Charles R. Goulding and Preeti Sulibhavi consider the FTC’s investigation into Welsh Carson and the importance of 3D printing’s value-add as a resource.

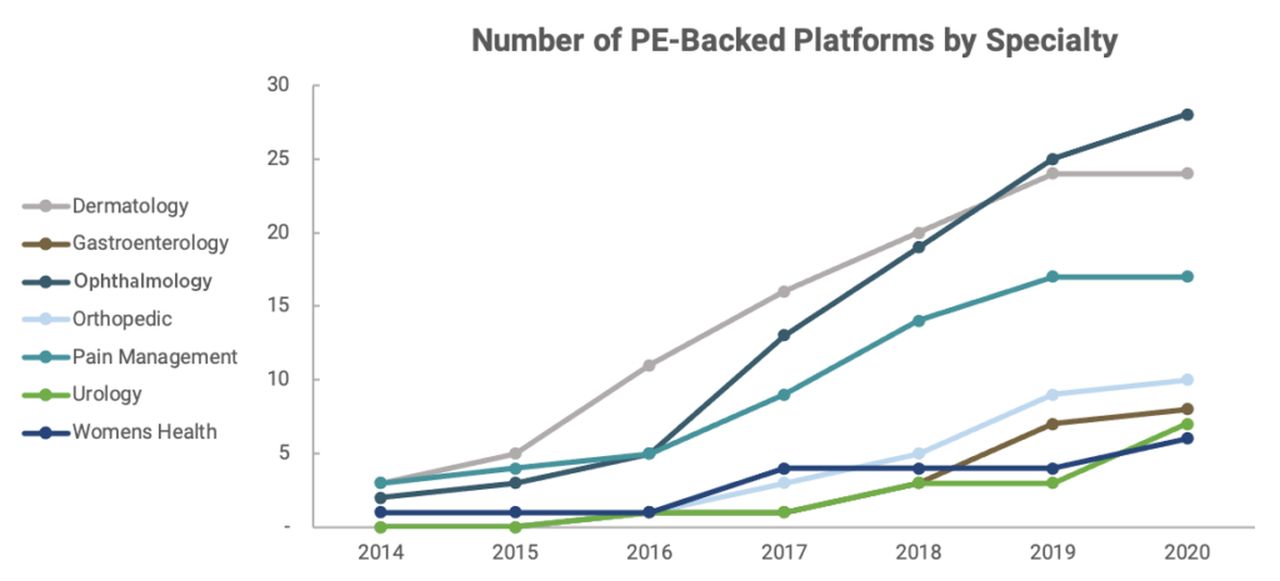

Lina Khan, the activist head of the FTC has made it clear that she wants the agency to move against private equity physician practice roll ups. We recently covered the 3D printing related benefits of these physician practice roll ups. Numerous categories of physician practice roll ups are currently experiencing rapid growth.

The FTC selected as its first case the Welsh Carson, Anderson & Stowe (Welsh Carson) private equity firm’s roll up of the majority of anesthesiology practices in Texas. The Welsh Carson firm now has ownership of 60 percent of the Texas anesthesia market. Welsh Carson also has ownership shares in radiology, orthopedic and primary care groups.

Enforcement agencies like the FTC typically pick cases with extreme fact patterns to get the business behavioral results they are striving for. Ms Khan is a frequent speaker on major media outlets so the agency’s actions become well publicized and are aimed at fulfilling the FTC’s policy goals of altering business behavior.

The challenge in the private equity roll up situation is that PE firms have increasingly been focused on improving operating performance which is often needed in the physician practice area. Physician practices have been experiencing staff shortages at all levels and also need to integrate numerous technologies like 3D printing into their practices. Managed care facilities that purchase physician practices often have financial resources, staff levels and shared technology centers that smaller physician practices can’t provide.

Examples of well regarded managed care practices that acquire physician practices while providing deep technical resources include Northwell on Long Island, The Mayo Clinic in Minnesota and Kaiser Permanente on the West coast. These larger health systems have the scale and resources to invest in emerging technologies like 3D printing that can improve patient outcomes but require significant upfront costs..

For example, Northwell Health has introduced 3D printing capabilities across its system, using the technology to create anatomical models for pre-surgical planning across a variety of specialties including cardiology, neurology, and orthopedics. These highly-detailed 3D printed organ models allow surgeons to carefully plan complicated procedures ahead of time, improving outcomes. Northwell also uses 3D printing to create customized implants, prosthetics, and surgical tools tailored to an individual patient’s anatomy.

The Mayo Clinic has one of the most advanced 3D printing programs in the country, with dozens of printers at its Minnesota headquarters producing over 85,000 3D printed models each year. Mayo uses 3D printing to aid complex neurosurgical planning, produce customized orthopedic implants, replicas of complex cardiac anatomies, and advanced splints and casts uniquely fitted to each patient. The level of customization and personalization enabled by 3D printing leads to better surgical results.

Smaller independent physician practices struggle to access advanced technologies like 3D printing due to the high equipment costs and specialized staff required. Being acquired by larger health systems with dedicated innovation budgets and shared resources can allow community-based practices easier access to these emerging tools.

However, the FTC worries that extensive consolidation of physician practices under a few large health systems or private equity firms could enable anticompetitive behavior and increased prices. There are merits to both arguments. While larger consolidated practices can reduce costs through economies of scale, too much market concentration could negatively impact pricing.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

In conclusion, the FTC’s action against Welsh Carson may or may not have merit. Other private equity firms rolling up physician practices should take extra effort to explain the value-add they intend to bring to the deal, with expanded 3D printing resources as one key component of their integration strategy. They should also be cognizant of avoiding too much market domination in a particular specialty or region.

There are positives and potential pitfalls with increased consolidation of physician practices that both the FTC and private equity firms need to consider as this rapidly accelerating trend continues nationwide. Careful analysis is required to strike the right balance between integration efficiency and maintaining market competition.