With 2020 sales and revenues of $41.7 billion, Caterpillar Inc. is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Caterpillar does business on every continent, principally operating through three primary segments – Construction Industries, Resource Industries, and Energy & Transportation – and providing financing and related services through their Financial Products segment.

Caterpillar spent $1.4 billion on research and development in 2020 alone, down from $1.7 billion in 2019 (largely due to the effects of the Covid-19 pandemic). In 2020, Caterpillar employed 97,300 people full time with 40,300 of them located in the United States.

When Caterpillar began its current investment in 3D printing components for heavy equipment earlier this decade, the company’s engineers and chemists tried to manage their expectations. But after only a few years of tinkering with commercially available additive manufacturing technology, the equipment manufacturer already has introduced 3D printed components into its supply chain.

The parts being produced today are primarily intended for the aftermarket, such as dealer repairs and replacements. For example, a grommet for a mounting on a motor grader is 3D printed from elastopolymer, saving money on a low-volume part. While not all the parts are critical, Caterpillar found that it was no longer economically viable to retool their traditional manufacturing pipelines to produce these highly specialized components.

Caterpillar also uses machine learning and predictive analytics to determine which locomotive and heavy equipment parts are likely to wear out all their use and utilize preventative maintenance to replace them before a breakdown in the field.

As of 2017, only one component in the new “Cat” machines is solely produced via 3D printing. Gas turbines made by Caterpillar’s Solar Turbine subsidiary require fuel mixers with complex fin designs that are difficult to cast with traditional methods, so then-AM product manager at Cat, Stacey DelVecchio, and her team found it easier to 3D print the mixers using a particle-bed-and-sintering technique. In this type of 3D printing, metal powder is heated and fused into place by a computer-controlled laser following a path prescribed by a 3D model. Successive layers of powder are added until the piece is complete. The resulting fuel mixer has all the complex crevices the design called for and only had to be removed from the base plate after the sintering was complete.

John Deere

With 2020 revenues of $35.5 billion, John Deere connects farmers with leading global technology. John Deere enjoys continued success through customer-centric innovation and smart-tech food production development.

This manufacturer is better known for its iconic agricultural machinery, but people shouldn’t overlook its exposure to construction and forestry equipment. The construction and forestry segment contributed around half as much in operating profit as the agriculture and turf segment did in 2019.

In addition, Deere’s $5.2 billion acquisition of Germany’s Wirtgen in 2017 made it one of the world’s leading providers of end-to-end road construction solutions. From quarry excavators and earth-moving equipment to crushers, asphalt plants, and ultimately compactors and pavers, Deere can now be called a one-stop-shop for road contractors.

“John Deere employees make significant efforts in the research and development of our products, which can lead to breakthroughs, customer-valued innovation,” said Chris Myers, vice president, Advanced Technology and Engineering, John Deere. “It is truly gratifying to see John Deere and its employees recognized for those efforts.”

John Deere is at the forefront of engineering and innovation. Using virtual reality to build the next generation tractor thereby making farming easier for future generations, is one example of such innovative techniques utilized by John Deere.

John Deere employed 69,600 people full time as of November 1, 2020, with 27,500 of them being in the United States and Canada. This is in addition to their consultants, independent contractors, and part-time workers.

John Deere’s Technology and Innovation Center’s Additive Manufacturing Lab (MTIC) in Moline, Illinois, has machines 3D printing prototypes from highly sophisticated ideas and designs. In prior years, John Deere could 3D print utilizing only plastic materials; now, the MTIC 3D printing activities include metals with innovative and industry-changing results. Examples of 3D printed technologies include tooling and spare parts. For John Deere, 3D printing tooling has been a great success. Deere’s tooling competency group deployed more than 40 3D printers, putting tools into factories to address the growing need. Now the company is looking to 3D print spare parts on demand, meeting customers’ uptime concerns immediately.

The U.S. Department of Agriculture expects that farmers will plant 182 million acres of corn and soybeans in 2021. This is a record number and up nearly eight million acres from 2020. This large jump is primarily due to an increase in soybean acreage, which is expected to rise nearly seven million acres from last year.

Conclusion

The business stars are in perfect alignment when an industry has two large multi-segment businesses favored by recent trends. With infrastructure and farming both experiencing positive development this year, the equipment manufacturing industry (both construction and farm) should be the ideal candidate for increased 3D printing utilization.